#NNPA BlackPress

COVID-19 financial warning: Consumers and banks should stay away from payday loans

NNPA NEWSWIRE — Zeroing in on the economic impacts of the crisis, people everywhere are struggling with competing needs in their lives. When living costs exceed available financial resources, tough times lead to tough decisions about how to feed families, keep a home to live in, ways to keep utilities working and a myriad of other day-to-day needs.

By Charlene Crowell, NNPA Newswire Contributor

For the foreseeable future, ‘normal’ life will be indefinitely suspended due to the global pandemic known as the coronavirus.

Record-breaking employment layoffs in the month of March resulted in the Department of Labor reporting that 10.4 million consumers lost their jobs and filed for unemployment compensation. As medical experts continue to track the virus, the New York Times reported at least 214,461 known infections and at least 4,800 related deaths.

Beyond these statistics, untold numbers of additional school and retail closures, and an expanding army of people working from home have also been directly affected by the virus.

Consumers both young and old have passed as the virus continues to spread across the country. Its viral wrath has spawned hot spots from the Pacific Northwest’s Seattle, to the Gulf Coast’s New Orleans, the Midwest’s Detroit and the nation’s largest urban metropolis, New York City.

Zeroing in on the economic impacts of the crisis, people everywhere are struggling with competing needs in their lives. When living costs exceed available financial resources, tough times lead to tough decisions about how to feed families, keep a home to live in, ways to keep utilities working and a myriad of other day-to-day needs.

Despite a $2 trillion federal rescue enacted with bipartisan support, checks of $1,200 promised to taxpayers, along with an additional $500 per child will arrive too late for first of the month April payments for bills like mortgages and rental payments. Many leaders also warn that despite its size or range of areas addressed, the legislation was not enough.

In a March 27 House floor statement, Congresswoman Maxine Waters, Chairwoman of the House Financial Services Committee warned colleagues that their job was not yet complete.

“[I] must make clear that the legislation is far from comprehensive, and that there are issues it leaves unaddressed and areas where it falls short…The American people need help now and this bill represents a down payment on that relief,” said Waters.

A similar reaction came from AARP chief executive Jo Ann Jenkins.

“Older Americans face the one-two punch of coronavirus’s health and economic consequences, and many need immediate relief and ongoing help and support to cope with the pandemic,” noted Jenkins. “Those needs are only set to grow in the weeks and months ahead.”

What can really make a difference between life’s success and failure is not just what leaders do but also what they didn’t do when they had the chance. The recent legislative package was silent on interest rates, as well as forgiveness of federal student loans, negative credit reports or bans on private evictions for late rental payments.

As the cost of living has risen faster and higher than most consumer incomes for more than a decade, the likelihood of a savings account large enough to cover household expenses for a month or more is slim to none.

The Consumer Financial Protection Bureau (CFPB), the agency tasked with protecting consumers from unscrupulous lenders has been conspicuously subdued. Instead of forceful and timely agency alerts via multi-media communications warning consumers about opportunistic scam artists, CFPB has offered a modest tip sheet on how consumers – not government – can protect themselves. Fortunately, as the viral saga unfolds, some news outlets are reporting on the potential harms of consumers turning to payday and car-title loans.

A joint response by five federal regulars – Board of Governors of the Federal Reserve System, Consumer Financial Protection Bureau (CFPB), Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), and the Office of the Comptroller of the Currency (OCC) – came on March 26 in a statement that encouraged banks, savings and loans, and credit unions to offer “responsible small dollar loans” to consumers and small businesses during the pandemic.

According to the regulators, “responsible small-dollar loans can play an important role in meeting customers’ credit needs because of temporary cash-flow imbalances, unexpected expenses, or income disruptions during periods of economic stress or disaster recoveries.”

Without any specifics defining “reasonable small dollar loans”, the regulators’ statement could be an inducement to join triple-digit lenders’ financial exploitation.

For Black America and other communities of color, predatory short-term loans of $500 or less began decades ago when payday and car-title storefronts took prominent residence in our neighborhoods across the country. Loans that were marketed as quick fixes for millions of consumers morphed into long-term financial nightmares that deepened debt with every renewal. In many cases, the interest paid on these loans was often double or triple the amount of principal borrowed.

A coalition of civil and consumer rights organizations released a joint statement warning of the possible spike in high-cost lending by the nation’s depository institutions – banks, credit unions and savings and loans.

“This is the worst possible time for banks to make predatory payday loans,” said Americans for Financial Reform Education Fund, the Center for Responsible Lending, Leadership Conference for Civil and Human Rights, NAACP, National Consumer Law Center.

“Around the time of the last recession, a handful of banks issued ‘deposit advances’ that put borrowers in an average of 19 loans a year at over 200% annual interest,” continued the leaders. “These bank payday loans disproportionately harmed the financially vulnerable and badly damaged banks’ reputations. Since 2013 when regulatory guidance warned against this form of credit, banks have mostly stayed away. We trust that they will continue to do so as they do not want to repeat mistakes of the past.”

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at charlene.crowell@responsiblelending.org.

#NNPA BlackPress

Supreme Court Decision Confirms Convicted Felon Will Assume Presidency

NNPA NEWSWIRE — In a 5-4 ruling, the court stated that Trump’s concerns could “be addressed in the ordinary course on appeal” and emphasized that the burden of sentencing was “relatively insubstantial” given that Trump will not face prison time. Chief Justice John Roberts and Justice Amy Coney Barrett joined the court’s three liberal justices in the majority, with four conservative justices dissenting.

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

@StacyBrownMedia

The Supreme Court on Thursday rejected President-elect Donald Trump’s emergency request to block criminal proceedings in his New York hush money case, ensuring that a sentencing hearing will proceed as scheduled on Friday. The decision makes it official that, on January 20, for the first time in its history, the United States will inaugurate a convicted felon as its president.

In a 5-4 ruling, the court stated that Trump’s concerns could “be addressed in the ordinary course on appeal” and emphasized that the burden of sentencing was “relatively insubstantial” given that Trump will not face prison time. Chief Justice John Roberts and Justice Amy Coney Barrett joined the court’s three liberal justices in the majority, with four conservative justices dissenting.

Trump was convicted in May for falsifying business records related to a $130,000 payment to adult film star Stormy Daniels before the 2016 election. Manhattan District Attorney Alvin Bragg argued that the Supreme Court lacked jurisdiction to intervene in a state criminal case, particularly before all appeals in state courts were exhausted.

Trump’s legal team claimed the sentencing process would interfere with his transition to power and argued that evidence introduced during the trial included official actions protected under the Supreme Court’s prior ruling granting former presidents immunity for official conduct. Merchan, the New York judge who presided over the trial, ruled in December that the evidence presented was unrelated to Trump’s duties as president.

Prosecutors dismissed Trump’s objections, stating that the sentencing would take less than an hour and could be attended virtually. They said the public interest in proceeding to sentencing outweighed the President-elect’s claims of undue burden.

Justice Samuel Alito, one of the four dissenting justices, confirmed speaking to Trump by phone on Wednesday. Alito insisted the conversation did not involve the case, though the call drew criticism given his previous refusals to recuse himself from politically sensitive matters.

The sentencing hearing is set for Friday at 9:30 a.m. in Manhattan. As the nation moves closer to an unprecedented inauguration, questions about the implications of a convicted felon assuming the presidency remain.

“No one is above the law,” Bragg said.

#NNPA BlackPress

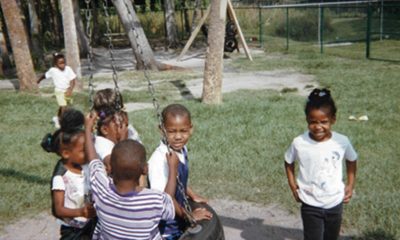

How Head Start Installs Confidence for Two Generations

NNPA NEWSWIRE — Head Start is a changemaker for all communities. Child by child, family by family, the seeds that are sowed continue to blossom as they stretch higher and higher toward the sunshine.

By Olivia Harvey

The founders of Head Start have always viewed parents as critical partners in their work to educate young children. They also understood that this partnership meant parents should help decide which services would most benefit their families and those in the community. As a result, Head Start created a formal leadership and policymaking role for parents and community members called the Policy Council.

Thank you to Head Start parent, Policy Council member, and alumna Olivia Harvey for recently sharing her story.

A few years ago my daughter Maliya was six years old and had just started kindergarten, after graduating from the Children First Head Start program in Sarasota County, Florida. It was hard to believe we’d reached this major milestone, but with all the love, care, and guidance she received from her incredible teachers, I’m confident that she will continue to blossom and thrive. Children First and the Head Start program have always been close to my heart, and the hearts of my family. My husband Malik is also a proud Head Start graduate along with some members of his family. He’s a wonderful support system and understands our shared mission of raising the healthiest, happiest family possible. Our lives are centered around family, and in addition to Maliya, we also have two other children, our sons Jeremiah and King. When we had our kids, we knew we didn’t have to look far to find quality, affordable childcare with amazing teachers we could trust. With the challenges we were facing, we knew we could turn to Children First’s Head Start program to help us find our path to success.

My family has been involved with Children First since Jeremiah was a toddler. Our family advocate, Ernestine, was there for Maliya and our entire family every step of the way. I know that even when my daughter is in high school, Ernestine will be there in a heartbeat if we ever need anything. The teachers care so deeply about the kids, and they never forget their faces. One day, Maliya came home with a photo taken by her teacher, Miss LaTonda. It was a baby picture of me because Miss LaTonda had been my teacher as well. I couldn’t believe she had kept it for all these years! It was such a special memory to share with my daughter, and it’s moments like this that let me know we will always be a part of the Children First family. Through Head Start, I also found a lot of support personally and as a parent. Due to the pandemic, I had reduced hours and was forced to seek other employment. During this time, I needed something that would allow me to feel professional and help me keep my skills up while at the same time offering me the flexibility to be a mom.

Luckily, Children First was offering a Job Skills Training Course as part of the agency’s Family Strengthening services. The class was perfect because it provided a sense of accountability and belonging. I learned about identifying and overcoming obstacles related to employment, and there was a special focus on resume writing, interviews, and ‘acing’ the first 90 days at a new job, which has benefited me! After a mock interview with my vocational family advocate Laura and her colleagues, I felt so confident with the skills that I had learned, and I decided to reach a higher goal in the workforce. I was offered a position at Sarasota School of the Arts & Sciences, where I have been working as a paraprofessional. While working full-time, I’ve also had the opportunity to go back to school to earn my bachelor’s degree to become a history or math teacher. My ambitions have led me to be a working professional, a full-time mom, and now, a student, but I’m not stopping there. In the future, I would like to earn my master’s degree and work as an administrator, with one of my ultimate goals being to run for the school board.

Because of Children First, Head Start, and my vocational coach, Laura, it feels like a whole new world of possibilities has opened. While I was unexpectedly unemployed but fighting to stay engaged, I was supported every step of the way. Laura and the team at Children First continue to guide me and my family on our journey to success. Although we still face unique challenges, I feel grateful and am so proud of how far we’ve come. Because Malik and I were able to grow and thrive in a healthy environment at the earliest stages of our lives, the lives of our children have been transformed for the better. Right now, some parents, families, and caregivers are struggling financially and socially. They need lower childcare prices, full workday hours with childcare coverage, and free transportation to and from daycare.

Head Start is a changemaker for all communities. Child by child, family by family, the seeds that are sowed continue to blossom as they stretch higher and higher toward the sunshine. Their promise is simple: every child, regardless of circumstances at birth, can reach their full potential. As I look to the future — from my youngest child thriving, to earning my teaching degree, to raising my beautiful children alongside my husband and beyond that, I know that thanks to Head Start, there is nothing to fear.

#NNPA BlackPress

Cold Weather Safety for Children

NNPA NEWSWIRE — Keep babies’ cribs free of stuffed animals and blankets. A firm mattress covered with a tight-fitting crib sheet is all that an infant needs to sleep safely.

By The Head Start Early Childhood Learning and Knowledge Center

Children are more vulnerable than adults to the effects of cold weather. The Head Start Early Childhood Learning and Knowledge Center developed these tips to help families and staff keep children safe, healthy, and warm in the winter.

Bundle up!

- Children are at greater risk for frostbite than adults. The best way to prevent frostbite is to make sure children dress warmly and don’t spend too much time outside in extreme weather.

- Dress children in layers of warm clothing. If the top layer gets wet, they will still have a dry layer underneath.

- Tuck scarves inside coats and jackets to prevent them from becoming strangulation hazards.

- Car seats and winter coats don’t mix. Bulky coats can compress in a crash and create a loose car seat harness. Instead, lay the jacket or a blanket over the children once you’ve safely strapped them into their car seat.

Keeping Healthy Outdoors

- There’s no set amount of time for children to play outside safely when the weather is cold. Use your best judgment. When the cold becomes unpleasant, it’s time to go inside.

- If you are unsure if weather conditions are safe for outdoor play, check the Child Care Weather Watch Chart.

- Have children come indoors periodically to prevent hypothermia or frostbite. A temperature of 0 degrees Fahrenheit and a wind speed of 15 mph creates a wind chill temperature of -19 F. Under these conditions, frostbite can occur in just 30 minutes.

- Frostnip is an early warning sign of frostbite. The skin may feel numb or tingly or appear red (on lighter skin).

- To prevent frostbite, check that mittens and socks are dry and warm. Frostbite occurs mostly on fingers, toes, ears, noses, and cheeks. The affected area becomes very cold, firm, and, depending on the color of the skin, turns white, yellowish-gray, or gray.

- Even though it’s cold outside, it’s important to use sunscreen and stay hydrated. Children are more likely than adults to become dehydrated.

Staying Safe Indoors and in Vehicles

- Keep anything that can burn at least three feet away from heating equipment, including furnaces, fireplaces, wood stoves, and portable space heaters.

- Set up a 3-foot “kid-free zone” around open fires and space heaters.

- Remember to turn portable heaters off when leaving the room.

- Test smoke alarms at least once a month.

- Vent all fuel-burning equipment to the outside to avoid carbon monoxide (CO) poisoning.

- Install and maintain CO alarms. Keep alarms at least 15 feet away from fuel-burning appliances.

- If you need to warm up your vehicle, remove it from the garage as soon as you start it to avoid the risk of CO poisoning. Don’t leave a vehicle running inside a garage.

- If vehicles are parked outside, check to make sure the tailpipe is not blocked with snow, which can also cause problems with CO.

Sleeping Safely in Any Season

- Keep babies’ cribs free of stuffed animals and blankets. A firm mattress covered with a tight-fitting crib sheet is all that an infant needs to sleep safely.

- If you are worried about keeping babies warm, dress them in a wearable blanket, also known as a sleep sack.

Infection Control

- Cold weather does not cause colds or flu. However, viruses that cause a cold and the flu are more common in the winter when children spend more time indoors.

- Keeping everyone’s hands clean is one of the most important ways to avoid getting sick and spreading germs to others. Wash hands with soap and clean running water and rub them together for at least 20 seconds.

- Teach children to cough or sneeze into their upper sleeve or elbow, not their hands. Adults should model this behavior.

- Review program policies on handwashing; cleaning, sanitizing, and disinfecting; and excluding children and caregivers who are sick.

- The U.S. Centers for Disease Control and Prevention and the American Academy of Pediatrics recommend that all children 6 months and older receive the seasonal flu vaccine every year. All early care and education program staff should also get vaccinated for the flu.

-

Activism3 weeks ago

Activism3 weeks agoBooks for Ghana

-

Arts and Culture4 weeks ago

Arts and Culture4 weeks agoPromise Marks Performs Songs of Etta James in One-Woman Show, “A Sunday Kind of Love” at the Black Repertory Theater in Berkeley

-

Bay Area3 weeks ago

Bay Area3 weeks agoGlydways Breaking Ground on 14-Acre Demonstration Facility at Hilltop Mall

-

Activism4 weeks ago

Activism4 weeks ago‘Donald Trump Is Not a God:’ Rep. Bennie Thompson Blasts Trump’s Call to Jail Him

-

Activism3 weeks ago

Activism3 weeks agoLiving His Legacy: The Late Oscar Wright’s “Village” Vows to Inherit Activist’s Commitment to Education

-

Arts and Culture3 weeks ago

Arts and Culture3 weeks agoIn ‘Affrilachia: Testimonies,’ Puts Blacks in Appalacia on the Map

-

Alameda County3 weeks ago

Alameda County3 weeks agoAC Transit Holiday Bus Offering Free Rides Since 1963

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCalifornia, Districts Try to Recruit and Retain Black Teachers; Advocates Say More Should Be Done

Pingback: COVID-19 financial warning: Consumers and banks should stay away from payday loans - BomaLink DrumBeat