Business

Dow Reshuffle: Apple Joins Blue-Chip Index, AT&T Gets Booted

In this Wednesday, Nov. 20, 2013, file photo, the Apple logo is illuminated in the entrance to the Fifth Avenue Apple store, in New York. (AP Photo/Mark Lennihan)

BERNARD CONDON, AP Business Writers

MAE ANDERSON, AP Business Writers

NEW YORK (AP) — Apple is in. AT&T is out.

In another milestone for the popular and profitable iPhone giant, Apple will replace AT&T in the venerable Dow Jones industrial average on March 19, the manager of the index announced Friday.

The move isn’t likely to impact the 30-stock index much, and will have no effect on the fortunes of the two companies. But market experts say it does have symbolic importance, sort of like getting an Oscar at the Academy Awards — or at least a nomination.

The change cements Apple as “the gold standard of technology,” says Daniel Ives, a financial analyst at FBR Research. “They’ve really become the modern-day Wright Brothers.”

The reshuffling of the 119-year-old Dow, a barometer of market fortune and folly once dominated by railroads, also reflects a changed business world.

“It underscores that technology continues to be a critical driver of the overall economy,” says Edward Jones analyst Bill Kreher.

Apple is the world’s most valuable company. Its market value on the stock exchange, or what it would take to buy all its shares, closed last month above $700 billion, a first for any company.

Apple won’t get top billing in the Dow, though. Thanks to a quirk in the way the index is calculated, that honor will go to a company a little over a tenth as valuable: Goldman Sachs.

The Dow weights companies by how much it costs to buy a single share, not all of them. On Friday, a Goldman share fetched $186.91 versus $126.60 for Apple.

A look at the musical chairs at the world’s most famous index:

THE REASON

For all the symbolic importance, the trigger for the move is less colorful. The manager of the index, the S&P Dow Jones Indices, said it’s making the change in response to a planned stock split for Visa, another Dow member.

After its four-to-one split, Visa will wind up with a lower price. S&P said that would reduce the weight of the information technology sector in the Dow because Visa, a credit-card and payment-processing giant, counts as a tech stock. Adding Apple will help balance out this reduction.

TWEAKING THE INDEX

S&P Dow Jones Indices said the decision to fold in Apple won’t alter the overall level of the index, which stood at 17,856 Friday.

S&P Dow Jones is casting the move as a sort of a housekeeping maneuver, a way to ensure that the index better reflects the U.S. economy and markets.

The switch is not a reflection of its view of Apple.

“This doesn’t mean we like the stock, or don’t like the stock, or something like that,” says David Blitzer, chairman of the index committee at S&P Dow Jones.

CHALLENGES AT AT&T

While the Dow change wasn’t triggered by anything AT&T did, it comes at a challenging time for the phone giant.

The nation’s second-largest wireless carrier is facing pressure from smaller rivals T-Mobile and Sprint in a competitive environment in which most Americans already have a cellphone.

Its stock has risen just 3.5 percent in the past 12 months. That compares with a 10.4 percent gain in the Standard & Poor’s 500. Apple, meanwhile, has jumped 67 percent.

To keep growing, AT&T has had to look beyond cellphones — to tablets and connected cars, for example. Adding a tablet to a phone plan gets AT&T another $10 in monthly service fees.

The Dallas-based company is also trying to wean customers off equipment subsidies and shift them toward installment plans in which they ultimately pay full price for a phone.

In its most recent quarter, AT&T booked a loss due to one-time expenses. But its revenue rose 4 percent as it added 1.9 million subscribers, double the year-ago quarterly increase.

AT&T has bounced in and out of the blue chip average over the Dow’s long history. It first entered in 1916 as American Telephone & Telegraph, joining Central Leather, Studebaker and other industrial giants in an elite club of 20 companies. Much later, in 2004, AT&T was kicked out only to return the following year when it merged with SBC Communications.

THE DOW STILL MATTERS

Created in 1896, the Dow is one of the oldest gauges of stocks. Grover Cleveland was U.S. president that year. Companies like the Pacific Mail Steamship were counted among its ranks.

The index tracks only 30 stocks. The Standard & Poor’s 500 reflects the moves of 500.

The S&P 500 also ranks companies differently, assigning weights based on the value of all a company’s shares, not just one. That gives Apple more influence on daily moves in the index than any other stock. It accounts for nearly 4 percent of the index.

Professional investors focus more on the S&P 500 because they think it reflects the stock market better. They tend to use that index, not the Dow, to judge the performance of their own portfolios.

Ordinary investors also prefer the S&P 500, judging from the money they’ve put into index funds that mimic its performance. Investors have $4 trillion in 1,261 funds that track the S&P 500, according to Morningstar. That compares with just $13.6 billion in 12 Dow-based index funds.

Still, the Dow can’t be dismissed as a relic. It continues to be much cited and isn’t seen as wildly distorted.

One reason is that, for all its flaws, the Dow has largely mirrored the ups and downs of the much larger S&P 500. In the past 12 months, for instance, the Dow has risen 8.7 percent versus the S&P 500’s 10.4 percent.

The last big Dow shake-up came in September 2013, when Goldman Sachs, Nike and Visa knocked out Alcoa, Bank of America and Hewlett-Packard.

___

AP Business Writer Matthew Craft contributed to this report.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Activism

OP-ED: AB 1349 Puts Corporate Power Over Community

Since Ticketmaster and Live Nation merged in 2010, ticket prices have jumped more than 150 percent. Activities that once fit a family’s budget now take significant disposable income that most working families simply don’t have. The problem is compounded by a system that has tilted access toward the wealthy and white-collar workers. If you have a fancy credit card, you get “presale access,” and if you work in an office instead of a warehouse, you might be able to wait in an online queue to buy a ticket. Access now means privilege.

By Bishop Joseph Simmons, Senior Pastor, Greater St. Paul Baptist Church, Oakland

As a pastor, I believe in the power that a sense of community can have on improving people’s lives. Live events are one of the few places where people from different backgrounds and ages can share the same space and experience – where construction workers sit next to lawyers at a concert, and teenagers enjoy a basketball game with their grandparents. Yet, over the past decade, I’ve witnessed these experiences – the concerts, games, and cultural events where we gather – become increasingly unaffordable, and it is a shame.

These moments of connection matter as they form part of the fabric that holds communities together. But that fabric is fraying because of Ticketmaster/Live Nation’s unchecked control over access to live events. Unfortunately, AB 1349 would only further entrench their corporate power over our spaces.

Since Ticketmaster and Live Nation merged in 2010, ticket prices have jumped more than 150 percent. Activities that once fit a family’s budget now take significant disposable income that most working families simply don’t have. The problem is compounded by a system that has tilted access toward the wealthy and white-collar workers. If you have a fancy credit card, you get “presale access,” and if you work in an office instead of a warehouse, you might be able to wait in an online queue to buy a ticket. Access now means privilege.

Power over live events is concentrated in a single corporate entity, and this regime operates without transparency or accountability – much like a dictator. Ticketmaster controls 80 percent of first-sale tickets and nearly a third of resale tickets, but they still want more. More power, more control for Ticketmaster means higher prices and less access for consumers. It’s the agenda they are pushing nationally, with the help of former Trump political operatives, who are quietly trying to undo the antitrust lawsuit launched against Ticketmaster/Live Nation under President Biden’s DOJ.

That’s why I’m deeply concerned about AB 1349 in its current form. Rather than reining in Ticketmaster’s power, the bill risks strengthening it, aligning with Trump. AB 1349 gives Ticketmaster the ability to control a consumer’s ticket forever by granting Ticketmaster’s regime new powers in state law to prevent consumers from reselling or giving away their tickets. It also creates new pathways for Ticketmaster to discriminate and retaliate against consumers who choose to shop around for the best service and fees on resale platforms that aren’t yet controlled by Ticketmaster. These provisions are anti-consumer and anti-democratic.

California has an opportunity to stand with consumers, to demand transparency, and to restore genuine competition in this industry. But that requires legislation developed with input from the community and faith leaders, not proposals backed by the very company causing the harm.

Will our laws reflect fairness, inclusion, and accountability? Or will we let corporate interests tighten their grip on spaces that should belong to everyone? I, for one, support the former and encourage the California Legislature to reject AB 1349 outright or amend it to remove any provisions that expand Ticketmaster’s control. I also urge community members to contact their representatives and advocate for accessible, inclusive live events for all Californians. Let’s work together to ensure these gathering spaces remain open and welcoming to everyone, regardless of income or background.

Activism

Oakland Post: Week of December 31, 2025 – January 6, 2026

The printed Weekly Edition of the Oakland Post: Week of – December 31, 2025 – January 6, 2026

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Activism

Big God Ministry Gives Away Toys in Marin City

Pastor Hall also gave a message of encouragement to the crowd, thanking Jesus for the “best year of their lives.” He asked each of the children what they wanted to be when they grow up.

By Godfrey Lee

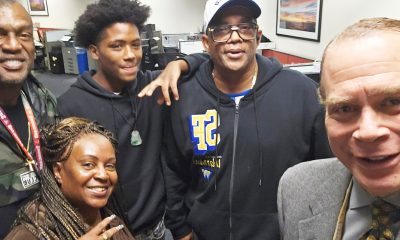

Big God Ministries, pastored by David Hall, gave toys to the children in Marin City on Monday, Dec. 15, on the lawn near the corner of Drake Avenue and Donahue Street.

Pastor Hall also gave a message of encouragement to the crowd, thanking Jesus for the “best year of their lives.” He asked each of the children what they wanted to be when they grew up.

Around 75 parents and children were there to receive the presents, which consisted mainly of Gideon Bibles, Cat in the Hat pillows, Barbie dolls, Tonka trucks, and Lego building sets.

A half dozen volunteers from the Big God Ministry, including Donnie Roary, helped to set up the tables for the toy giveaway. The worship music was sung by Ruby Friedman, Keri Carpenter, and Jake Monaghan, who also played the accordion.

Big God Ministries meets on Sundays at 10 a.m. at the Mill Valley Community Center, 180 Camino Alto, Mill Valley, CA Their phone number is (415) 797-2567.

-

Activism4 weeks ago

Activism4 weeks agoDesmond Gumbs — Visionary Founder, Mentor, and Builder of Opportunity

-

Activism4 weeks ago

Activism4 weeks agoFamilies Across the U.S. Are Facing an ‘Affordability Crisis,’ Says United Way Bay Area

-

Alameda County4 weeks ago

Alameda County4 weeks agoOakland Council Expands Citywide Security Cameras Despite Major Opposition

-

Alameda County4 weeks ago

Alameda County4 weeks agoBling It On: Holiday Lights Brighten Dark Nights All Around the Bay

-

Activism4 weeks ago

Activism4 weeks agoBlack Arts Movement Business District Named New Cultural District in California

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of December 17 – 23, 2025

-

Activism4 weeks ago

Activism4 weeks agoLu Lu’s House is Not Just Toying Around with the Community

-

Activism3 weeks ago

Activism3 weeks agoFirst 5 Alameda County Distributes Over $8 Million in First Wave of Critical Relief Funds for Historically Underpaid Caregivers