Community

New Report Exposes Tax System’s Role in Widening Racial Wealth Gap, Calls for Urgent Reforms

NNPA NEWSWIRE — The message from Color of Change and Americans for Tax Fairness is clear: America’s tax system is broken, and without immediate reforms, the racial wealth gap will continue to widen. “Addressing the insidious racial preferences in our tax code is one of the most direct ways we can not only help Black communities grow here and now but for generations to come,” concludes Color of Change Managing Director Portia Allen-Kyle.

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

@StacyBrownMedia

Color of Change, the nation’s largest online racial justice organization, and Americans for Tax Fairness released a damning report Thursday exposing the deep racial inequities entrenched in the U.S. tax system.

The issue brief “How Tax Fairness Can Promote Racial Equity,” written by Color of Change Managing Director Portia Allen-Kyle and Americans for Tax Fairness Executive Director David Kass, exposes the systemic flaws in tax policy that have widened the racial wealth gap and prevented economic mobility for Black, brown, and Indigenous communities.

The report urgently calls for sweeping reforms to stop the flow of tax benefits to the wealthiest Americans — who are overwhelmingly white — while offering concrete solutions to make the tax code work for everyone, not just the top 1%.

“An equitable tax system does two things,” Allen-Kyle asserted. “It narrows the racial wealth gap from the bottom up and spurs economic mobility for Black, brown, and Indigenous individuals and families. Our current tax code fails on both accounts. It’s a prime example of how so-called ‘colorblind’ systems actively prevent Black families from building generational wealth and economic security.”

Tax Code Deepens Racial Disparities, Experts Say

The brief pulls no punches in describing how current tax policies disproportionately benefit wealthy white families, further deepening racial inequalities. By giving preferential treatment to wealth over work, the system locks in economic advantages for white households while leaving communities of color to bear the brunt of these inequities.

“Our tax system is not only failing to address racial wealth inequality, it’s exacerbating it,” Kass warns in the report. “We privilege wealth over work, fail to adequately tax our richest households and corporations, and allow inherited fortunes to compound unchecked by taxation. This perpetuates a legacy of racial inequality.”

The racial wealth gap has exploded in recent years, with the median wealth gap between Black and white households jumping from $172,000 in 2019 to over $214,000 in 2022. Economic crises such as the Great Recession and the COVID-19 pandemic further entrenched these divides, benefiting the already wealthy, while leaving Black, brown and Indigenous communities further behind.

The Racial Wealth Gap and Homeownership

Homeownership, long touted as a primary means of building wealth in America, has failed to deliver for Black families. The report points to factors such as biased home appraisals and a regressive property tax system as key reasons why Black homeowners have been unable to accumulate wealth at the same rate as their white counterparts.

As the brief notes, with critical provisions of the Tax Cuts and Jobs Act (TCJA) set to expire, now is a pivotal moment for tax reform. “We have a once-in-a-generation opportunity to reform our tax system to address racial inequality,” the report states, comparing recent monumental legislation like the Bipartisan Infrastructure Law and the Inflation Reduction Act.

Three Key Reforms to Tackle Racial Inequity

The report lays out three central reforms aimed at curbing the wealth concentration among the ultra-rich and dismantling the racial inequities baked into the tax code:

- Taxing Wealth Fairly: The report calls for equalizing the tax rates on wealth and work. Currently, capital gains — profits from investments — are taxed at a far lower rate than wages earned by working people, a disparity that overwhelmingly benefits white households. The vast majority of capital gains income flows to white families, who comprise only two-thirds of taxpayers but receive 92% of the benefits from lower tax rates on investment income.

- Strengthening the Estate Tax: The estate tax, which is supposed to curb the accumulation of dynastic wealth, has been weakened over time, allowing large fortunes — primarily held by white families — to grow even larger across generations. The report calls for stronger enforcement of the estate tax to prevent the further entrenchment of wealth and power within a small, overwhelmingly white elite.

- Targeting Tax Deductions to Benefit Lower-Income Households: Deductions for mortgage interest, college savings, and retirement accounts disproportionately benefit wealthier, predominantly white households. In order to prevent lower-income and minority households from falling behind due to policies that are currently biased in favor of the wealthy, the brief advocates for restructuring these deductions.

Biden-Harris Administration and Senate Proposals for Change

Both the Biden-Harris administration and Senate Finance Committee Chairman Ron Wyden have proposed addressing the racial wealth gap.

The Billionaire Minimum Income Tax (BMIT) and the Billionaire Income Tax (BIT) would ensure that the wealthiest Americans — who often go years without paying taxes — contribute their fair share. These proposals would raise over $500 billion in revenue over the next decade, which could be reinvested in healthcare, education, and housing for communities of color.

As the report points out, our current tax system is skewed in favor of the ultrawealthy. It allows the rich to avoid paying taxes on the increased value of their investments unless they sell them. They often borrow against these growing fortunes, further delaying taxation, which allows white billionaires to accumulate vast wealth while paying a fraction of what working families pay in taxes.

Defending IRS Funding to Hold the Wealthy Accountable

The report also highlights the critical need to defend IRS funding, restored under the Inflation Reduction Act, which is essential for cracking down on wealthy tax cheats.

Contrary to Republican claims, this funding will not increase tax enforcement on households earning less than $400,000. Instead, it will improve customer service and expand the Direct File program, saving taxpayers significant time and money.

The Biden administration’s restored IRS funding is expected to raise an additional $100 billion over the next decade by ensuring the wealthiest Americans and corporations pay what they legally owe.

A Call for Urgent Action

The message from Color of Change and Americans for Tax Fairness is clear: America’s tax system is broken, and without immediate reforms, the racial wealth gap will continue to widen.

“Addressing the insidious racial preferences in our tax code is one of the most direct ways we can not only help Black communities grow here and now but for generations to come,” Allen-Kyle concludes.

Commentary

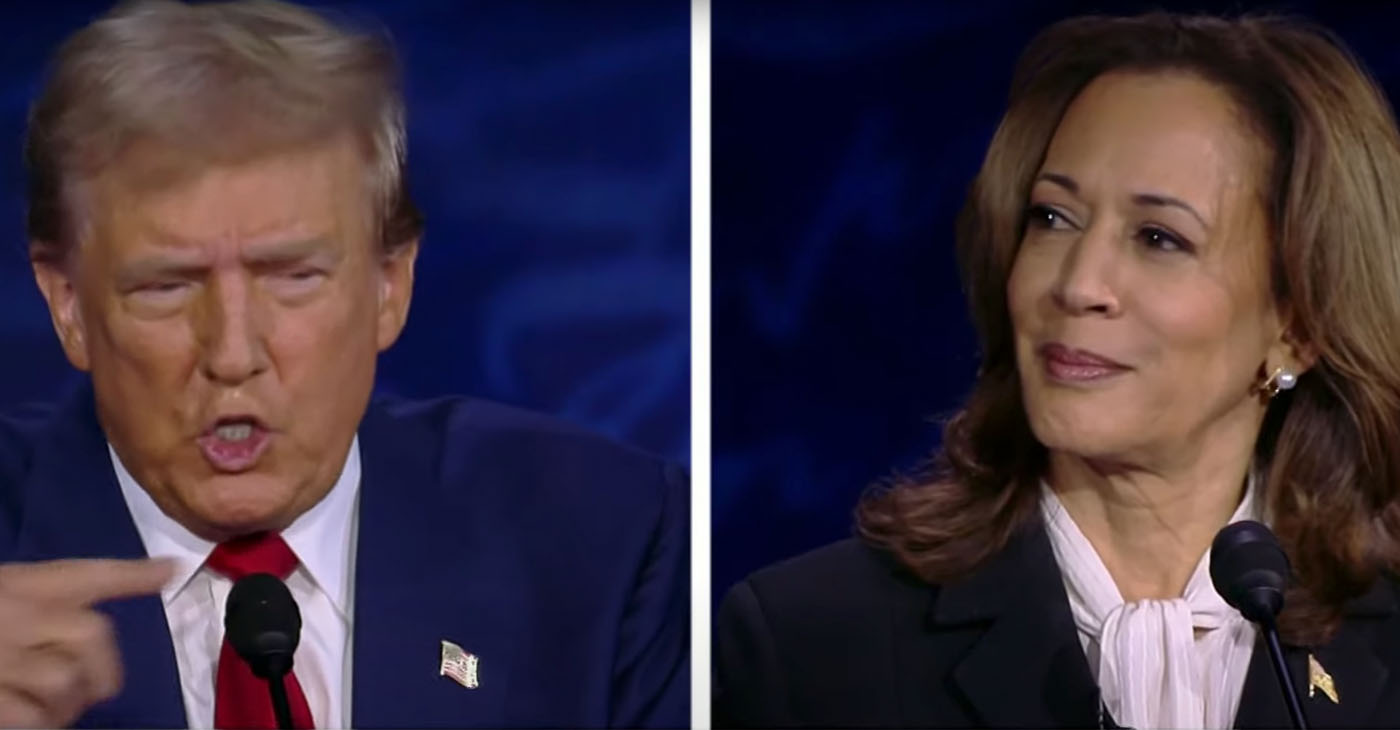

Harris Dominates First Presidential Debate as Trump Struggles to Defend Record

NNPA NEWSWIRE — Vice President Kamala Harris positioned herself as a problem-solver, taking on issues like housing, childcare, and the economy. In her opening statement, she outlined her “opportunity economy” plan, which focuses on bolstering the middle class. “I was raised as a middle-class kid, and I am actually the only person on this stage who has a plan that is about lifting up the middle class and working people of America,” Harris said. She detailed a $6,000 child tax credit as part of her plan to support young families.

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

Vice President Kamala Harris decisively took control of the first presidential debate against former President Donald Trump in Philadelphia on Tuesday night, delivering a performance that put Trump on the defensive for much of the evening. Moderators David Muir and Linsey Davis of ABC News kept a tight handle on the debate, significantly improving from CNN’s June handling of Trump and President Joe Biden.

The debate began with a surprise as Harris approached Trump to shake his hand and introduced herself as “Kamala Harris,” an unusual move that set the tone for the night. Trump’s trademark scowl stayed in place throughout the debate, as Harris pressed him on his legal woes and diminished his record. Displaying her prosecutorial skills, Harris consistently turned the conversation toward Trump’s convictions, his business fraud case, and his role in the January 6 insurrection.

Harris positioned herself as a problem-solver, taking on issues like housing, childcare, and the economy. In her opening statement, she outlined her “opportunity economy” plan, which focuses on bolstering the middle class.

“I was raised as a middle-class kid, and I am actually the only person on this stage who has a plan that is about lifting up the middle class and working people of America,” Harris said. She detailed a $6,000 child tax credit as part of her plan to support young families.

Trump, by contrast, criticized the Biden-Harris economy, calling it “the worst period of time” he had seen. He defended his tariff policies and took aim at Harris, labeling her a “Marxist” while also accusing her of copying his economic policies. “I was going to send her a MAGA hat,” Trump quipped.

Abortion rights were another major focus of the night. Trump, when asked if he would veto a federal abortion ban, declined to answer directly, stating, “I won’t have to,” and arguing that the end of Roe v. Wade had satisfied everyone. Harris, in turn, vowed to restore Roe’s protections through federal legislation if elected.

“I pledge to you: when Congress passes a bill to put back in place the protections of Roe v. Wade as President of the United States, I will proudly sign it into law,” she said.

As the debate went on, Trump repeated several conspiracy theories, including a claim that migrants were eating pets in U.S. cities, which Muir quickly fact-checked. Trump doubled down, citing “people on television” as his source. Harris largely let Trump’s more outlandish statements pass, opting to stay on policy while allowing the moderators to address his factually inaccurate remarks.

In one of the most heated moments, Harris invited viewers to attend a Trump rally for themselves, commenting, “He talks about fictional characters like Hannibal Lecter and windmills causing cancer. You’ll notice people start leaving his rallies early—out of exhaustion and boredom.”

Trump, visibly irritated, retorted that he holds “the most incredible rallies in the history of politics,” but the debate soon returned to more substantive issues like crime and inflation.

The night clearly contrasted Biden’s earlier debate with Trump, as Harris managed to keep Trump on the defensive. Trump continued to fixate on conspiracy theories and past grievances, while Harris stayed focused on presenting her vision for the future.

With fewer than 60 days until the election, the debate sets the tone for what will likely be a hard-fought campaign. As the debate ended, Harris closed with a message to the American people: “This is about who we are as a country. The choice is clear—between chaos and leadership, fear and hope.”

Bay Area

Homelessness Committee and Advocates Urge City to Stop Confiscating Unhoused People’s Belongings

Encampment sweeps are not a new method of action to evict people from living and sleeping on the streets in San Francisco. However, recent reports indicate that city staff are not following proper policy, exacerbating the problems for unhoused people. Homeless advocates and allies held a press conference on Thursday at City Hall, condemning staff workers for destroying people’s property during encampment evictions and asking officials to ensure that important documents and medication are not being stripped from these individuals.

By Magaly Muñoz

Encampment sweeps are not a new method of action to evict people from living and sleeping on the streets in San Francisco. However, recent reports indicate that city staff are not following proper policy, exacerbating the problems for unhoused people.

Homeless advocates and allies held a press conference on Thursday at City Hall, condemning staff workers for destroying people’s property during encampment evictions and asking officials to ensure that important documents and medication are not being stripped from these individuals.

“By destroying the very items that could help people regain stability, the city is not just punishing people for being poor, but actively making it harder for them to escape homelessness,” Jennifer Friedenbach, executive director of the Coalition on Homelessness, said.

Friedenbach criticized the city for not fixing their housing problem or finding new ways to shelter people, instead they are further adding to the harm of the “humanitarian crisis that San Francisco is facing.”

The press conference was held before the monthly Homelessness Oversight Commission (HOC) meeting, where commissioners discussed a draft resolution to submit to city staff highlighting the importance of not separating people from their items as this might cause further distress.

The resolution lists ssential items that workers should be cautious of not destroying or throwing away including medical documents and medication, work permits, identification, and survival gear, such as blankets or tents.

City policy instructs workers to “bag and tag” items left behind after an encampment sweep. These items are labeled by Public Works and kept at their operations yard for 90 days before being discarded.

But according to several reports and videos of the sweeps, the city has not always followed this policy and has on numerous occasions thrown away people’s medications or tents, leaving individuals without their essentials.

During the meeting, commissioners suggested adding school records and family related support items, such as diapers, to the resolution because of the increasing number of families living on the streets.

Virginia Taylor, senior policy advisor for Safe & Sound, said 531 families are waiting for housing in San Francisco. Many of these families are living out of their cars or in RVs, yet the city has limited safe parking spots where people can situate themselves.

Along with not throwing out people’s belongings, advocates are also continuing to ask the city to stop the encampment sweeps because all they are accomplishing is moving unhoused folks block to block without solving the root problem of lack of consistent housing.

“We need urgent action, more family shelter beds, a stop to vehicle sweeps, expanded safe parking programs and housing solutions that keep our multi-generational families together. Our children’s futures depend on it. Let’s build a San Francisco where no family falls through the crack and every child has the opportunity to thrive,” Taylor said.

Speakers referenced the RV sweep conducted in early August on Zoo Road, where dozens of people, many of them non-English speaking immigrants, were asked to leave the parking lot or else their vehicles would be towed and they would be cited.

While people were offered shelter beds or housing vouchers, some worried about where they would stay while the city processed their applications. This drew criticism of San Francisco’s method of not always having immediate options for people yet continuing to sweep unhoused folks with nowhere to go.

Commissioners of HOC agreed that the city is not trying to exacerbate the issue and the resolution is one of many steps to ensure that there are no setbacks in the progress to ending homelessness in San Francisco.

The HOC will approve the resolution at a later meeting once amendments and changes are made.

Bay Area

Former Mayor Willie L. Brown Endorses Dana Lang for BART Board District 7

Former San Francisco Mayor Willie L. Brown has announced his endorsement support for Dana Lang for BART Board District 7 Seat, which includes voters from both sides of the Bay, and in San Francisco includes Bay View Hunters Point and Treasure Island. Brown acknowledged that Lang has been a behind-the-scenes force in transportation funding for many years and can help BART manage its financial challenges.

By Oakland Post Staff

Former San Francisco Mayor Willie L. Brown has announced his endorsement support for Dana Lang for BART Board District 7 Seat, which includes voters from both sides of the Bay, and in San Francisco includes Bay View Hunters Point and Treasure Island.

Brown acknowledged that Lang has been a behind-the-scenes force in transportation funding for many years and can help BART manage its financial challenges.

“When I met with Dana Lang I asked many questions, then I asked others about her contributions. Getting to know her I realized that she truly understood transportation. At a time when BART is facing a “fiscal cliff” and an upcoming deficit of nearly $360 million per year, Dana is more than ready for this job, she is ready to meet the moment!”

Over the past 24 years Lang has been a funding and grants specialist with several municipal transportation agencies, including the Metropolitan Transportation Commission, San Francisco Muni, San Francisco Police Department and San Francisco International Airport (SFO).

Lang says, “I’ve faced a number of fiscal crises in my career — such as securing $52 million in new transit security funding for SFMTA (Muni) during the 2008 Great Recession, when others thought it was not possible. I have always managed to identify new funding and ways to make transit more secure. Facing a crisis is the best time to act, through advocacy and policy setting. We’ve got to keep BART running and make it safer and more vibrant in order to meet the needs of our riders, our work force, and our community.”

Lang grew up in the low-income minority community of East Palo Alto, CA, and knew that locating grants and resources could positively impact an entire city and its surrounding region — helping to create and retain agency jobs, getting transit riders to their workplaces, and encouraging small business development near transit hubs.

With that in mind, she pursued a bachelor’s degree in economics from Wellesley College, then an MBA from UC Berkeley’s Haas School of Business. She started her municipal career as a policy advisor to Mayor Elihu Harris and helped secure grants for the City of Oakland before moving to the Metropolitan Transportation Commission to serve as a transportation grants specialist.

During her 24-year career she has helped secure hundreds of millions of dollars for Bay Area transit agencies and municipalities. In addition to BART’s financial health, Lang’s priorities for BART also include safety, cleanliness, station vitality — and bringing riders back to BART. She has served on the BART Police Civilian Review Board since 2022.

Lang is also endorsed by BART Board Director Robert Raburn, former BART Board Director Carole Ward Allen, the Rev. Amos Brown, pastor of San Francisco’s Third Baptist Church, Alameda County supervisors Keith Carson and Nate Miley, former Oakland Mayor Elihu Harris, District 4 Oakland City Councilmember Janani Ramachandran, Oakland Chinatown leader Carl Chan, and many others.

Lang is seeking the BART Board District 7 Seat, which includes San Francisco’s Bay View Hunters Point and Treasure Island, a large portion of Oakland, the cities of Alameda, Emeryville, Piedmont, and a small portion of Berkeley.

-

Activism3 weeks ago

Activism3 weeks agoJaylen Brown and Jason Kidd’s $5 Billion Plans

-

Activism3 weeks ago

Activism3 weeks agoOPINION: Why the N-Word Should Be Eliminated from Schools: A Call to Educators, Parents and Students

-

Arts and Culture3 weeks ago

Arts and Culture3 weeks agoAfrican American Historic Ties to Blue Jeans Revealed in Indigo-Dyeing Workshop at Black-Eyed Pea Festival

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of September 11 -17, 2024

-

California Black Media3 weeks ago

California Black Media3 weeks agoOpinion: California Ethnic Media Celebrates Its Purpose — And People

-

Bay Area3 weeks ago

Bay Area3 weeks agoLibby Schaaf, Associates Stiff Penalties for ‘Serious’ Campaign Violations in 2018, 2020 City Elections

-

Community3 weeks ago

Community3 weeks agoPresident Dixon’s Vision for College of Alameda

-

Bay Area3 weeks ago

Bay Area3 weeks agoDistrict 3 Councilmember Carroll Fife Kicks Off Reelection Campaign