Politics

Dems Still Steamed Over Labor’s Trade Attacks

Activism

Oakland Post: Week of February 25 – March 3, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 25 – March 3, 2026

Activism

Oakland Post: Week of February 18 – 24, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 18 – 24, 2026

Activism

Oakland Post: Week of February 11 – 17, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 11 – 17, 2026

-

Activism4 weeks ago

Activism4 weeks agoCommunity Celebrates Turner Group Construction Company as Collins Drive Becomes Turner Group Drive

-

Business4 weeks ago

Business4 weeks agoCalifornia Launches Study on Mileage Tax to Potentially Replace Gas Tax as Republicans Push Back

-

Activism4 weeks ago

Activism4 weeks agoDiscrimination in City Contracts

-

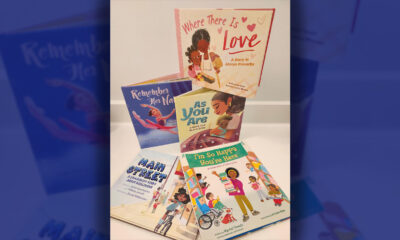

Arts and Culture4 weeks ago

Arts and Culture4 weeks agoBook Review: Books on Black History and Black Life for Kids

-

Activism4 weeks ago

Activism4 weeks agoCOMMENTARY: The Biases We Don’t See — Preventing AI-Driven Inequality in Health Care

-

Activism4 weeks ago

Activism4 weeks agoPost Newspaper Invites NNPA to Join Nationwide Probate Reform Initiative

-

Alameda County4 weeks ago

Alameda County4 weeks agoBlack History Events in the East Bay

-

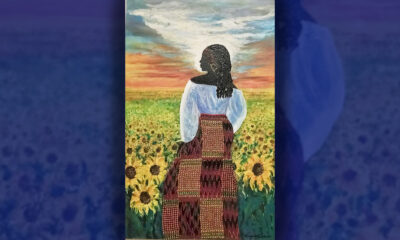

Activism4 weeks ago

Activism4 weeks agoArt of the African Diaspora Celebrates Legacy and Community at Richmond Art Center