#NNPA BlackPress

Framing Our Future: Liberty Bank Celebrates 50 Years

NNPA NEWSWIRE — The elder McDonald, served as president & CEO of Liberty Bank from its founding in 1972, leading and growing the Black-owned bank for the better part of 50 years until earlier this year, when his son Todd, a Morehouse College graduate who earned his MBA from Northwestern University’s Kellogg School of Management, picked up the mantle to lead Liberty into the future.

The post Framing Our Future: Liberty Bank Celebrates 50 Years first appeared on BlackPressUSA.

By Anitra D. Brown | The New Orleans Tribune

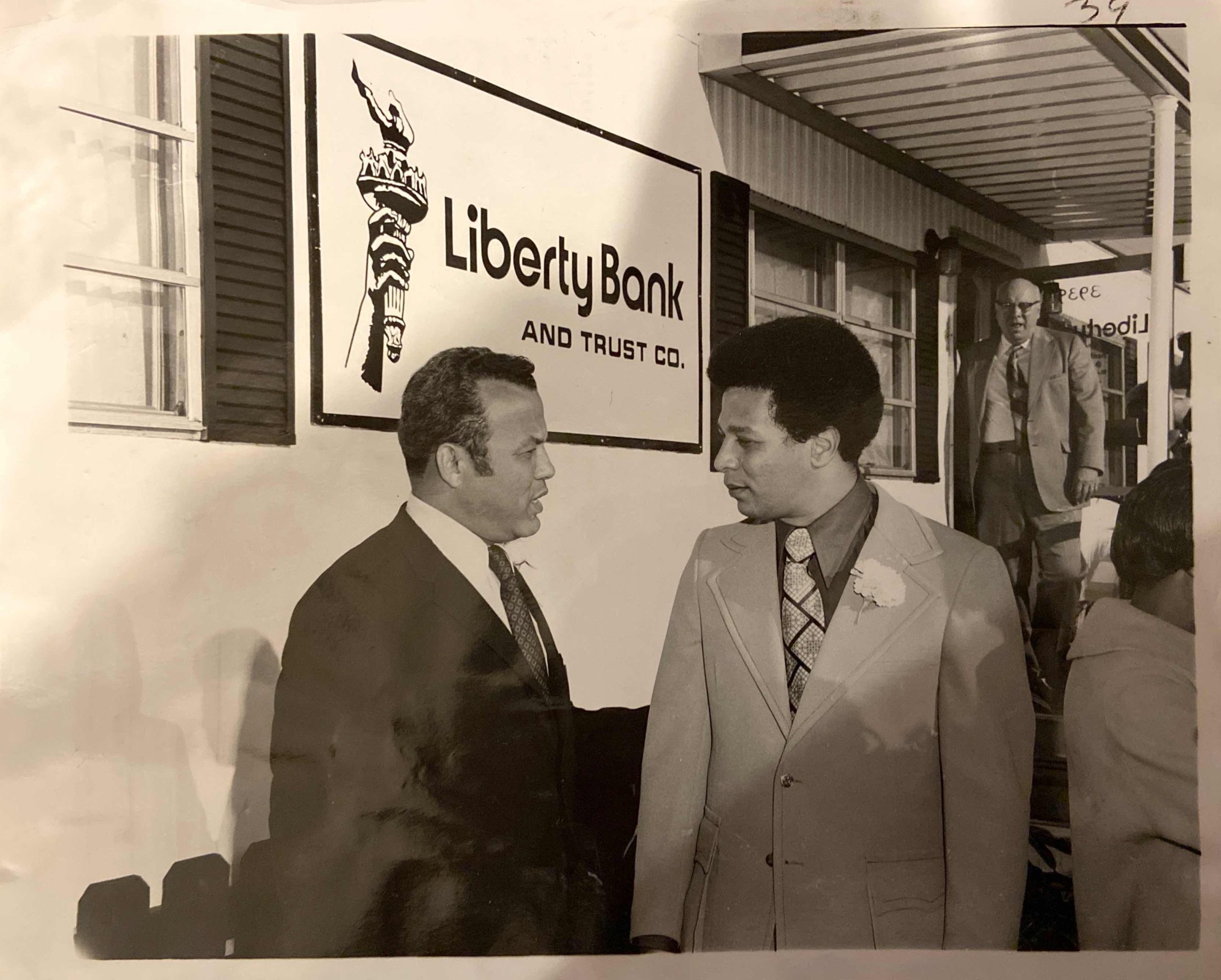

Alden J. McDonald and his son Todd have at least two things in common. The first is that neither saw himself as a bank president. In fact, Alden McDonald says it took a novena and Dr. Norman Francis asking him three times to become the president of what would be the newly founded Liberty Bank & Trust before he said “yes.”

“I didn’t’ know whether I was prepared to run a bank.” Alden McDonald once told The New Orleans Tribune. “No one else had walked that plank.”

The truth – he was ready. A graduate of the LSU School of Banking and of Columbia University’s Commercial Banking Management Program, McDonald began his career at International City Bank in New Orleans in 1966, rising to the position of vice president for consumer lending. And during those six years, he zealously learned all he could about the industry, working 12- to 14-hour days.

International City Bank didn’t want him to leave, offering him a senior vice president position to urge him to stay, he says. Instead, he followed advice given to him by the young lady he was dating at the time, Rhesa Ortique, whom he went on to marry. She was the one who suggested he go to a novena in search of guidance and direction.

“So, I did the novena, and I made the decision to do this, right. I am 29 at the time, and to be honest with you, I didn’t know what the hell I was thinking.”

In contrast, it didn’t take a special prayer service for Todd McDonald to know he wanted to be his own boss one day; still, he didn’t see banking in his future. The enterprising youngster, who washed his parents’ friends’ cars while they visited to make extra money, always saw himself as a businessman. However, he thought banking was static and that it would not offer the diverse opportunities he wanted to experience… that was until he had the opportunity to shadow one of his father’s friends, Joe Canizaro, the founder of First Bank & Trust. It was then he realized there was more to banking than, well, banking.

“He brought me into meetings, and I saw how he used the bank as a platform to go into many different businesses. I mean he was building a city in Mississippi; he had the hospitality company; he had a construction company; health care — all these different businesses. And I was like, so you could run a bank and have all of these tentacles out there at the same time. Okay, I would never get tired of doing this.”

At the time, a younger Todd McDonald didn’t really see his father doing all of that at Liberty; but he understood why.

In 1972, with Dr. Norman Francis on its Board of Directors, Alden McDonald as President & CEO and $2 million in assets, Liberty Bank was founded to more Black New Orleanians and other under-served members of the community achieve their dreams. Today, Liberty has branches in 11 states and has $1 billion in assets.

“It was for obvious reasons — a lack of capital,” he says. “I’m sure he could have ventured off in many different ways, as well. But that experience provided me with a vision for myself. How do we leverage a bank charter? You know, I’ve been around my dad for 41 years; but I’ve only been employed with the bank for 19. I heard the stories about him helping people. And so, I’m like, you know, once you start applying the ‘helping people’ with the ‘making money’ and ‘helping other people make money’, it was an easy sell. I’ve dedicated my life to this. I wake up thinking about it. I go to sleep thinking about it.”

And with that, the other thing father and son have in common is that despite each man’s initial misgivings, running a bank is precisely what he has done or is doing.

With his son’s rise to bank president, Alden McDonald, continues to serve as the head of the Liberty Financial Holding Company.

It’s Always Been Huge

The elder McDonald, served as president & CEO of Liberty Bank from its founding in 1972, leading and growing the Black-owned bank for the better part of 50 years until earlier this year, when his son Todd, a Morehouse College graduate who earned his MBA from Northwestern University’s Kellogg School of Management, picked up the mantle to lead Liberty into the future.

The pair took a little time to catch up with The New Orleans Tribune recently to talk about what is now the nation’s largest Black-owned bank. Sitting at a table in the community room of the bank’s headquarters in New Orleans East, the elder McDonald began by mentioning a significant milestone Liberty Bank reached in recent years – $1 billion dollars in assets.

“It was his idea, not mine,” he says with proud smile and a little laughter, nodding in Todd’s direction.

Todd chimes in through the laughter, “That’s what we have to do as a bank to survive. If we don’t get bigger, the cost of operating just gets bigger and you can’t manage the expense side. So, it was very important for us to reach that milestone.”

“It’s a lot of money,” Alden McDonald says. “How many other people do we know that have a billion-dollar company? How many in the city of New Orleans. Just, when you think about it… the significance of it. It’s… it’s…

“Huge,” Todd interjects, finishing the sentence his father started.

“Huge,” Alden McDonald repeats reflectively. “You know, Todd and I, we talked five years ago when he took a real an active role at the bank. He was in charge of strategic planning and visioning. And his vision went beyond my wildest dreams. When he was pushing for a billion dollars, he was looking to make sure we could survive in the banking industry. When I got in the banking industry, there were 35,000 banks. Today, there are less than 5,000 banks. When I got into the business, there were 100 Black banks. Today, there are less than 20. Everything in the industry says a $200 million bank is not going to survive. A $500 million bank is not going to survive. So the benchmark he came up with was a billion.”

The achievement took more than just reaching $1 billion in assets. As Alden McDonald explains, in the banking industry, the rule of thumb is an eight percent capital to asset ratio. In banking terms, capital is the total equity a company has — assets minus liability.

“And then, a couple of years ago, the feds started sending signals. They wanted a 10 percent ratio,” the senior McDonald says.

When Liberty set out to grow to a billion in assets it only had about $60 million in equity. It needed at least $90 million.

It was Todd, who, while serving as Liberty’s executive vice president of corporate strategy, developed national partnerships that produced several new revenue streams that raised $30 million in capital for the bank.

All of this was taking place over the last few years with the pandemic as a backdrop and in the wake of the murder of George Floyd, events that prompted shifts in the nation, one of which included a bit of pressure put on the big boys of banking to help minority banks grow.

And Liberty’s plan for raising the equity it needed to support its growth was realized.

“If it was me, I would asked JP Morgan for $5 million, Citibank for $5 million, Wells Fargo for $5 million and Bank of America for $5 million. Todd goes in, he asks JP Morgan for $30 million. I said, ‘boy, you’re crazy?’ They ended up giving $18 million. Wells gave $5 million. Citi gave $5 million. Bank of America gave $2 million,” the elder McDonald recounts. “I would have been pleased with whatever; but because of the young mind and the young vision, he ended up getting $30 million of non-voting capital. Non-voting. It does not dilute one bit of ownership,”

Perhaps the only thing huger than Liberty Bank reaching that milestone – more than $1 billion in assets the equity to back it up – is the force the bank has been for its customers in New Orleans and across the country.

Even when its assets weren’t, Liberty’s impact has been huge from the start.

Forging a Path to Financial Freedom

The first Liberty Bank branch was a repurposed construction trailer located on Tulane Avenue.

If Alden McDonald wasn’t ready to lead a Black-owned bank in 1972, Black New Orleans was ready for one.

Beginning in the early 1960s, Alden McDonald and Dr. Norman Francis saw a Black community growing increasingly dissatisfied with inequity and looking for increased opportunity, especially on the economic front. They wanted mortgage loans and loans to start businesses or launch political campaigns without higher interest rates or resorting to subprime finance companies. And if they couldn’t find what they wanted in the mainstream banking industry, they would have to create their own.

That is why Francis asked a young Alden McDonald to leave his comfortable job and start his own bank not once, not twice, but three times — there was a need for a bank that would help more Black New Orleanians and other under-served members of the community achieve their dreams.

Liberty Bank was one of 42 African American-owned banks to open in the U.S. between 1962 and 1979, according to the National Bankers Association. They opened to serve communities that had been all but shut out of the mainstream. When the other banks refused to loan African Americans money or loaned it to them at extraordinarily high interest rates, Black-owned banks were there; and their influence was tangible from the very early history.

There is no telling how many Black New Orleanians own homes and operate businesses because Liberty Bank exists.

Norman Francis once said, “We had a dream to do something special in New Orleans. We started a community bank with a focus on an under-served population.”

From a construction trailer on Tulane Avenue, Liberty now has branches in 11 states and the cyber ability to conduct banking operations nationwide. Liberty Bank has withstood natural disasters and weathered national and regional financial crises. It has not only existed for 50 years, it has thrived. From $2 million in assets in 1972 to the largest African American-owned financial institution in the United States.

More importantly, here in New Orleans, and in other cities across the country, Liberty has helped individuals achieve their financial goals and financial freedom. That is what is meant by “Framing Our Future”, the theme of the bank’s 50-year anniversary.

Big Things Popping

The bank is also a player in helping business owners and investors make major moves. On the day The Tribune met with the McDonalds, they were gearing up for a meeting with a customer about a major project in downtown Minneapolis — the redevelopment of a one-million-square-foot building, Alden McDonald tells.

Financing those types of multi-million-dollar endeavors have become common practice for Liberty Bank.

Just before the pandemic, Alden McDonald says the bank launched a new loan product designed specifically to help African American business owners get into the airport concessions business.

“We were lending money to African Americans with airport contracts,” he says. “Now, we got in it at the wrong time, but we still made out pretty good. We loaned about $30 million to business owners with concessions in airports in New York, New Jersey, Dallas, Los Angeles, and Chicago. We had them all over. It’s helped those businesses grow their capital. When you grow capital, you can hire more people, more Black people. So, the whole pie grows. Despite the pandemic, we only had a problem with one loan and we didn’t lose any money.”

Then there is the project in Houston.

“The mayor in Houston has put together a housing effort there to build maybe 500 homes using all Black folks — the contractors, the developers. And we are financing them. We think that’s going to be a real big signature project with anywhere between $30 million and $50 million in financing from us. And we do a little bit more than just lend the money. For example, this one developer didn’t have much experience, so we put them in touch with another developer we were financing in Houston to partner with him. Then the city gave him a contract that wasn’t to his advantage. So, when we read it, in putting his package together, we said, ‘this ain’t gonna work’. So we helped him to go back to the city, had the city to rework his contract where it made sense and protected him from losing money.”

There are other examples. Too many to include in a single article.

In addition to banking, Liberty has its own insurance agency and a heavy equipment leasing company. It also recently launched its own commercial insurance brokerage firm.

“We intend to be the largest Black-owned commercial insurance brokerage in the country in the next five years,” Alden McDonald says. “What does that mean? It means we are starting another company that will employ additional people. We are going to be able to help other companies in that business to write bigger policies. There is a network of smaller Black-owned commercial insurance brokers across the country, and we are going to help those businesses create more jobs and grow Black wealth. And we’re going to make some money. I always say that you can’t do good, if you don’t do well.”

And if Liberty Bank has its way, it will be doing both well and good into the future.

“We don’t plan on taking another 50 years to reach another $1 billion in assets. He plans on getting there in the next five years,” Alden says, again nodding at Todd.

“My perspective is we have a long runway,” says Todd. “I mean, we have decades ahead of us. You know, it is a lot of work and we’re just taking it step by step. We know organizationally, we can’t be everything to everybody. So, we’ve got to choose our lane and commit to it. We have an amazing underwriting muscle. As my dad mentioned earlier, typically Black-owned institutions didn’t have access to capital. So, the focus is what did we do the first 50 years and how do we leverage that to do it bigger the next 50 years.”

And while Liberty certainly has big things popping, it continues to provide access to basic financial services such as personal checking and savings accounts and multi-faceted products for both individuals and small businesses.

Even as it celebrates 50 years and touts more than a $1 billion in assets, helping everyday people achieve financial freedom is still a primary focus of the bank, says Todd McDonald.

In fact, the smallest loan Liberty offers is $500, it’s the sort of small dollar loan at a low interest rate that Liberty provides to customers to keep them from falling prey to predatory lenders like those in the payday loan industry.

“That’s the least amount of money you can borrow. But to me, that’s the most important product that we have,” says Todd. “I don’t say that a lot, but I prefer to help the average person get out of debt. If I can help someone consolidate from $1,000 a month in payments down to $300 a month in payments, saving them $700 dollars a month, it’s better than making a $1 million loan to me. Now if we repeat that and get a 1,000 people at a time refinancing debt, that’s $700,000 a month back into the pockets of people that look like you and me. Then, we could have the same thousand people start to buy their own homes. Now, if we coordinate efforts like that across the country, we could really pick up some ground. it’s off to the races from that standpoint. So, we’re not just looking at big transactions.”

Celebrating 50 Years with a Golden Jubilee

Liberty Bank’s story of resilience, profitability and empowerment was showcased on Friday, Dec. 2, at Liberty’s “Golden Jubilee” celebration at the Mahalia Jackson Theater. The event was produced by Bright Moments, LLC and was directed by celebrated theater icon Tommye Myrick.

Norman Robinson and Sally Ann Roberts narrated the event that explored the unique role Liberty Bank has played in closing the wealth gap in America. The evening featured song, dance, spoken word and visual renderings that tell the story the African American experience.

The show was led by the musical arrangements of the New Orleans Jazz Orchestra under the direction of Grammy award winner Adonis Rose and featured Irma Thomas, Leah Chase, Jr., Chase Kamata, Sharon Martin, Phillip Manuel, John Boutte, Tonya Boyd-Cannon, the Mystics, the Franklin Avenue Male Chorus, the C Sharpe Gospel Ensemble, the Kia Knight Dance Ensemble, Stilt Walkers, African Drummers, Harold Evans, Gwendolyn Foxworth, Lady Tambourine, Erica Falls, Peteh the Poet, and a host of others.

The post Framing Our Future: Liberty Bank Celebrates 50 Years appeared first on The New Orleans Tribune.

The post Framing Our Future: Liberty Bank Celebrates 50 Years first appeared on BlackPressUSA.

#NNPA BlackPress

OP-ED: The Illusion of Allyship. White Women, Your Yard Signs Mean Nothing to Me

NNPA NEWSWIRE – “The blue bracelets are something White women are wearing so others can see that they didn’t vote for Trump,” says Liberal Lisa from Oklahoma on X. Chile, bye. These bracelets are hollow symbols, empty gestures that mean nothing to me. An accessory to claim distance from Trump’s legacy is superficial comfort, while the choice to not stand with us in the voting booth is far more profound.

Political yard signs can symbolize intentions and allegiance. But this year, they’ve also symbolized betrayal. During this general election, Black women were led to believe that more White women would stand with us. Exit polls, however, told a different story. Despite overwhelming displays of support, more White women still chose to vote for the convicted felon, reality TV star, and rapist. White women answered the call but left us hanging at the polls.

A Familiar Disappointment

I live in DeKalb County, Georgia, and the abundance of Harris-Walz yard signs could’ve fooled me. But I’ve seen this before, back when Stacey Abrams ran for governor. White women showed up, put up signs, attended rallies, knocked on doors, and phone-banked. Yet, when it came time to vote, they let us down—not once but twice. I’ve been here for over 15 years, and if there’s one thing I know, it’s that political signs are symbols without weight.

In every election, I’ve talked with White women. Most aren’t the primary earners in their families and vote along party lines, aligning with the preferences of their fathers and husbands. These conversations reveal a reluctance to break from tradition, even when their votes affect women and certainly when their votes impact the lives of people who look like me.

The Illusion of Solidarity—Symbols Are Not Enough

On social media, I’m seeing White women posting pictures of blue bracelets to “prove” they didn’t vote for Trump. “The blue bracelets are something White women are wearing so others can see that they didn’t vote for Trump,” says Liberal Lisa from Oklahoma on X. Chile, bye. These bracelets are hollow symbols, empty gestures that mean nothing to me. An accessory to claim distance from Trump’s legacy is superficial comfort, while the choice to not stand with us in the voting booth is far more profound.

I’ve seen Black Lives Matter signs and black squares posted on Instagram to “prove” support for Black people, but we now know that was a lie, too. Will those same people who claimed Black lives mattered now take down their Harris-Walz signs and show their true selves?

Navigating these truths is a daily struggle for me—professionally and socially. White women often misuse their privilege, supporting us only when it’s convenient. Seeing overqualified Black women sabotaged or abandoned by White women at critical moments is a constant emotional challenge. It’s exhausting to live with this reality, especially when solidarity seems like something they pick up and discard at will.

One clever campaign ad from Harris-Walz that spoke directly to White women. “Your Vote, Your Choice” emphasized that their vote was private—independent of their household situation. Another was from Olivia Howell Dreizen, the “Vote Without Fear” campaign, which empowered women to consider the greater impact of their choices. But it seems many still couldn’t choose the roadmap to freedom—even when it was handed to them.

A Call for Action Beyond Words

White women, I want to believe you care, but actions speak louder than yard signs, bracelets, or Instagram posts. Show up in our communities, advocate in your workplaces, and stand up to dismantle the structures that uphold white supremacy. Only through real action will we know where you stand.

If you choose not to act, we see you—and we know exactly where you stand. Good luck these next four years.

Disclaimer: The views and opinions expressed in this article do not necessarily reflect the official policy or position of BlackPressUSA.com or the National Newspaper Publishers Association.

#NNPA BlackPress

Supernova Parenting Conference Empowers Over 100 Parents with Resources for Neurodivergence and Mental Health

The inaugural Supernova Parenting Conference was co-hosted by Natasha Nelson, known as Supernova Momma, and Yolanda Walker, founder of Parenting Decolonized. It brought together over 100 parents, caregivers, and educators dedicated to fostering understanding and support for neurodivergent children and mental health challenges. The conference provided invaluable resources, expert insights, and a collaborative space for […]

The inaugural Supernova Parenting Conference was co-hosted by Natasha Nelson, known as Supernova Momma, and Yolanda Walker, founder of Parenting Decolonized. It brought together over 100 parents, caregivers, and educators dedicated to fostering understanding and support for neurodivergent children and mental health challenges. The conference provided invaluable resources, expert insights, and a collaborative space for connection, marking a significant step toward creating a more inclusive parenting community.

The event featured a variety of workshops, panel discussions, and keynote speeches from leading experts in neurodiversity and mental health. Attendees left with practical tools and strategies to enhance their parenting journeys, emphasizing the importance of understanding and supporting the unique needs of neurodivergent children.

“While the conference was a tremendous success, we believe that our work doesn’t end here,” said Natasha Nelson. “It’s crucial to continue providing ongoing support and resources for parents as they navigate this important journey. We want to ensure families can access the tools they need long after the conference.”

To extend the momentum generated at the conference, Natasha and Yolanda are excited to announce the launch of the Supernova Parenting Community. This membership-based initiative aims to offer a safe and supportive environment for parents and caregivers to continue their growth as conscious parents.

Membership is available for as little as $5 a month via Patreon, making it accessible for all families seeking support.

“We know that parenting can be a challenging journey, especially when navigating neurodivergence and mental health issues,” Yolanda Walker added. “Our goal is to build a community where parents feel seen, heard, and supported. We hope you’ll join us in this vital work.”

For more information about the Supernova Parenting Community and to sign up for membership, please visit supernovaparenting.org

#NNPA BlackPress

Election Night on The Yard at Howard University

Election Night on The Yard at Howard University

-

Alameda County4 weeks ago

Alameda County4 weeks agoAlameda County District Attorney Pamela Price Announces $7.5 Million Settlement Agreement with Walmart

-

Activism3 weeks ago

Activism3 weeks ago‘Jim Crow Was and Remains Real in Alameda County (and) It Is What We Are Challenging and Trying to Fix Every Day,’ Says D.A. Pamela Price

-

Bay Area3 weeks ago

Bay Area3 weeks agoIn the City Attorney Race, Ryan Richardson Is Better for Oakland

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of October 30 – November 5, 2024

-

Alameda County3 weeks ago

Alameda County3 weeks agoD.A. Price Charges Coliseum Flea Market Vendors in Organized Retail Theft Case

-

Activism3 weeks ago

Activism3 weeks ago‘Criminal Justice Reform Is the Signature Civil Rights Issue of Our Time,’ says D.A. Pamela Price

-

Activism3 weeks ago

Activism3 weeks ago“Two things can be true at once.” An Afro-Latina Voter Weighs in on Identity and Politics

-

Arts and Culture3 weeks ago

Arts and Culture3 weeks agoMacArthur Fellow Jericho Brown’s Poetry Reflects Contemporary Culture and Identity