#NNPA BlackPress

COMMENTARY: House Chair Waters leads charge to return consumer protection to CFPB

NNPA NEWSWIRE — Although Director Kraninger announced a plan to suspend the payday rule, changes in how the Bureau operated with regard to these lenders began under Mulvaney. While at CFPB, he urged Congress to repeal the rule and joined a lawsuit brought by a payday lender that sought to indefinitely suspend the rule.

By Charlene Crowell, Deputy Director, The Center for Responsible Lending

On March 7, the House Financial Services Committee, chaired by Congresswoman Maxine Waters marked the first time that the new Director of the Consumer Financial Protection Bureau (CFPB) appeared for a hearing in this capacity. Entitled, Putting Consumers First? A Semi-Annual Review of the Consumer Financial Protection Bureau,” the session is the first of two mandated by the Dodd-Frank Wall Street Financial Reform and Consumer Protection Act. Twice a year, CFPB’s Director must report to each chamber of Congress.

But before the hearing, other actions signaled that Director Kathy Kraninger would likely be forced to defend both the Bureau’s actions and inactions that occurred at the hands of Trump political appointees. Under Mick Mulvaney, CFPB’s former Acting Director, a series of actions turned the agency’s focus away from consumers, regulation and enforcement to make its policies and structure more favorable to deregulation and business.

One day before the hearing, Congresswoman Waters and other majority members of the Financial Services Committee held a news conference to announce the reintroduction of the Consumers First Act. Initially filed in 2018 by Waters, the 2019 version has the same intent: to block and reverse the Trump Administration’s anti-consumer agenda. This year, Waters has the support of co-sponsoring lawmakers representing 19 states as diverse as California, Florida, Michigan, North Carolina and Virginia. Another boost – the bill is also supported by 51 consumer, civil rights, and labor advocates.

“The bill reverses the harmful structural changes Mulvaney and his deputies made to damage the agency one-by-one,” said Chairwoman Waters at the news conference. “We will be asking all of the questions that our members deem necessary to find out whether or not she is on the road to restoring much of the damage that was done by Mr. Mulvaney.”

Ohio’s Rep. Joyce Beatty, one of the bill’s co-sponsors, took direct aim at the Bureau’s changed perspective on payday lending adding, “Under Trump’s CFPB director Mulvaney, the CFPB has reduced transparency and accountability, weakened enforcement…and became more interested in helping payday lenders who allegedly misled consumers and charged exorbitantly high interest rates, rather than protecting the American consumers they were sworn to serve.”

Readers may recall that during Black History Month, Director Kraninger announced the Bureau’s intent to suspend the August 2019 effective date of the long-awaited payday rule. After more than five years of public forums, rulemaking, research and thousands of public comments, Director Kraninger still intends to begin the rulemaking process anew.

In response, consumer, clergy, and civil rights advocates received updated information from the Center for Responsible Lending that pinpoints state by state, how current triple-digit interest rates (APRs) continue to harm consumers across the country. Regardless of a state’s population size or average incomes, the cost of borrowing payday loans remains a debt trap. Further, in states where these loans remain legal, lenders continue to squeeze billions of dollars of fees from borrowers whose annual average earnings are $22,500.

Prepared by Charla Rios, a researcher with the Center for Responsible Lending, the updated payday map reveals that in 2019, 31 states charged 200 percent APRs or higher on payday loans. Of these, 18 states have APRs of 400 percent or more, three more – Idaho, Nevada, and Texas charge in excess of 600 percent.

The Lone Star State can rightfully claim one other distinction: its 661 percent APR is the nation’s highest. That claim becomes even more curious when that figure is compared to the actions of more than 40 cities that have adopted some kind of regulation on these predatory loans. In 2011, the City of Dallas led the municipal curbs with an ensuing unsuccessful legal challenge. Fortunately, the Texas Supreme Court upheld the city’s restriction.

Despite these disappointing numbers, there have been recent and notable consumer victories on payday lending. Colorado and South Dakota successfully approved by voter referenda 36 percent payday rate caps. In each of these referenda, voters supported rate caps by 75 percent majorities.

“When no rate caps exist, payday lenders become more predatory as they charge even higher triple-digit interest rates that financially bury people in debt,” said Rios. “The 2019 map shows just how much real reform is needed at the state and federal levels.”

Although Director Kraninger announced a plan to suspend the payday rule, changes in how the Bureau operated with regard to these lenders began under Mulvaney. While at CFPB, he urged Congress to repeal the rule and joined a lawsuit brought by a payday lender that sought to indefinitely suspend the rule. Earlier and as a member of Congress representing South Carolina, Mulvaney opposed the idea of creating the CFPB and counted payday lenders among his top donors.

The 2017 payday rule was promulgated after five years of hearings from a variety of stakeholders and everyday citizens. There was also extensive research, and a public comment period where literally thousands of statements documented this financial exploitation wrought by payday loans.

“Eliminating this protection is plain and simple a huge gift to predatory lenders so they can keep borrowers trapped in unaffordable debt with interest rates exceeding 300 percent,” concluded Diane Standaert, a CRL EVP and Director of State Policy.

Charlene Crowell is the Center for Responsible Lending’s Communications Deputy Director. She can be reached at Charlene.crowell@responsiblelending.org.

#NNPA BlackPress

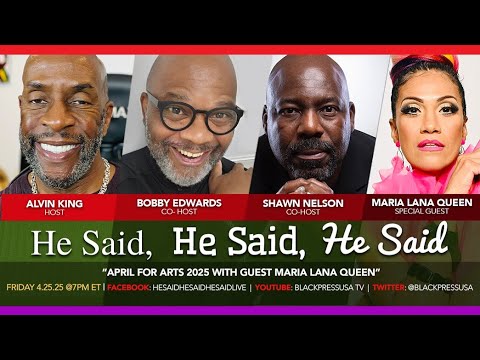

LIVE! — HE SAID, HE SAID, HE SAID: APRIL FOR THE ARTS 2025, MARIA LANA QUEEN — FRI. 4.25.25 7PM EST

Tune in Friday, April 25, 2025 @ 7pm EST for another live new episode of “He Said, He Said, He Said Live!” A Look at the World …

https://youtube.com/watch?v=kjPIugVQCAg&autoplay=0&cc_lang_pref=en&cc_load_policy=0&color=0&controls=1&fs=1&h1=en&loop=0&rel=0

Tune in Friday, April 25, 2025 @ 7pm EST for another live new episode of “He Said, He Said, He Said Live!” A Look at the World …

#NNPA BlackPress

The Marathon

Headlines and Cory Booker. LET IT BE KNOWN NEWS | We amplify Black voices and headlines that reflect or impact the Black …

Headlines and Cory Booker. LET IT BE KNOWN NEWS | We amplify Black voices and headlines that reflect or impact the Black …

#NNPA BlackPress

Hot Topics and Headlines

The WHCA board has unanimously decided we are no longer featuring a comedic performance. Lonnie Bunch III is speaking out …

The WHCA board has unanimously decided we are no longer featuring a comedic performance. Lonnie Bunch III is speaking out …

-

Activism4 weeks ago

Activism4 weeks agoOakland Post Endorses Barbara Lee

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 2 – 8, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump Profits, Black America Pays the Price

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 9 – 15, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoHarriet Tubman Scrubbed; DEI Dismantled

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump Targets a Slavery Removal from the National Museum of African-American History and Culture

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoLawmakers Greenlight Reparations Study for Descendants of Enslaved Marylanders

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoNew York Stands Firm Against Trump Administration’s Order to Abandon Diversity in Schools