#NNPA BlackPress

$349 billion COVID-19 Small Business Program short-changes businesses of color

NNPA NEWSWIRE — The Center for Responsible Lending (CRL) estimated that as many as 95% Black-owned businesses stood no chance of securing a program loan. Other communities of color were similarly likely to be shut out as well: 91% of both Latino-owned and Native Hawaiian or Pacific Islander-owned businesses were financially shortchanged.

Federal lawsuits allege systemic lending biases that place 8.7 million jobs at risk

By Charlene Crowell, NNPA Newswire Contributor

A $349 billion program created to assist America’s small businesses was launched on April 3 to provide payroll, utilities, rent and more for eligible applicants screened by the U.S. Small Business Administration (SBA). On April 16 – less than two weeks later — this national stimulus enacted in the throes of the COVID-19 pandemic, ran out of funds. In separate but related legal actions, federal lawsuits were filed, challenging the lack of equitable access to the stimulus program.

On April 19, four class action lawsuits challenged banks’ use of PPP funds. Filed separately in the U.S. District Court’s Central California office, the lawsuits are against Bank of America, JP Morgan Chase, U.S. Bank and Wells Fargo.

While this legal process unfolds, the Center for Responsible Lending (CRL) estimated that as many as 95% Black-owned businesses stood no chance of securing a program loan. Other communities of color were similarly likely to be shut out as well: 91% of both Latino-owned and Native Hawaiian or Pacific Islander-owned businesses were financially shortchanged.

At the same time, businesses of color together are responsible for employing 8.7 million people and represent 30% of all U.S. businesses. Additionally, the combined contributions that these businesses make to the national economy is a noteworthy $1.38 trillion.

Days later on April 21, an additional $310 billion for the Paycheck Protection Program (PPP) was approved by the U.S. Senate and is expected to be quickly passed in the U.S. House. Even so, some reactions to the new funding suggested that it was still too little and needs to better address how Black and other businesses of color can fully participate.

“This bill distributes most of the funding again to large banks that prioritized wealthier businesses over small ones,” said Ashley Harrington, Federal Advocacy Director with the Center for Responsible Lending (CRL). “Businesses of color were locked out of round one of the SBA PPP, and this Congress proposal fails to assure that they will have fair access to the new $60 billion small business appropriation. Nor does it ensure equity and transparency by requiring data tracking on borrower demographics and loan amounts to be collected or reported.”

“While it is a good and necessary change to include set-asides for community banks to reach more businesses and rural areas, the bill fails to dedicate targeted funds for use by minority depository institutions (MDIs), and community development financial institutions (CDFIs),” added Harrington. “These are the institutions with a strong track record of serving borrowers of color. Both MDIs and CDFIs should have access to this vital small business support.”

The set-asides included in the new appropriations bill allocate monies to institutions based on bank size alone. Since over 98% of banks and credit unions fall into the allocation that includes CDFIs and MDIs, it is highly unlikely that these institutions will be able to access the funds – especially as the monies will have run out before these two types of institutions would be able to secure SBA approval.

The new set-asides included in the new appropriations bill allocates monies to institutions based on bank size alone. This provision places CDFIs and MDIs in direct competition with better resourced smaller institutions like community banks for loan funds.

PPP was a federal response that was supposed to supply funds through June 30 to small businesses and nonprofit organizations. It was created as part of a $2 trillion, national rescue plan authorized through the CARES Act. Instead, it is now no longer accepting applications or approving new lenders in the program. The program’s loans were capped to no more than $10 million and came with an explicit exclusion of businesses based outside of the United States. For six months, loan payments would be suspended and under specific and verifiable conditions, the loans also could be completely forgiven.

PPP applicants were required to interact with banks and other existing SBA lenders. For communities of color, this specific condition meant beginning, not continuing or expanding financial relationships. Fees paid by the federal government to participating financial institutions were based on the size of loans approved for originating program loans. For example, American Banker reported recently that on a $10 million loan, bank fees would be $100,000, and fees for a $350,000 loan would be $17,500.

Together, these two program requirements gave larger small businesses quicker and greater access to these loans. Instead of providing needed relief for struggling businesses, the PPP is just the latest iteration of federal funding and resources being systematically withheld from individuals and people of color.

A similar reaction to the exhaustion of funding was expressed by Orson Aguilar, director of economic policy for UnidosUS (formerly LaRaza) that champions rights for Latinos.

“We know that many companies did not benefit because they do not have banking relationships and that is a requirement,” said Aguilar.

Through the assistance of the Leadership Conference on Civil and Human Rights, 111 organizations across the country, including CRL, jointly told Congress their collective concerns over the exclusion of relief to communities of color in the federal pandemic response.

“Communities that have already been marginalized by structural barriers to equal opportunities and who have low levels of wealth are particularly vulnerable during this current emergency,” wrote the civil rights advocates in an April 16 letter. “While many working people have been sidelined, many others are still providing essential services during the crisis – working at our grocery stores, delivering mail and packages, and providing care to vulnerable people – putting their lives at risk, often at reduced hours and wages, to keep our country running.”

“The ongoing crisis has laid bare the structural racism and barriers to opportunity that are entrenched in our society, and our collective actions now must not worsen them,” concluded the coalition.

CRL identified specific ways in which the COVID-19 federal response can become more inclusive. Its PPP recommendations include:

- Dedicate 20% of all new funding to businesses of color;

- At least $25 billion in funding for MDIs and CDFIs;

- Provide an alternative PPP loan of up to a $100,000 that can be forgiven and better fits the needs of very small businesses;

- Adjust program rules to serve more small businesses and ensure equity and transparency by requiring all lenders to provide both borrower demographics and loan amounts;

- Expand outreach and enrollment assistant through community development corporations and community-based organizations.

“The Great Recession drained communities of color of a trillion dollars of wealth that they have yet to recover,” concluded Mike Calhoun, CRL President. “They should not be excluded from one of the largest COVID-19 relief programs. We cannot allow that to happen again.”

Charlene Crowell is a Senior Fellow with the Center for Responsible Lending. She can be reached at charlene.crowell@responsiblelending.org.

#NNPA BlackPress

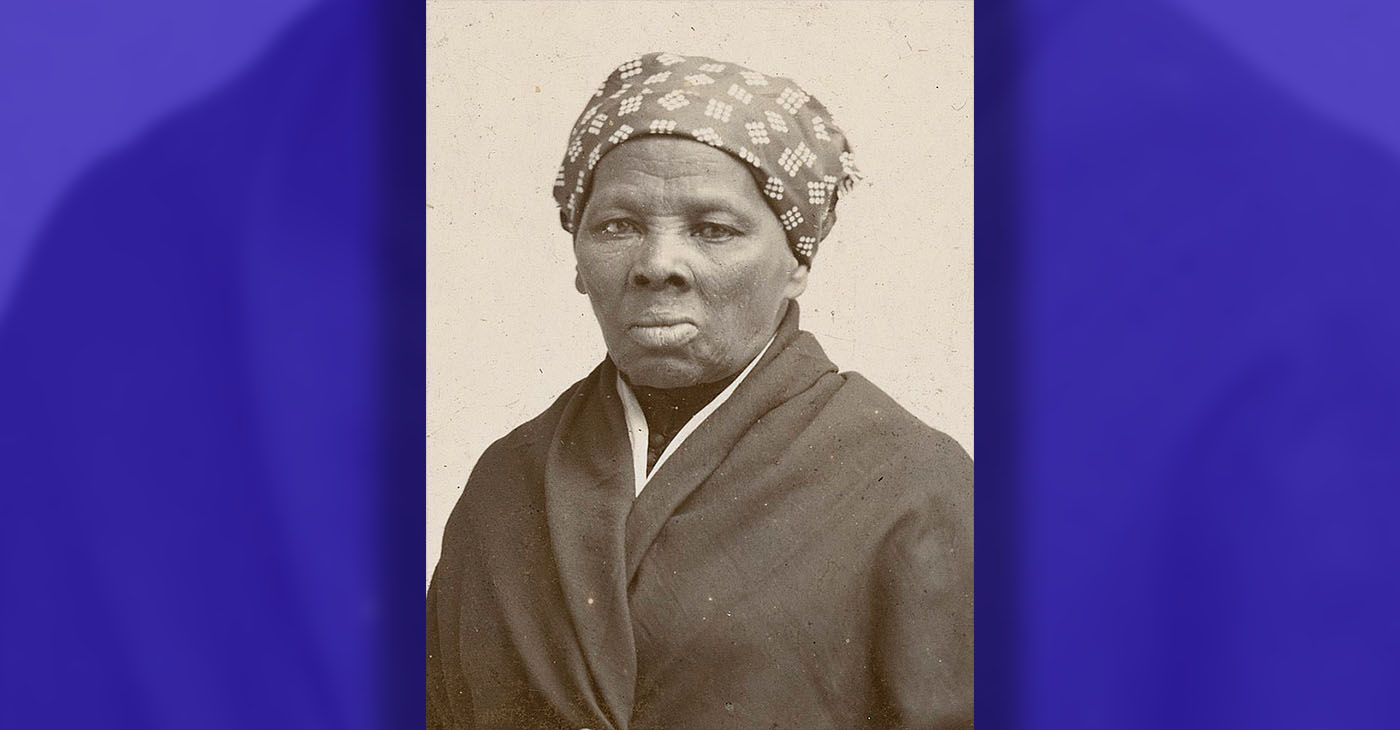

Harriet Tubman Scrubbed; DEI Dismantled

A photograph of Harriet Tubman has been removed from a National Park Service webpage about the Underground Railroad.

By Stacy M. Brown

BlackPressUSA.com Senior National Correspondent

A photograph of Harriet Tubman has been removed from a National Park Service webpage about the Underground Railroad. Previously, the page opened with a photo of Tubman and a description that acknowledged slavery and the efforts of enslaved African Americans to escape bondage. That language is now gone. In its place are images of postage stamps and a reworded introduction that refers to the Underground Railroad as “one of the most significant expressions of the American civil rights movement” that “bridged the divides of race.” The updated version does not mention slavery. The change follows an executive order signed by President Donald Trump last month directing the Smithsonian Institution to eliminate “divisive narratives.” A review by The Washington Post found that since Trump’s return to office, dozens of webpages across the National Park Service have been edited to soften or eliminate references to slavery, racial injustice, and the historical struggles of African Americans.

On the website for the Stone National Historic Site in Maryland, mentions of Declaration of Independence signer Thomas Stone owning enslaved people were removed. Elsewhere, references to “enslaved African Americans” were changed to “enslaved workers.” A page exploring Benjamin Franklin’s views on slavery and his slave ownership was taken offline. The Defense Department also removed several webpages related to diversity and minority contributions to the U.S. military, including a tribute to Jackie Robinson’s Army service and content honoring the Tuskegee Airmen, the Navajo Code Talkers, and the Marines at Iwo Jima. Officials later said some content would be republished after public outcry. Nearly 400 books were removed from the library at the U.S. Naval Academy. The list includes Maya Angelou’s I Know Why the Caged Bird Sings, Memorializing the Holocaust, Half American, and Pursuing Trayvon Martin. Officials cited Defense Secretary Pete Hegseth’s directive to eliminate books that promote diversity, equity, and inclusion.

Private companies contracting with the federal government have begun rolling back language diversity and initiatives in response to federal pressure. UnitedHealth Group removed DEI language from its website. Goldman Sachs dropped its diversity requirement for companies it takes public and revised annual filings to reflect “developments in the law.” Bank of America replaced the term “diversity” with “talent” and “opportunity.” Deloitte instructed U.S.-based employees working with federal clients to remove pronouns from email signatures. Coca-Cola, PepsiCo, Disney, Paramount, JPMorgan Chase, Victoria’s Secret, and others have renamed or eliminated DEI programs. Some, like Paramount, cited the need to comply with Trump’s executive orders.

Target has faced financial and reputational fallout following its reversal of DEI commitments. The company has lost over $12.4 billion in revenue and faces multiple lawsuits related to its shifting policies. Rev. Jamal Bryant launched a national “Target Fast,” urging community mobilization. Separately, the NAACP and the National Newspaper Publishers Association (NNPA) initiated public education and selective buying campaigns to increase pressure on the retail giant.

“Black consumers helped build Target into a retail giant, and now they are making their voices heard,” said Dr. Benjamin F. Chavis Jr., president and CEO of the NNPA. “If corporations believe they can roll back diversity commitments without consequence, they are mistaken.”

#NNPA BlackPress

What Parents Think about Childcare Right Now

BLACKPRESSUSA NEWSWIRE — Children’s earliest years are a critical period when the foundation is built for lifelong physical health and emotional well-being

By: RAPID, Stanford Center on Early Childhood

The RAPID Survey Project, based in the Stanford Center on Early Childhood, is a program of ongoing national and place-based surveys designed to gather essential information on the needs, health-promoting behaviors, and well-being of young children and their caregivers. Our objective is to make timely and actionable data on the experiences of parents, caregivers, and young children available in an ongoing manner to support parent- and data-informed decision-making. Children’s earliest years are a critical period when the foundation is built for lifelong physical health and emotional well-being. Research shows that consistent, responsive caregiving is conducive to healthy development during these early years. We asked parents of infants and toddlers (birth to age 3) to tell us about their childcare experiences and preferences. Using responses from parents of infants or toddlers who participated in national RAPID household surveys in January 2024 and November 2024, we aim to understand the types of childcare that families with infants and toddlers use and what is most important to parents when selecting child care.

Family, friends, and neighbor (FFN) care is the most common childcare choice for families with infants and toddlers.

We asked parents of infants and toddlers questions about how much childcare they use, as well as their experiences using center-based care, home-based care, and both paid and unpaid family, friend, and neighbor (FFN) care. More than two in three (68%) parents of infants and toddlers use childcare for five hours or more per week. Among these families, and consistent with other national data, FFN care makes up the largest share of providers of infants and toddlers.

Responses from the survey show that, on a weekly basis:

—32% of parents use center-based care

—26% of parents use unpaid FFN care

—13% of parents use paid FFN care

—12% of parents use home-based care in the childcare provider’s residence

“Sometimes it is difficult to find relatives/friends who I trust and are available as sometimes their plans change.” Parent in Wisconsin

“I’m relying on family and things arise that make them unable to help. I have looked into center-based care and considered going back to work, but it will cost me more for childcare than I can make in income to pay for it.” Parent in Ohio

“I use babysitters, mostly teenagers, so their schedules are sometimes unreliable. They do their best, but they have other commitments, too. They also can’t always work during the day, which is when I need them.” Parent in Texas

Reliable access to childcare is a particular concern for many parents of infants and toddlers.

The predictable schedules and routines that are associated with stable access to childcare support the positive well-being and development of children, families, and caregivers. In their responses to open-ended questions, parents of infants and toddlers spoke about the different challenges they experience securing childcare, including issues with affordability, hours, location, and trust in their provider. As indicated by the quotes in this fact sheet, parents mentioned concerns about providers meeting the specific and intensive caregiving needs of infants and toddlers, while at the same time families navigate high costs, low availability, and inconsistent schedules. Additionally, many parents, particularly those living in rural areas, noted the limited childcare options near their home or work. This points to the barriers to reliable childcare access that families with infants and toddlers face, and these data can inform policies and programs that support families in meeting this critical need.

“In a rural area, childcare is very hard to find, and rates are not competitive because they don’t have to be.” Parent in Montana

“I had challenges finding other part-time care closer to where we live so I drive one hour twice a week for part-time care.” Parent in Louisiana

“We had to contact this provider very early on. I was maybe five or six weeks pregnant. And she happened to have a spot. If we had waited much longer, we wouldn’t have gotten in.” Parent in South Carolina

“I am currently using backup care days offered by my employer as our primary form of childcare for our younger child. In March, I will run out of days to use, and we are struggling to find an affordable option nearby that has availability when we need it.” Parent in Virginia

Trust in their childcare provider is the most important thing to families with infants and toddlers.

To understand families’ childcare needs, we asked parents what factor matters the most when selecting childcare for their infants and toddlers. We provided a list of factors to choose from for each type of childcare used. Across all types of childcare, parents of infants and toddlers are most likely to say that trust and/or comfortability with their provider is the top factor when they select child care for their family. Parents are significantly more likely to endorse trust and/or comfortability with their provider than any other factor, including affordability, availability, location, or the hours the provider is available.

Factors for selecting childcare, in order of frequency endorsed by parents of infants and toddlers:

- Trust and/or comfortability

- Affordability

- Availability

- Location

- Hours

“Finding a trustworthy and experienced caregiver who could handle our infant’s specific needs was a major concern.” Parent in New York

“Ensuring the caregiver has the necessary experience and qualifications to care for an infant adds another layer of difficulty.” Parent in Iowa

Predictable and nurturing caregiving contributes to positive early childhood development, and more work is needed to support families with infants and toddlers looking for childcare. RAPID data show that there is an unmet need among families with infants and toddlers for reliable, affordable, and trusted sources of childcare and that families are using a patchwork of childcare arrangements to find trusted sources of care for their infants and toddlers that they can afford and rely on. Parents themselves are experts in selecting the sources and settings of childcare that will best support their family and foster their child’s development, and they are placing an emphasis on selecting providers that their family trusts and feels comfortable with. These findings can inform policies and programs that address parents’ childcare concerns and experiences, so they are better supported in providing the healthy, responsive caregiving that is essential to their young children’s development.

#NNPA BlackPress

Trump Profits, Black America Pays the Price

BLACKPRESSUSA NEWSWIRE — Over the weekend, while 401(k)s crumbled and mass layoffs loomed, Trump was the main attraction at two lavish, money-making events

By Stacy M. Brown

BlackPressUSA.com Senior National Correspondent

As financial pain spreads across the nation, Black families are facing some of the harshest blows — while Donald Trump and his family throw parties, rake in cash, and dismantle protections built to ensure essential equity. Over the weekend, while 401(k)s crumbled and mass layoffs loomed, Trump was the main attraction at two lavish, money-making events: a Saudi-backed LIV Golf tournament at his Trump Doral resort and a seven-figure fundraiser at Mar-a-Lago. This all unfolded just days after Trump signed off on sweeping global tariffs — with a Sharpie now sold at his resort gift shop for $3 — sparking one of the largest market crashes in U.S. history. In just 48 hours, the S&P 500 lost $5 trillion in value. By Monday, stocks were in free fall. Analysts warned of inflation spikes that would hit everything from gas to groceries — and disproportionately impact low- and middle-income households.

But for Trump, it was business booming. Every room, including the $13,000-a-night suite, was sold out at Doral. Guests shelled out up to $1,400 for exclusive access, snapped up $550 Trump purses and $18 imported souvenirs, and dined on $130 steaks while posing for photos with Trump family members. “This is the perfect venue,” Eric Trump declared as his father bounced between luxury properties. That same day, the former president posted from his golf club: “THIS IS A GREAT TIME TO GET RICH, RICHER THAN EVER BEFORE.” For Black Americans — who already face the steepest hurdles in the economy — the timing is more than just offensive. It’s dangerous. As the markets tank and federal agencies brace for disruption, Trump is also waging war on racial equity. He’s issued orders wiping out diversity, equity, and inclusion (DEI) efforts across the federal government. That includes dismantling Executive Order 11246 — a cornerstone civil rights protection that, since 1965, has barred discriminatory practices by federal contractors.

Roughly 18% of the federal workforce is Black. Many of those workers are now in limbo, with DEI staffers placed on forced leave and entire programs frozen. Experts warn these rollbacks could erase decades of progress in hiring, retention, and advancement — not just in government, but in every sector that follows federal precedent. Trump has also threatened clean air and water protections for historically neglected Black neighborhoods and proposed privatizing the U.S. Postal Service — one of the largest employers of African Americans. As working families watch their savings disappear, their job security vanishes, and their communities come under attack, Trump and his donors raise glasses over filet mignon and $1 million checks. The disparity isn’t just stark — it’s systemic. And it’s being monetized in real-time. From his Palm Beach resort, as the country buckles under the weight of his policies, Trump made his position clear:

“THIS IS A GREAT TIME TO GET RICH.”

-

Activism3 weeks ago

Activism3 weeks agoWe Fought on Opposite Sides of the Sheng Thao Recall. Here’s Why We’re Uniting Behind Barbara Lee for Oakland Mayor

-

Activism4 weeks ago

Activism4 weeks agoSan Francisco Is Investing Millions to Address Food Insecurity. Is Oakland Doing the Same?

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoRev. Dr. Jamal Bryant’s Black Church Target Boycott Mobilizes 150,000

-

Activism3 weeks ago

Activism3 weeks agoFaith Leaders Back Barbara Lee for Mayor, Criticize Candidate Loren Taylor for Dishonest Campaigning

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 12 – 18, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoRecently Approved Budget Plan Favors Wealthy, Slashes Aid to Low-Income Americans

-

Activism3 weeks ago

Activism3 weeks agoGroup Takes First Steps to Recall District Attorney Diana Becton

-

Activism2 weeks ago

Activism2 weeks agoOakland’s Most Vulnerable Neighborhoods Are Struggling to Eat and Stay Healthy

Pingback: Panafricanmedia Networks