#NNPA BlackPress

Beware of Predatory Lending When Shopping for a Home

Predatory lending practices are the fraudulent, deceptive, and unfair tactics some people use to dupe consumers into mortgage loans they can’t afford. Burdened with high mortgage debts, victims of predatory lending find themselves unable to manage the upkeep of their houses. They struggle just to stay on top of their mortgage payments. Often, the strain […]

The post Beware of Predatory Lending When Shopping for a Home first appeared on BlackPressUSA.

Predatory lending practices are the fraudulent, deceptive, and unfair tactics some people use to dupe consumers into mortgage loans they can’t afford. Burdened with high mortgage debts, victims of predatory lending find themselves unable to manage the upkeep of their houses. They struggle just to stay on top of their mortgage payments. Often, the strain is too much. They succumb to foreclosure and lose their homes, which is devastating.

Run down and vacant houses, the inevitable result of predatory lending, wreak havoc on neighborhoods. Property values fall. People move away. Neighborhoods that once were stable start to crumble. Something that has been so important for so many people lay in ruins. Everyone who lived in a neighborhood destroyed by predatory lending becomes a victim.

The United States Attorney’s Office has made combating predatory lending a priority. The Office is taking a comprehensive approach to addressing the problem of predatory lending through education, prosecution, and remediation.

EDUCATION

An educated consumer is the predatory lending syndicate’s worst customer. Educated consumers know what loans are right for them and where to find them. The United States Attorney’s Office has prepared a brochure with some helpful information about preventing mortgage fraud. You can print it out, double-sided, and fold it in thirds to hand it out. PROSECUTION

The U.S. Attorney’s Office has prosecuted and will continue to prosecute the worst predatory lenders. The Office can use your help. Pay attention to what is going on in your community. If something looks suspicious, check it out. Report it.

Tips to Protect Your Home:

Get help! There are scores of housing and credit counselors that can help you decide whether a loan is right for you.

Know your credit rating. Obtain a copy of your credit report.

Trust your instincts. If it sounds too good to be true, it probably isn’t true. Many predatory lenders are slick salesmen. They know how to talk. They don’t always tell you the whole truth. If a deal doesn’t sound right to you, walk away.

Ask questions, demand answers. Predatory lenders will try to fool you by making your loan confusing. If you don’t understand anything, ask. Demand an answer.

Read everything. Get all the loan documents before closing. Don’t sign anything until you have read it. If there is something incorrect, fix it. If you’re confused about something, ask.

Don’t fall for a “bait and switch.” If what you read in your loan papers is not what you wanted, expected, or agreed to, don’t sign. Be prepared to walk out.

Learn about your loan. There are many organizations that produce publications that can be helpful.

Shop around. There are lots of people who may be willing to give you a loan. Most of them are honest, responsible people. Find them. Call as many banks as you can. Look in your newspaper’s real estate section for advertisements. Go to the library and search the internet; try “mortgage,” “mortgage rate,” and “mortgage companies.”

Take your time. A predatory lender will try to rush you so you can’t ask questions. Take all the time you need to understand what your deal is.

Say “No.” Don’t let someone talk you into something you really don’t want or need. Also, it’s ok to change your mind.

Never let a contractor get a loan for you. If you are doing home improvements, a contractor may tell you that he can get a loan for you. Don’t let him. Find the loan yourself; it will be cheaper.

Don’t make final payment to a contractor until all the work is done. Some contractors may ask you to sign over checks to them or to sign so-called “completion certificates” before they finish the work on your house. Don’t. Make sure you’re happy with the work on your house before you turn over any money to a contractor.

Avoid pre-payment penalties. If possible, don’t take a loan that penalizes you for re-financing. You may get stuck in a loan that you can’t get out of.

Don’t lie. No matter what anyone else may tell you, it’s not ok to lie on a form, even a little. If you get a loan based on false documents, you may be getting in over your head. You won’t be able to afford the loan.

Report wrongdoing. If you learn that someone did something illegal, report it.

Red Flags:

Aggressive solicitations. Whose idea was it to get this loan? Did someone sell it to you? Be wary of anyone who came to you trying to sell you a loan. If you need a loan, shop around for it yourself.

Loan flipping. Loan flipping is pressuring you to re-finance your loan over and over. Before you re-finance, make sure a new loan makes you better off. For instance, do not refinance a low interest loan into one with a higher interest rate. See a housing counselor.

High fees. Look at your Good Faith Estimate of Costs and your settlement sheet. Do you know what each fee is for? If not, ask. If your total fees are more than 5% of your loan, that’s probably too much.

Property taxes. If you don’t save enough money to pay your tax bill, a predatory lender will try to lend you money for your taxes. You may want to have your taxes “escrowed.” That means that you will put aside some money each month for your taxes.

Balloon Payments. A balloon payment is one very large payment you make at the end of the loan. Predatory lenders like balloon payments because they can tell you that your monthly payment is low. The problem is that you may not be able to make the payment and will need to re-finance. You’ll need a new loan with new fees and costs.

Consolidating debt. It’s not always a good idea to pay off your credit cards with a mortgage loan. If you can’t pay your credit cards, it’s almost impossible for someone to take your house. If you consolidate, however, your house is collateral. Consolidating means you risk losing your house to pay your credit cards.

Many government organizations publish consumer materials about predatory lending online, so be sure to consult those for more information.

Source: U.S. Department of Justice

Felicia Guidry is 2023-24 President of the Houston Black Real Estate Association (HBREA).

The post Beware of Predatory Lending When Shopping for a Home appeared first on Houston Forward Times.

The post Beware of Predatory Lending When Shopping for a Home first appeared on BlackPressUSA.

#NNPA BlackPress

LIHEAP Funds Released After Weeks of Delay as States and the District Rush to Protect Households from the Cold

BLACKPRESSUSA NEWSWIRE — The federal government has released $3.6 billion in home heating assistance after a delay that left states preparing for the start of winter without the program’s annual funding.

By Stacy M. Brown

Black Press USA Senior National Correspondent

The federal government has released $3.6 billion in home heating assistance after a delay that left states preparing for the start of winter without the program’s annual funding. The Low-Income Home Energy Assistance Program, known as LIHEAP, helps eligible households pay heating and cooling bills. The release follows a shutdown that stretched 43 days and pushed agencies across the country to warn families of possible disruptions.

State officials in Minnesota, Kansas, New York, and Pennsylvania had already issued alerts that the delay could slow the processing of applications or force families to wait until December for help. In Pennsylvania, more than 300,000 households depend on the program each year. Minnesota officials noted that older adults, young children, and people with disabilities face the highest risk as temperatures fall.

The delay also raised concerns among advocates who track household debt tied to rising utility costs. National Energy Assistance Directors Association Executive Director Mark Wolfe said the funds were “essential and long overdue” and added that high arrearages and increased energy prices have strained families seeking help.

Some states faced additional pressure when other services were affected by the shutdown. According to data reviewed by national energy advocates, roughly 68 percent of LIHEAP households also receive nutrition assistance, and the freeze in multiple programs increased the financial burden on low-income residents. Wolfe said families were placed in “an even more precarious situation than usual” as the shutdown stretched into November.

In Maryland, lawmakers urged the Trump administration to release funds after the state recorded its first cold-related death of the season. The Maryland Department of Health reported that a man in his 30s was found outdoors in Frederick County when temperatures dropped. Last winter, the state documented 75 cold-related deaths, the highest number in five years. Rep Kweisi Mfume joined more than 100 House members calling for immediate federal action and said LIHEAP “is not a luxury” for the 100,000 Maryland households that rely on it. He added that seniors and veterans would be placed at risk if the program remained stalled.

Maryland Gov. Wes Moore used $10.1 million in state funds to keep benefits moving, but noted that states cannot routinely replace federal dollars. His administration said families that rely on medical equipment requiring electricity are particularly vulnerable.

The District of Columbia has already mapped out its FY26 LIHEAP structure in documents filed with the federal government. The District’s plan shows that heating assistance, cooling assistance, weatherization, and year-round crisis assistance operate from October 1 through September 30. The District allocates 50 percent of its LIHEAP funds to heating assistance, 10 percent to cooling, 13 percent to year-round crisis assistance, 15 percent to weatherization, and 10 percent to administrative costs. Two percent is used for services that help residents reduce energy needs, including education on reading utility bills and identifying energy waste.

The District’s plan lists a minimum LIHEAP benefit of $200 and a maximum of $1,800 for both heating and cooling assistance. Crisis benefits are provided separately and may reach up to $500 when needed to resolve an emergency. The plan states that a household is considered in crisis if it has been disconnected from energy service, if heating oil is at 5 percent or less of capacity, or if the household has at least $200 owed after the regular benefit is applied.

The District’s filing notes that LIHEAP staff conduct outreach through community meetings, senior housing sites, Advisory Neighborhood Commissions, social media, posters, and mass mailings. The plan confirms that LIHEAP applicants can apply in person, by mail, by email, or through a mobile-friendly online application and that physically disabled residents may request in-home visits.

As agencies nationwide begin distributing the newly released funds, states continue working through large volumes of applications. Wolfe said LIHEAP administrators “have been notified that the award letters have gone out and the states can begin to draw down the funds.”

#NNPA BlackPress

Seven Steps to Help Your Child Build Meaningful Connections

BLACKPRESSUSA NEWSWIRE — Swinging side by side with a friend on the playground. Sharing chalk over bright, colorful sidewalk drawings. Hiding behind a tree during a spirited game of hide-and-seek. These simple moments between children may seem small, but they matter more than we think

By Niyoka McCoy, Ed.D., Chief Learning Officer, Stride/K12

Swinging side by side with a friend on the playground. Sharing chalk over bright, colorful sidewalk drawings. Hiding behind a tree during a spirited game of hide-and-seek. These simple moments between children may seem small, but they matter more than we think: They lay the foundation for some of life’s most important skills.

Through everyday play, young children begin learning essential social and emotional skills like sharing, resolving conflicts, showing empathy, and managing their emotions. These social skills help shape emotional growth and set kids up for long-term success. Socialization in early childhood isn’t just a “nice-to-have”—it’s essential for development.

Yet today, many young children who haven’t yet started school aren’t getting enough consistent, meaningful interaction with peers. Research shows that there’s a decline in active free play and peer socialization when compared to previous generations.

There are many reasons for this. Children who are home with a parent during the day may spend most of their time with adults, limiting opportunities for peer play. Those in daycare or preschool may have restricted free play, and large classrooms can reduce supervision and social coaching. Some children live in rural areas, are homebound due to illness, have full schedules, or rely on screens to fill their playtime. And for some families, finding other families with young children to connect with isn’t easy.

While these challenges can feel significant, opportunities for connection still exist in every community. Families can take simple steps to help children build friendships, create a sense of belonging, and strengthen social skills. Here are some ideas to get started:

- Storytime sessions at libraries or local bookstores

- Community offerings such as parent-child workshops, art, music, gymnastics, swimming, or sports programs

- Weekly events at children’s museums, which may include art projects, music workshops, or science experiments

- Outdoor exploration, where kids can play with peers

- Local parenting groups that organize playdates and group activities

- Volunteer opportunities where children can participate, such as pet adoption events or packing meals at a food bank

- Classes for kids at local businesses, including hardware, grocery, or craft stores

Some of these community activities are free or low-cost and give kids the chance to build friendships and practice social skills. Parents can also model positive social behavior by interacting with other parents and encouraging their children to play with their peers.

These may seem like small moments of connection, but they can have a powerful impact. Every time your child shares a toy, plays make-believe with peers, or races a friend down the slide, they’re not just playing—they’re learning the skills that build confidence, empathy, and lasting friendships. And it’s good for you, too. Creating intentional opportunities for play also helps you strengthen your own network of parents who can support one another as your children grow together.

#NNPA BlackPress

Seven Steps to Help Your Child Build Meaningful Connections

BLACKPRESSUSA NEWSWIRE — Swinging side by side with a friend on the playground. Sharing chalk over bright, colorful sidewalk drawings. Hiding behind a tree during a spirited game of hide-and-seek. These simple moments between children may seem small, but they matter more than we think

By Niyoka McCoy, Ed.D., Chief Learning Officer, Stride/K12

Swinging side by side with a friend on the playground. Sharing chalk over bright, colorful sidewalk drawings. Hiding behind a tree during a spirited game of hide-and-seek. These simple moments between children may seem small, but they matter more than we think: They lay the foundation for some of life’s most important skills.

Through everyday play, young children begin learning essential social and emotional skills like sharing, resolving conflicts, showing empathy, and managing their emotions. These social skills help shape emotional growth and set kids up for long-term success. Socialization in early childhood isn’t just a “nice-to-have”—it’s essential for development.

Yet today, many young children who haven’t yet started school aren’t getting enough consistent, meaningful interaction with peers. Research shows that there’s a decline in active free play and peer socialization when compared to previous generations.

There are many reasons for this. Children who are home with a parent during the day may spend most of their time with adults, limiting opportunities for peer play. Those in daycare or preschool may have restricted free play, and large classrooms can reduce supervision and social coaching. Some children live in rural areas, are homebound due to illness, have full schedules, or rely on screens to fill their playtime. And for some families, finding other families with young children to connect with isn’t easy.

While these challenges can feel significant, opportunities for connection still exist in every community. Families can take simple steps to help children build friendships, create a sense of belonging, and strengthen social skills. Here are some ideas to get started:

- Storytime sessions at libraries or local bookstores

- Community offerings such as parent-child workshops, art, music, gymnastics, swimming, or sports programs

- Weekly events at children’s museums, which may include art projects, music workshops, or science experiments

- Outdoor exploration, where kids can play with peers

- Local parenting groups that organize playdates and group activities

- Volunteer opportunities where children can participate, such as pet adoption events or packing meals at a food bank

- Classes for kids at local businesses, including hardware, grocery, or craft stores

Some of these community activities are free or low-cost and give kids the chance to build friendships and practice social skills. Parents can also model positive social behavior by interacting with other parents and encouraging their children to play with their peers.

These may seem like small moments of connection, but they can have a powerful impact. Every time your child shares a toy, plays make-believe with peers, or races a friend down the slide, they’re not just playing—they’re learning the skills that build confidence, empathy, and lasting friendships. And it’s good for you, too. Creating intentional opportunities for play also helps you strengthen your own network of parents who can support one another as your children grow together.

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of November 12 – 18, 2025

-

Activism3 weeks ago

Activism3 weeks agoIN MEMORIAM: William ‘Bill’ Patterson, 94

-

Activism3 weeks ago

Activism3 weeks agoHow Charles R. Drew University Navigated More Than $20 Million in Fed Cuts – Still Prioritizing Students and Community Health

-

Bay Area3 weeks ago

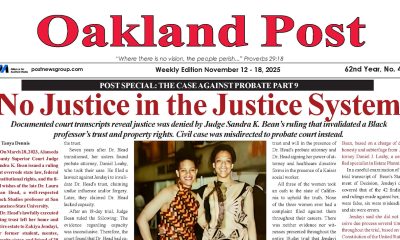

Bay Area3 weeks agoNo Justice in the Justice System

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoLewis Hamilton set to start LAST in Saturday Night’s Las Vegas Grand Prix

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoThe Perfumed Hand of Hypocrisy: Trump Hosted Former Terror Suspect While America Condemns a Muslim Mayor

-

#NNPA BlackPress2 weeks ago

#NNPA BlackPress2 weeks agoBeyoncé and Jay-Z make rare public appearance with Lewis Hamilton at Las Vegas Grand Prix

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump’s Death Threat Rhetoric Sends Nation into Crisis