#NNPA BlackPress

COMMENTARY: Capitol Hill hearing takes up the war between the needy and the greedy

NNPA NEWSWIRE — “Any universe with payday lending is answering the question of how to make poverty a sustainable profitable enterprise,” noted Boston’s Rep. Ayanna Pressley (D-MA). “Well a lot of people are getting rich off of keeping people poor. And so how do we reform anything that’s based on that premise? The short answer is, we don’t.”

By Charlene Crowell, NNPA Newswire Contributor

At an April 30 Capitol Hill hearing, the multi-dimensional problems wrought by small-dollar, high-cost loans were brought to the attention of lawmakers serving on the powerful House Financial Services Committee. A witness panel representing bankers, consumers, clergy, and public policy organizations taught, recounted, reasoned and preached to lawmakers on the rippling and disastrous effects of debt-trap loans.

Each addressed the industry that reaps billion-dollar profits from the poor: payday, car-title, and other triple-digit interest small-dollar products. The average annual interest rate for payday loans in the United States is 391% although in more than 17 states, many of them home to consumers of color, the APR is even higher.

As consumers suffer financially, it’s a different story for payday lenders: $4.1 billion in fees every year in the 33 states that allow these debt traps, according to the Center for Responsible Lending (CRL). Similarly, the annual fees generated on car-title loans was found to be $3.8 billion.

The session occurred as the current Administration seeks to permanently reverse a payday rule that was developed over five years of public hearings, research and comments that sought the input of consumers, financial institutions and other stakeholders. Announced by the first Consumer Financial Protection Bureau (CFPB) Director, the rule would require lenders to determine if a consumer could repay the loan, also known as the ability-to-repay standard.

With a new CFPB Director, the rule’s suspension was accompanied by an announcement of an intent to begin rulemaking anew. For the industry, the suspension provides yet another opportunity to take the teeth out of financial regulation. For consumers, long-awaited consumer protection that would have taken effect this summer is now indefinite.

With the average borrower earning $25,000 to $30,000 a year, whatever difficulty led them to a payday loan store or web site, made their lives even worse.

For Detroit resident Ken Whittaker, the hearing was a high-profile opportunity to share his personal experience with a $700 payday loan that wound up costing him $7,000, in addition to debt collections, a court judgment, and his tax refund garnished.

“I found I could not afford to pay off the first loan without taking out another one. Then I began a cycle of debt which lasted over a year,” testified Whittaker. “Soon I was paying $600 per month in fees and interest. I eventually closed my bank account to stop payments from being drawn out and leaving me without cash for my family’s rent, groceries and other essential bills.”

In the hearing’s most poignant moment, Whittaker appealed to the lawmakers saying, “Please support strong reform of predatory payday and car title lending for people like me. We work hard to support our families and make our finances stable, and this kind of lending only makes it harder.”

For one lawmaker, Boston’s Rep. Ayanna Pressley, Whittaker’s plea was heard loud and clear.

“Any universe with payday lending is answering the question of how to make poverty a sustainable profitable enterprise,” noted Rep. Pressley. “Well a lot of people are getting rich off of keeping people poor. And so how do we reform anything that’s based on that premise? The short answer is, we don’t.”

Todd McDonald, Senior Vice President and Board Director of the New Orleans-based Liberty Bank and Trust, a Community Development Financial Institution (CDFI) spoke at the hearing from the perspective of community banks. His own firm operates in eight states through 15 branches. He is also a board member of the National Bankers Association, the leading trade association for the nation’s Minority Depository Institutions.

“As a CDFI that serves a largely low and moderate-income consumer base that often utilizes these high-cost, small dollar loans,” testified McDonald, “Liberty often works to help our customers get out of these predatory loans and into more manageable products.”

Since 2008, Liberty Bank has offered a payday and car-title loan alternative known as Freedom Fast loans that averages just over $6,000 and comes with an average interest rate of 12.6%. Liberty provides these loans to customers with credit scores ranging from a low of 500 to higher than 700. It also reports payments to the credit bureaus so that customers can also build their credit ratings.

For the Rev. Dr. Frederick Douglass Haynes III, senior pastor of Dallas’ Friendship West Baptist Church and a leading partner in the Faith and Credit Roundtable facilitated by the Center for Responsible Lending, predatory lending is a matter of economic justice that deserves actions and not just hearings.

“Payday predators are a part of a hostile takeover of the economy of the unbanked and underserved. This exploitative industry targets and saturates communities that are already suffering from economic apartheid,” said Rev. Haynes to the lawmakers. “When the vulnerable are drowning in desperation the payday industry throws a ‘life preserver’ weighted with the iron of usurious interest rates.”

“We are calling for strong protections so that those who experience an emergency don’t end up drowning in debt they cannot repay,” added Rev. Haynes.” The pastor forcefully called for the CFPB to implement its “common sense rule” and for enacting legislation, like a bill introduced by Illinois’ Senator Richard Durbin, that would establish a national 36% interest rate cap while allowing states to have lower rate ceilings.

“Borrowers have described the debt trap, in their own words, as ‘a hole that you can’t get out of’, ‘soul-crushing’, and a ‘living hell’, Diane Standaert, a CRL EVP testified. “And research has shown time and time again, that these high-cost lending storefronts are disproportionately situated in Black and Latino communities, even when they have the same or higher incomes than white communities.”

The good Reverend Haynes agreed, adding, “The Bible teaches that nations will be judged by how they treat ‘the least of these’. It must not be said of this nation, “I was hungry, and you gave me a payday loan… I was given a bad hand and you gave me a bad plan.”

Amen, Reverend!

Charlene Crowell is the Communications Deputy Director with the Center for Responsible Lending. She can be reached at Charlene.crowell@responsiblelending.org.

#NNPA BlackPress

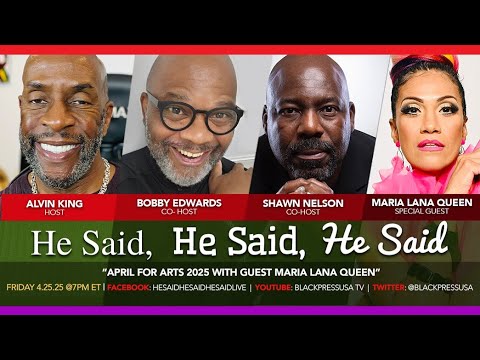

LIVE! — HE SAID, HE SAID, HE SAID: APRIL FOR THE ARTS 2025, MARIA LANA QUEEN — FRI. 4.25.25 7PM EST

Tune in Friday, April 25, 2025 @ 7pm EST for another live new episode of “He Said, He Said, He Said Live!” A Look at the World …

https://youtube.com/watch?v=kjPIugVQCAg&autoplay=0&cc_lang_pref=en&cc_load_policy=0&color=0&controls=1&fs=1&h1=en&loop=0&rel=0

Tune in Friday, April 25, 2025 @ 7pm EST for another live new episode of “He Said, He Said, He Said Live!” A Look at the World …

#NNPA BlackPress

The Marathon

Headlines and Cory Booker. LET IT BE KNOWN NEWS | We amplify Black voices and headlines that reflect or impact the Black …

Headlines and Cory Booker. LET IT BE KNOWN NEWS | We amplify Black voices and headlines that reflect or impact the Black …

#NNPA BlackPress

Hot Topics and Headlines

The WHCA board has unanimously decided we are no longer featuring a comedic performance. Lonnie Bunch III is speaking out …

The WHCA board has unanimously decided we are no longer featuring a comedic performance. Lonnie Bunch III is speaking out …

-

Activism4 weeks ago

Activism4 weeks agoOakland Post Endorses Barbara Lee

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 2 – 8, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump Profits, Black America Pays the Price

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 9 – 15, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoHarriet Tubman Scrubbed; DEI Dismantled

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump Targets a Slavery Removal from the National Museum of African-American History and Culture

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoLawmakers Greenlight Reparations Study for Descendants of Enslaved Marylanders

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoNew York Stands Firm Against Trump Administration’s Order to Abandon Diversity in Schools