Business

CFPB Makes Move to Support Payday Lenders During Black History Month

NNPA NEWSWIRE — When given the chance at the ballot box, Americans overwhelmingly vote to impose a 36 percent or less rate cap. Today, 16 states and the District of Columbia have these rate caps in place, providing strong protection from payday loan sharks. In remaining states – those without a rate cap – interest rates run as high as 460 percent in California, over 400 percent in Illinois and 662 percent in Texas.

By Charlene Crowell, Communications Deputy Director with the Center for Responsible Lending and NNPA Newswire Contributor

Each February, Black History Month commemorates the unique American experience of Blacks in America. This year marks the 400th anniversary of the Jamestown, Virginia arrival of captured and shackled Africans.

In the ensuing years, as slavery grew, so did the wealth of those who claimed our forefathers as ‘property’. By April 12-13, 1861, the wealth built on slave labor was forcefully protected with the Battle of Fort Sumter, considered by historians to be the start of the Civil War that lasted until 1865 and the war’s end.

Slavery’s iron shackles that bound women, children and men may be gone. But in today’s America, the iron has been replaced by a different kind of shackle, just as debilitating as iron: predatory debt.

Abundant research has shown that payday and car-title lenders trap people in debilitating debt that can trigger a series of negative consequences: overdraft fees, the loss of a bank account, loss of personal vehicles and even bankruptcy. People struggling to repay these loans have been reported to forego daily living needs or needed medical treatments.

So, it is indeed troubling that in 2019, that under the Trump Administration, the federal agency with a designated mission to provide consumer financial protection took an about-face to protect predatory lenders instead of consumers on February 6. Kathy Kraninger, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s plan to repeal a rule aimed at stopping the payday lending debt trap.

Promulgated by CFPB’s first director during the Obama Administration, the rule requires payday and other small-dollar lenders to make loans only after determining borrowers’ ability-to-repay. That now-suspended rule followed years of public hearings, rulemaking sessions, and research that ultimately found that triple-digit interest rates on loans were virtual debt traps for borrowers. Further, the people targeted for these predatory loans are those who could least afford interest or fees that exceeded the principal borrowed: the poor, the elderly, communities of color, and military veterans.

The Bureau’s Notice of Proposed Rulemaking (NPRM) announced by the CFPB offers a two-part plan. The first is to needlessly delay the effective date of a common-sense consumer protection rule. The second is to rewrite and likely gut the substance of the rule itself. The likely cumulative effect will allow payday and other predatory lenders to continue to ply their wares and continue financially exploiting consumers of color.

Reactions to CFPB’s announcement were as strong as they were plentiful.

“With little accountability for their actions, payday lenders have long preyed upon communities of color and drained them of their hard-earned savings,” noted Hilary O. Shelton, NAACP’s Washington Bureau Director and Senior Vice President for Policy and Advocacy. “Stripping the key protections of this rule is a disservice to the public,” he added.

Similar comments came from other civil rights organizations.

“This decision will put already struggling families in a cycle of debt and leave them in an event worse financial position,” said Vanita Gupta, president and CEO of The Leadership Conference on Civil and Human Rights. “This administration has moved the CFPB away from protecting consumers to protecting the very companies abusing them.”

When given the chance at the ballot box, Americans overwhelmingly vote to impose a 36 percent or less rate cap. Today, 16 states and the District of Columbia have these rate caps in place, providing strong protection from payday loan sharks. In remaining states – those without a rate cap – interest rates run as high as 460 percent in California, over 400 percent in Illinois and 662 percent in Texas.

According to Rebecca Borne, a CRL Senior Policy Counsel, Kraninger’s announcement ignores five years’ worth of input from a broad group of stakeholders: faith leaders, veteran and military organizations, civil rights groups, consumer advocates and consumers across the country.

“But over the past year, payday lenders have spearheaded an in effort with Mick Mulvaney and now Kraninger’s help, to take consumer protections away from financially vulnerable Americans, “said Borne. “We urge Director Kraninger to reconsider, as her current plan will keep families trapped in predatory, unaffordable debt.”

Let us all hope and work for a different kind of emancipation: financial freedom.

Charlene Crowell is the Communications Deputy Director with the Center for Responsible Lending. She can be reached at Charlene.crowell@responsiblelending.org.

Activism

Books for Ghana

We effectively facilitated cross-continent community building! We met the call and provided 400 books for ASC’s students at the call of the Minister of Education. We supported the work of a new African writer whose breakout novel is an action-packed depiction of a young woman steeped in Ghanaian culture who travels to the USA for college, all the while experiencing the twists, turns, and uncertainties that life brings.

By Min. Rauna Thurston, Chief Mpuntuhene Afua Ewusiwa I

My travels to Afrika began in June 2022, on a tour led by Prof. Manu Ampim, Director of the organization Advancing The Research. I was scheduled to become an ordained Minister by Wo’se Community of the Sacred African Way. It was vital that my feet touch the soil of Kemet and my spirit connect with the continent’s people before ordination.

Since 2022, I’ve made six trips to Afrika. During my travels, I became a benefactor to Abeadze State College (ASC) in Abeadze Dominase, Ghana, originally founded by Daasebre Kwebu Ewusi VII, Paramount Chief of Abeadze Traditional Area and now run by the government. The students there were having trouble with English courses, which are mandatory. The Ghanaian Minister of Education endorsed a novel written by 18-year-old female Ghanaian first-time writer, Nhyira Esaaba Essel, titled Black Queen Sceptre. The idea was that if the students had something more interesting to read, it would evoke a passion for reading; this seemed reasonable to me. Offer students something exciting and imaginative, combined with instructors committed to their success and this could work.

The challenge is how to acquire 800 books?!

I was finishing another project for ASC, so my cash was thin and I was devoid of time to apply for annual grants. I sat on my porch in West Oakland, as I often do, when I’m feeling for and connecting to my ancestors. On quiet nights, I reminisce about the neighborhood I grew up in. Across the street from my house was the house that my Godfather, Baba Dr. Wade Nobles and family lived in, which later became The Institute for the Advanced Study of Black Family Life & Culture (IASBFLC). Then, it came to me…ancestors invited me to reach out to The Association of Black Psychologists – Bay Area Chapter (ABPsi-Bay Area)! It was a long shot but worth it!

I was granted an audience with the local ABPsi Board, who ultimately approved funding for the book project with a stipulation that the Board read the book and a request to subsequently offer input as to how the book would be implemented at ASC. In this moment, my memory jet set to my first ABPsi convention around 2002, while working for IASBFLC. Returning to the present, I thought, “They like to think because it feels good, and then, they talk about what to do about what they think about.” I’m doomed.

However, I came to understand why reading the book and offering suggestions for implementation were essential. In short: ABPsi is an organization that operates from the aspirational principles of Ma’at with aims of liberating the Afrikan Mind, empowering the Afrikan character, and enlivening: illuminating the Afrikan spirit. Their request resulted in a rollout of 400 books in a pair-share system. Students checked out books in pairs, thereby reducing our bottom line to half of the original cost because we purchased 50% fewer units. This nuance promoted an environment of Ujima (collective work & responsibility) and traditional Afrikan principles of cooperation and interdependence. The student’s collaborative approach encouraged shared responsibility, not only for the physical book but for each other’s success. This concept was Dr. Lawford Goddard’s, approved by the Board, with Dr. Patricia “Karabo” Nunley at the helm.

We effectively facilitated cross-continent community building! We met the call and provided 400 books for ASC’s students at the call of the Minister of Education. We supported the work of a new African writer whose breakout novel is an action-packed depiction of a young woman steeped in Ghanaian culture who travels to the USA for college, all the while experiencing the twists, turns, and uncertainties that life brings. (A collectible novel for all ages). A proposed future phase of this collaborative project is for ASC students to exchange reflective essays on Black Queen Sceptre with ABPsi Bay Area members.

We got into good trouble. To order Black Queen Sceptre, email esselewurama14@gmail.com.

I became an ordained Minister upon returning from my initial pilgrimage to Afrika. Who would have imagined that my travels to Afrika would culminate in me becoming a citizen of Sierra Leone and recently being named a Chief Mpuntuhene under Daasebre Kwebu Ewusi VII, Paramount Chief of Abeadze Traditional Area in Ghana, where I envision continued collaborations.

Min. Rauna/Chief Mpuntuhene is a member of ABPsi Bay Area, a healing resource committed to providing the Post Newspaper readership with monthly discussions about critical issues in Black Mental Health, Wealth & Wellness. Readers are welcome to join us at our monthly chapter meetings every 3rd Saturday via Zoom and contact us at bayareaabpsi@gmail.com.

Black History

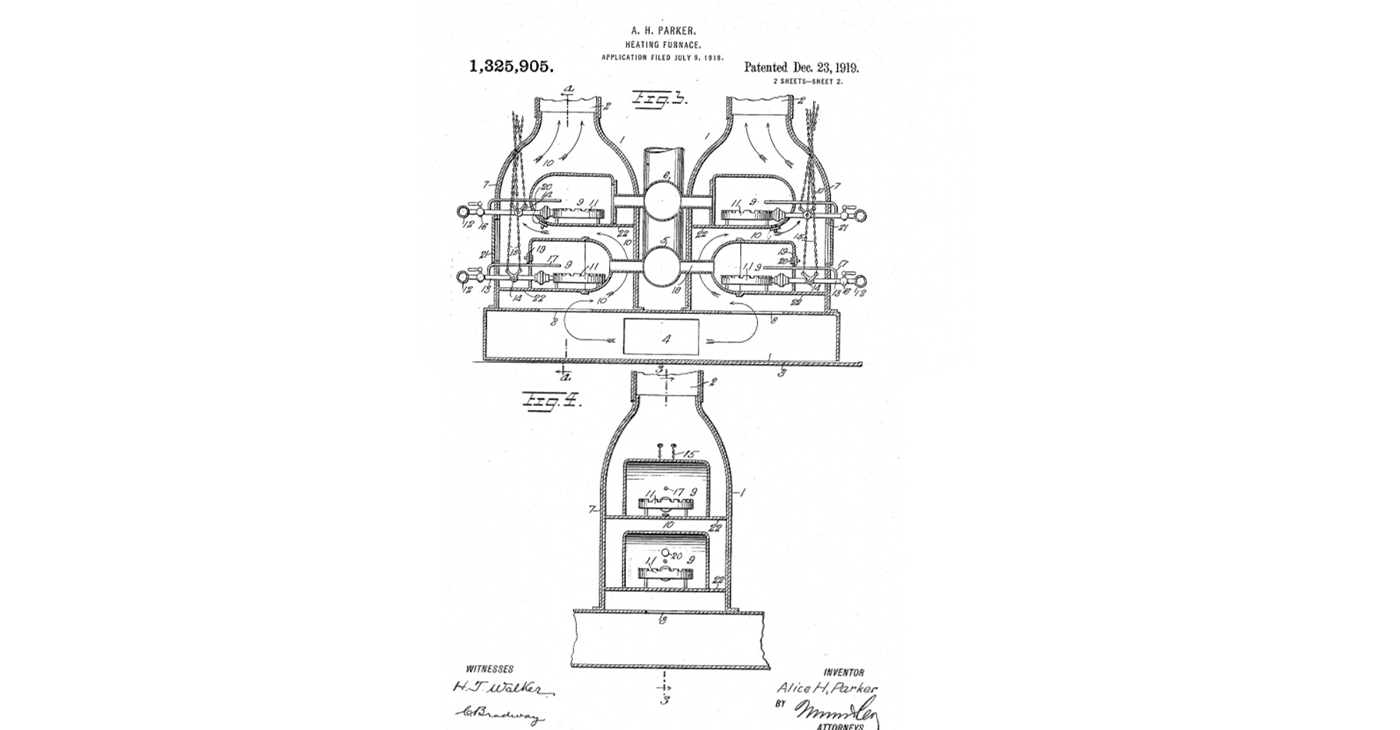

Alice Parker: The Innovator Behind the Modern Gas Furnace

Born in Morristown, New Jersey, in 1895, Alice Parker lived during a time when women, especially African American women, faced significant social and systemic barriers. Despite these challenges, her contributions to home heating technology have had a lasting impact.

By Tamara Shiloh

Alice Parker was a trailblazing African American inventor whose innovative ideas forever changed how we heat our homes.

Born in Morristown, New Jersey, in 1895, Parker lived during a time when women, especially African American women, faced significant social and systemic barriers. Despite these challenges, her contributions to home heating technology have had a lasting impact.

Parker grew up in New Jersey, where winters could be brutally cold. Although little is documented about her personal life, her education played a crucial role in shaping her inventive spirit. She attended Howard University, a historically Black university in Washington, D.C., where she may have developed her interest in practical solutions to everyday challenges.

Before Parker’s invention, most homes were heated using wood or coal-burning stoves. These methods were labor-intensive, inefficient, and posed fire hazards. Furthermore, they failed to provide even heating throughout a home, leaving many rooms cold while others were uncomfortably warm.

Parker recognized the inefficiency of these heating methods and imagined a solution that would make homes more comfortable and energy-efficient during winter.

In 1919, she patented her design for a gas-powered central heating system, a groundbreaking invention. Her design used natural gas as a fuel source to distribute heat throughout a building, replacing the need for wood or coal. The system allowed for thermostatic control, enabling homeowners to regulate the temperature in their homes efficiently.

What made her invention particularly innovative was its use of ductwork, which channeled warm air to different parts of the house. This concept is a precursor to the modern central heating systems we use today.

While Parker’s design was never fully developed or mass-produced during her lifetime, her idea laid the groundwork for modern central heating systems. Her invention was ahead of its time and highlighted the potential of natural gas as a cleaner, more efficient alternative to traditional heating methods.

Parker’s patent is remarkable not only for its technical innovation but also because it was granted at a time when African Americans and women faced severe limitations in accessing patent protections and recognition for their work. Her success as an inventor during this period is a testament to her ingenuity and determination.

Parker’s legacy lives on in numerous awards and grants – most noticeably in the annual Alice H. Parker Women Leaders in Innovation Award. That distinction is given out by the New Jersey Chamber of Commerce to celebrate outstanding women innovators in Parker’s home state.

The details of Parker’s later years are as sketchy as the ones about her early life. The specific date of her death, along with the cause, are also largely unknown.

Activism

2024 in Review: Seven Questions for Frontline Doulas

California Black Media (CBM) spoke with Frontline Doulas’ co-founder Khefri Riley. She reflected on Frontline’s accomplishments this year and the organization’s goals moving forward.

By Edward Henderson, California Black Media

Frontline Doulas provides African American families non-medical professional perinatal services at no cost.

This includes physical, emotional, informational, psychosocial and advocacy support during the pregnancy, childbirth and postpartum period. Women of all ages — with all forms of insurance — are accepted and encouraged to apply for services.

California Black Media (CBM) spoke with co-founder Khefri Riley. She reflected on Frontline’s accomplishments this year and the organization’s goals moving forward.

Responses have been edited for clarity and length.

Looking back at 2024, what stands out to you as your most important achievement and why?

In 2024, we are humbled to have been awarded the contract for the Los Angeles County Medical Doula Hub, which means that we are charged with creating a hub of connectivity and support for generating training and helping to create the new doula workforce for the medical doula benefit that went live in California on Jan. 1, 2023.

How did your leadership and investments contribute to improving the lives of Black Californians?

We believe that the revolution begins in the womb. What we mean by that is we have the potential and the ability to create intentional generational healing from the moment before a child was conceived, when a child was conceived, during this gestational time, and when a child is born.

And there’s a traditional saying in Indigenous communities that what we do now affects future generations going forward. So, the work that we do with birthing families, in particular Black birthing families, is to create powerful and healthy outcomes for the new generation so that we don’t have to replicate pain, fear, discrimination, or racism.

What frustrated you the most over the last year?

Working in reproductive justice often creates a heavy burden on the organization and the caregivers who deliver the services most needed to the communities. So, oftentimes, we’re advocating for those whose voices are silenced and erased, and you really have to be a warrior to stand strong and firm.

What inspired you the most over the last year?

My great-grandmother. My father was his grandmother’s midwife assistant when he was a young boy. I grew up with their medicine stories — the ways that they healed the community and were present to the community, even amidst Jim Crow.

What is one lesson you learned in 2024 that will inform your decision-making next year?

I find that you have to reach for your highest vision, and you have to stand firm in your value. You have to raise your voice, speak up and demand, and know your intrinsic value.

In a word, what is the biggest challenge Black Californians face?

Amplification. We cannot allow our voices to be silent.

What is the goal you want to achieve most in 2025?

I really would like to see a reduction in infant mortality and maternal mortality within our communities and witness this new birth worker force be supported and integrated into systems. So, that way, we fulfill our goal of healthy, unlimited birth in the Black community and indeed in all birthing communities in Los Angeles and California.

-

California Black Media4 weeks ago

California Black Media4 weeks agoCalifornia to Offer $43.7 Million in Federal Grants to Combat Hate Crimes

-

Black History4 weeks ago

Black History4 weeks agoEmeline King: A Trailblazer in the Automotive Industry

-

California Black Media4 weeks ago

California Black Media4 weeks agoCalifornia Department of Aging Offers Free Resources for Family Caregivers in November

-

California Black Media4 weeks ago

California Black Media4 weeks agoGov. Newsom Goes to Washington to Advocate for California Priorities

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of November 27 – December 3, 2024

-

Activism4 weeks ago

Activism4 weeks agoOCCUR Hosts “Faith Forward” Conference in Oakland

-

Activism4 weeks ago

Activism4 weeks agoRichmond Seniors Still Having a Ball After 25 Years

-

Bay Area4 weeks ago

Bay Area4 weeks agoRichmond’s New Fire Chief Sworn In