Advice

5 Things to Do When You Get Your First Paycheck

“That first paycheck is such a great moment and an opportunity to start managing your money. Direct deposit and automatic savings are some ways that we can stay on top of our goals,” said September Hargrove, Northern California Director for Community Banking at Chase.

Getting your first paycheck is an exciting experience and an opportunity to kickstart your financial journey. Mapping out your short and long-term financial goals early on will allow you to build a strong foundation for your future.

“That first paycheck is such a great moment and an opportunity to start managing your money. Direct deposit and automatic savings are some ways that we can stay on top of our goals,” said September Hargrove, Northern California Director for Community Banking at Chase.

September Hargrove, Northern California Director for Community Banking at Chase.

Here are five things to help you make the most of that first paycheck:

Open a Bank Account: Checking accounts allow you to deposit money, make transfers, withdraw cash, pay bills and take care of other banking transactions either in person, online or through your bank’s mobile app. Most accounts come with a debit card that can be used anywhere cards are accepted. What’s important is that you’re fitted with the account that best suits your needs. Learn more about the documents you need to open an account.

Set up Direct Deposit: For quick access to the money you earn, set up direct deposit. It will make your funds available in your account on pay day, making it easier to pay your bills, send money and meet financial obligations on time, and without needing a trip to the bank or ATM.

Set Up Automatic Savings: Autosave helps you reach your savings goals with automatic transfers from your Chase checking account to your Chase savings account – just set it, forget it and watch your savings grow! For instance, every time you get paid, pay yourself first or set up an automatic transfer of even $1 per day. Autosave allows you to adjust your goals or pause at any time. Savings goals are personal and setting money aside to build an emergency fund for unexpected life events is a great habit to start.

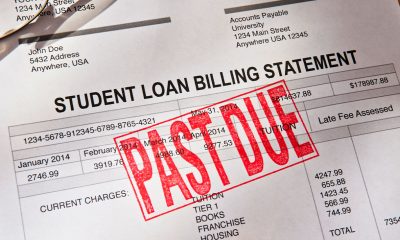

Tackle Your Debt: Assess your current debt—like student loans or credit cards—then tackle the most critical ones first with a high interest rate. A local Chase banker can help you create a plan, so it doesn’t feel like an overwhelming task. Having a plan often comes with assurance and peace of mind.

Plan for the future: If you have access to a retirement account through your work, sign up for it – your employer will automatically deduct the money from your paycheck and many companies even offer a match. It is never too early to start saving for your future. The more proactive you are in planning for these life events, the less of a burden they become when the time comes.

For more information, visit your local Chase branch and speak to a banker or visit chase.com/communityteam to schedule a visit.

Advice

Support Your Child’s Mental Health: Medi-Cal Covers Therapy, Medication, and More

Advertorial

When children struggle emotionally, it can affect every part of their lives — at home, in school, with friends, and even their physical health. In many Black families, we’re taught to be strong and push through. But our kids don’t have to struggle alone. Medi-Cal provides mental health care for children and youth, with no referral or diagnosis required.

Through California Advancing and Innovating Medi-Cal (CalAIM), the state is transforming how care is delivered. Services are now easier to access and better connected across mental health, physical health, and family support systems. CalAIM brings care into schools, homes, and communities, removing barriers and helping children get support early, before challenges escalate.

Help is Available, and it’s Covered

Under Medi-Cal, every child and teen under age 19 has the right to mental health care. This includes screenings, therapy, medication support, crisis stabilization, and help coordinating services. Parents, caregivers, and children age 12 or older can request a screening at any time, with no diagnosis or referral required.

Medi-Cal’s Mental Health and Substance Use Disorder Program

For children and youth with more serious mental health needs, including those in foster care or involved in the justice system, Medi-Cal offers expanded support, including:

- Family-centered and community-based therapy to address trauma, behavior challenges, or system involvement.

- Wraparound care teams that help keep children safely at home or with relatives.

- Activity funds that support healing through sports, art, music, and therapeutic camps.

- Initial joint behavioral health visits, where a mental health provider and child welfare worker meet with the family early in a case.

- Child welfare liaisons in Medi-Cal health plans who help caregivers and social workers get services for children faster

Keeping Kids Safe from Opioids and Harmful Drugs

DHCS is also working to keep young people safe as California faces rising risks from opioids and counterfeit pills. Programs like Elevate Youth California and Friday Night Live give teens mentorship, leadership opportunities, and positive outlets that strengthen mental well-being.

Through the California Youth Opioid Response, families can learn how to avoid dangerous substances and get treatment when needed. Song for Charlie provides parents and teens with facts and tools to talk honestly about mental health and counterfeit pills.

DHCS also supports groups like Young People in Recovery, which helps youth build skills for long-term healing, and the Youth Peer Mentor Program, which trains teens with lived experience to support others. These efforts are part of California’s strategy to protect young people, prevent overdoses, and help them make healthier choices.

Support for Parents and Caregivers

Children thrive when their caregivers are supported. Through CalAIM’s vision of whole-person care, Medi-Cal now covers dyadic services, visits where a child and caregiver meet together with a provider to strengthen bonding, manage stress, and address behavior challenges.

These visits may include screening the caregiver for depression or anxiety and connecting them to food, housing, or other health-related social needs, aligning with CalAIM’s Community Supports framework. Notably, only the child must be enrolled in Medi-Cal to receive dyadic care.

Family therapy is also covered and can take place in clinics, schools, homes, or via telehealth, reflecting CalAIM’s commitment to flexible, community-based care delivery.

Additionally, BrightLife Kids offers free tools, resources, and virtual coaching for caregivers and children ages 0–12. Families can sign up online or through the BrightLife Kids app. No insurance, diagnosis, or referral is required.

For teens and young adults ages 13–25, California offers Soluna, a free mental health app where young people can chat with coaches, learn coping skills, journal, or join supportive community circles. Soluna is free, confidential, available in app stores, and does not require insurance.

CalHOPE also provides free emotional support to all Californians through a 24/7 support line at (833) 317-HOPE (4673), online chat, and culturally responsive resources.

Support at School — Where Kids Already Are

Schools are often the first place where emotional stress is noticed. Through the Children and Youth Behavioral Health Initiative (CYBHI), public schools, community colleges, and universities can offer therapy, counseling, crisis support, and referrals at no cost to families.

Services are available during school breaks and delivered on campus, by phone or video, or at community sites. There are no copayments, deductibles, or bills.

Medi-Cal Still Covers Everyday Care

Medi-Cal continues to cover everyday mental health care, including therapy for stress, anxiety, depression, or trauma; medication support; crisis stabilization; hospital care when needed; and referrals to community programs through county mental health plans and Medi-Cal health plans.

How to Get Help

- Talk to your child’s teacher, school counselor, or doctor.

- In Alameda County call 510-272-3663 or the toll-free number 1-800-698-1118 and in San Francisco call 855-355-5757 to contact your county mental health plan to request an assessment or services.

- If your child is not enrolled in Medi-Cal, you can apply at com or my.medi-cal.ca.gov.

- In a mental health emergency, call or text 988, the Suicide and Crisis Lifeline.

Every child deserves to grow up healthy and supported. Medi-Cal is working to transform care so it’s accessible, equitable, and responsive to the needs of every family.

Advice

COMMENTARY: If You Don’t Want Your ‘Black Card’ Revoked, Watch What You Bring to Holiday Dinners

From Thanksgiving to Christmas to New Year’s Day, whether it’s the dining room table or the bid whist (Spades? Uno, anyone?) table, your card may be in danger.

By Wanda Ravernell

Post Staff

From the fourth week of November to the first week in January, if you are of African descent, but particularly African American, certain violations of cultural etiquette will get your ‘Black card’ revoked.

From Thanksgiving to Christmas to New Year’s Day, whether it’s the dining room table or the bid whist (Spades? Uno, anyone?) table, your card may be in danger.

It could take until Super Bowl Sunday for reinstatement.

I don’t know much about the card table, but for years I was on probation by the ‘Aunties,’ the givers and takers of Black cards.

How I Got into Trouble

It was 1970-something and I was influenced by the health food movement that emerged from the hippie era. A vegetarian (which was then considered sacrilegious by most Black people I knew) prepared me a simple meal: grated cheese over steamed broccoli, lentils, and brown rice.

I introduced the broccoli dish at the Friday night supper with my aunt and grandfather. She pronounced the bright green broccoli undone, but she ate it. (I did not, of course, try brown rice on them.)

I knew that I would be allowed back in the kitchen when she attempted the dish, but the broccoli had been cooked to death. (Y’all remember when ALL vegetables, not just greens, were cooked to mush?)

My Black card, which had been revoked was then reattained because they ate what I prepared and imitated it.

Over the decades, various transgressions have become normalized. I remember when having a smoked turkey neck instead of a ham hock in collard greens was greeted with mumblings and murmurings at both the dining room and card tables. Then came vegan versions with just olive oil (What? No Crisco? No bacon, at least?) and garlic. And now my husband stir fries his collards in a wok.

But No Matter How Things Have Changed…

At holiday meals, there are assigned tasks. Uncle Jack chopped raw onions when needed. Uncle Buddy made the fruit salad for Easter. My mother brought the greens in winter, macaroni salad in summer. Aunt Deanie did the macaroni and cheese, and the great aunts, my deceased grandmother’s sisters, oversaw the preparation of the roast beef, turkey, and ham. My father, if he were present, did the carving.

These designations/assignments were binding agreements that could stand up in a court of law. Do not violate the law of assignments by bringing some other version of a tried-and-true dish, even if you call it a new ‘cheese and noodle item’ to ‘try out.’ The auntie lawgivers know what you are trying to do. It’s called a menu coup d’état, and they are not having it.

The time for experiments is in your own home: your spouse and kids are the Guinea pigs.

My mother’s variation of a classic that I detested from that Sunday to the present was adding crushed pineapple to mashed sweet potatoes. A relative stops by, tries it, and then it can be introduced as an add-on to the standard holiday menu.

My Aunt Vivian’s concoctions from Good Housekeeping or Ladies’ Home Journal magazine also made it to the Black people’s tables all over the country in the form of a green bean casserole.

What Not to Do and How Did It Cross Your Mind?

People are, of all things holy, preparing mac ‘n’ cheese with so much sugar it tastes like custard with noodles in it.

Also showing up in the wrong places: raisins. Raisins have been reported in the stuffing (makes no sense unless it’s in a ‘sweet meats’ dish), in a pan of corn bread, and – heresy in the Black kitchen – the MAC ‘n’ CHEESE.

These are not mere allegations: There is photographic evidence of these Black card violations, but I don’t want to defame witnesses who remained present at the scene of the crimes.

The cook – bless his/her heart – was probably well-meaning, if ignorant. Maybe they got the idea from a social media influencer, much like Aunt Viv got recipes from magazines.

Thankfully, a long-winded blessing of the food at the table can give the wary attendee time to locate the oddity’s place on the table and plan accordingly.

But who knows? Innovation always prevails, for, as the old folks say, ‘waste makes want.’ What if the leftovers were cut up, dipped in breadcrumbs and deep fried? The next day, that dish might make it to the TV tray by the card table.

An older cousin – on her way to being an Auntie – in her bonnet, leggings, T-shirt, and bunny slippers and too tired to object, might try it and like it….

And if she ‘rubs your head’ after eating it, the new dish might be a winner and (Whew!) everybody, thanks God, keeps their Black cards.

Until the next time.

Activism

Essay: Intentional Self Care and Community Connections Can Improve Our Wellbeing

At the deepest and also most expansive level of reality, we are all part of the same being, our bodies made from the minerals of the earth, our spirits infused by the spiritual breath that animates the universe. Willingness to move more deeply into fear and pain is the first step toward moving into a larger consciousness. Willingness to move beyond the delusion of our separateness can show us new ways of working and living together.

By Dr. Lorraine Bonner, Special to California Black Media Partners

I went to a medical school that was steeped in the principles of classical Western medicine. However, I also learned mindfulness meditation during that time, which opened me to the multifaceted relationship between illnesses and the interconnecting environmental, mental and emotional realities that can impact an individual’s health.

Therefore, when I began to practice medicine, I also pursued training in hypnosis, relaxation techniques, meditation, and guided imagery, to bring a mind-body focus to my work in medical care and prevention.

The people I saw in my practice had a mix of problems, including high blood pressure, diabetes, and a variety of pain issues. I taught almost everyone relaxation breathing and made some general relaxation tapes. To anyone willing, I offered guided imagery.

“My work embraced an approach to wellness I call “Liberatory Health” — one that not only addresses the treatment and management of disease symptoms but also seeks to dismantle the conditions that make people sick in the first place.”

From my perspective, illness is only the outermost manifestation of our efforts to cope, often fueled by addictions such as sugar, tobacco, or alcohol, shackled by an individualistic cult belief that we have only ourselves to blame for our suffering.

At the deepest and also most expansive level of reality, we are all part of the same being, our bodies made from the minerals of the earth, our spirits infused by the spiritual breath that animates the universe. Willingness to move more deeply into fear and pain is the first step toward moving into a larger consciousness. Willingness to move beyond the delusion of our separateness can show us new ways of working and living together.

To put these ideas into practical form, I would quote the immortal Mr. Rogers: “Find the helpers.” There are already people in every community working for liberation. Some of them are running for office, others are giving food to those who need it. Some are volunteering in schools, libraries or hospitals. Some are studying liberation movements, or are working in urban or community gardens, or learning to practice restorative and transformative justice, or creating liberation art, music, dance, theater or writing. Some are mentoring high schoolers or apprenticing young people in a trade. There are many places where compassionate humans are finding other humans and working together for a better world.

A more compassionate world is possible, one in which we will all enjoy better health. Creating it will make us healthier, too.

In community, we are strong. Recognizing denial and overcoming the fragmenting effects of spiritual disorder offer us a path to liberation and true health.

Good health and well-being are the collective rights of all people!

About the Author

Dr. Lorraine Bonner is a retired physician. She is also a sculptor who works in clay, exploring issues of trust, trustworthiness and exploitation, as well as visions of a better world.

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoLIHEAP Funds Released After Weeks of Delay as States and the District Rush to Protect Households from the Cold

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of November 26 – December 2, 2025

-

Alameda County3 weeks ago

Alameda County3 weeks agoSeth Curry Makes Impressive Debut with the Golden State Warriors

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTrinidad and Tobago – Prime Minister Confirms U.S. Marines Working on Tobago Radar System

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoThanksgiving Celebrated Across the Tri-State

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTeens Reject Today’s News as Trump Intensifies His Assault on the Press