#NNPA BlackPress

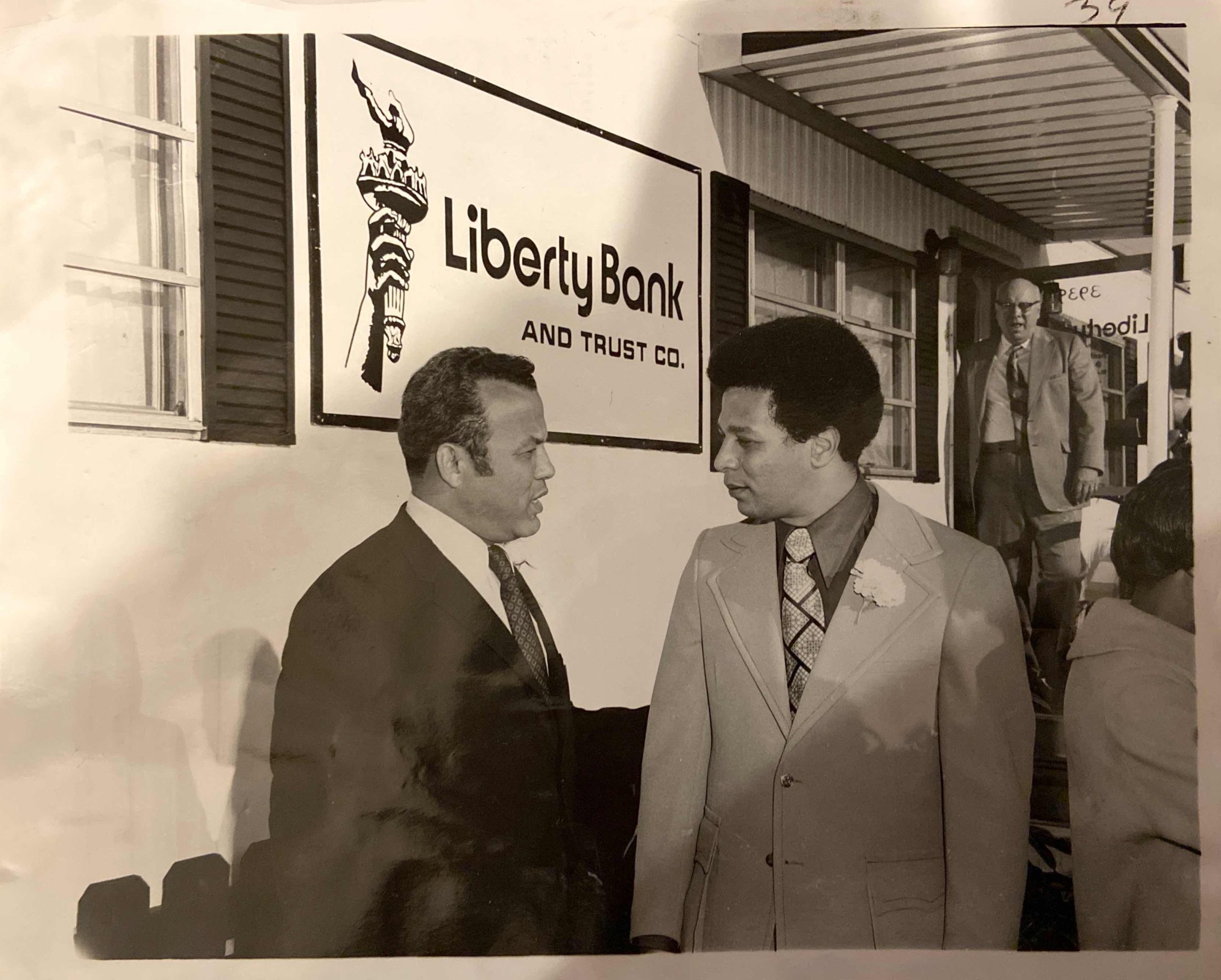

Framing Our Future: Liberty Bank Celebrates 50 Years

NNPA NEWSWIRE — The elder McDonald, served as president & CEO of Liberty Bank from its founding in 1972, leading and growing the Black-owned bank for the better part of 50 years until earlier this year, when his son Todd, a Morehouse College graduate who earned his MBA from Northwestern University’s Kellogg School of Management, picked up the mantle to lead Liberty into the future.

The post Framing Our Future: Liberty Bank Celebrates 50 Years first appeared on BlackPressUSA.

Published

3 years agoon

By

admin

By Anitra D. Brown | The New Orleans Tribune

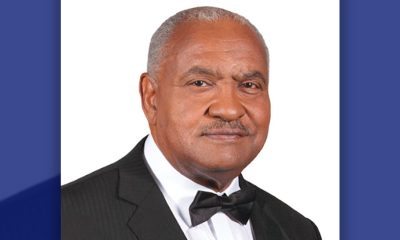

Alden J. McDonald and his son Todd have at least two things in common. The first is that neither saw himself as a bank president. In fact, Alden McDonald says it took a novena and Dr. Norman Francis asking him three times to become the president of what would be the newly founded Liberty Bank & Trust before he said “yes.”

“I didn’t’ know whether I was prepared to run a bank.” Alden McDonald once told The New Orleans Tribune. “No one else had walked that plank.”

The truth – he was ready. A graduate of the LSU School of Banking and of Columbia University’s Commercial Banking Management Program, McDonald began his career at International City Bank in New Orleans in 1966, rising to the position of vice president for consumer lending. And during those six years, he zealously learned all he could about the industry, working 12- to 14-hour days.

International City Bank didn’t want him to leave, offering him a senior vice president position to urge him to stay, he says. Instead, he followed advice given to him by the young lady he was dating at the time, Rhesa Ortique, whom he went on to marry. She was the one who suggested he go to a novena in search of guidance and direction.

“So, I did the novena, and I made the decision to do this, right. I am 29 at the time, and to be honest with you, I didn’t know what the hell I was thinking.”

In contrast, it didn’t take a special prayer service for Todd McDonald to know he wanted to be his own boss one day; still, he didn’t see banking in his future. The enterprising youngster, who washed his parents’ friends’ cars while they visited to make extra money, always saw himself as a businessman. However, he thought banking was static and that it would not offer the diverse opportunities he wanted to experience… that was until he had the opportunity to shadow one of his father’s friends, Joe Canizaro, the founder of First Bank & Trust. It was then he realized there was more to banking than, well, banking.

“He brought me into meetings, and I saw how he used the bank as a platform to go into many different businesses. I mean he was building a city in Mississippi; he had the hospitality company; he had a construction company; health care — all these different businesses. And I was like, so you could run a bank and have all of these tentacles out there at the same time. Okay, I would never get tired of doing this.”

At the time, a younger Todd McDonald didn’t really see his father doing all of that at Liberty; but he understood why.

In 1972, with Dr. Norman Francis on its Board of Directors, Alden McDonald as President & CEO and $2 million in assets, Liberty Bank was founded to more Black New Orleanians and other under-served members of the community achieve their dreams. Today, Liberty has branches in 11 states and has $1 billion in assets.

“It was for obvious reasons — a lack of capital,” he says. “I’m sure he could have ventured off in many different ways, as well. But that experience provided me with a vision for myself. How do we leverage a bank charter? You know, I’ve been around my dad for 41 years; but I’ve only been employed with the bank for 19. I heard the stories about him helping people. And so, I’m like, you know, once you start applying the ‘helping people’ with the ‘making money’ and ‘helping other people make money’, it was an easy sell. I’ve dedicated my life to this. I wake up thinking about it. I go to sleep thinking about it.”

And with that, the other thing father and son have in common is that despite each man’s initial misgivings, running a bank is precisely what he has done or is doing.

With his son’s rise to bank president, Alden McDonald, continues to serve as the head of the Liberty Financial Holding Company.

It’s Always Been Huge

The elder McDonald, served as president & CEO of Liberty Bank from its founding in 1972, leading and growing the Black-owned bank for the better part of 50 years until earlier this year, when his son Todd, a Morehouse College graduate who earned his MBA from Northwestern University’s Kellogg School of Management, picked up the mantle to lead Liberty into the future.

The pair took a little time to catch up with The New Orleans Tribune recently to talk about what is now the nation’s largest Black-owned bank. Sitting at a table in the community room of the bank’s headquarters in New Orleans East, the elder McDonald began by mentioning a significant milestone Liberty Bank reached in recent years – $1 billion dollars in assets.

“It was his idea, not mine,” he says with proud smile and a little laughter, nodding in Todd’s direction.

Todd chimes in through the laughter, “That’s what we have to do as a bank to survive. If we don’t get bigger, the cost of operating just gets bigger and you can’t manage the expense side. So, it was very important for us to reach that milestone.”

“It’s a lot of money,” Alden McDonald says. “How many other people do we know that have a billion-dollar company? How many in the city of New Orleans. Just, when you think about it… the significance of it. It’s… it’s…

“Huge,” Todd interjects, finishing the sentence his father started.

“Huge,” Alden McDonald repeats reflectively. “You know, Todd and I, we talked five years ago when he took a real an active role at the bank. He was in charge of strategic planning and visioning. And his vision went beyond my wildest dreams. When he was pushing for a billion dollars, he was looking to make sure we could survive in the banking industry. When I got in the banking industry, there were 35,000 banks. Today, there are less than 5,000 banks. When I got into the business, there were 100 Black banks. Today, there are less than 20. Everything in the industry says a $200 million bank is not going to survive. A $500 million bank is not going to survive. So the benchmark he came up with was a billion.”

The achievement took more than just reaching $1 billion in assets. As Alden McDonald explains, in the banking industry, the rule of thumb is an eight percent capital to asset ratio. In banking terms, capital is the total equity a company has — assets minus liability.

“And then, a couple of years ago, the feds started sending signals. They wanted a 10 percent ratio,” the senior McDonald says.

When Liberty set out to grow to a billion in assets it only had about $60 million in equity. It needed at least $90 million.

It was Todd, who, while serving as Liberty’s executive vice president of corporate strategy, developed national partnerships that produced several new revenue streams that raised $30 million in capital for the bank.

All of this was taking place over the last few years with the pandemic as a backdrop and in the wake of the murder of George Floyd, events that prompted shifts in the nation, one of which included a bit of pressure put on the big boys of banking to help minority banks grow.

And Liberty’s plan for raising the equity it needed to support its growth was realized.

“If it was me, I would asked JP Morgan for $5 million, Citibank for $5 million, Wells Fargo for $5 million and Bank of America for $5 million. Todd goes in, he asks JP Morgan for $30 million. I said, ‘boy, you’re crazy?’ They ended up giving $18 million. Wells gave $5 million. Citi gave $5 million. Bank of America gave $2 million,” the elder McDonald recounts. “I would have been pleased with whatever; but because of the young mind and the young vision, he ended up getting $30 million of non-voting capital. Non-voting. It does not dilute one bit of ownership,”

Perhaps the only thing huger than Liberty Bank reaching that milestone – more than $1 billion in assets the equity to back it up – is the force the bank has been for its customers in New Orleans and across the country.

Even when its assets weren’t, Liberty’s impact has been huge from the start.

Forging a Path to Financial Freedom

The first Liberty Bank branch was a repurposed construction trailer located on Tulane Avenue.

If Alden McDonald wasn’t ready to lead a Black-owned bank in 1972, Black New Orleans was ready for one.

Beginning in the early 1960s, Alden McDonald and Dr. Norman Francis saw a Black community growing increasingly dissatisfied with inequity and looking for increased opportunity, especially on the economic front. They wanted mortgage loans and loans to start businesses or launch political campaigns without higher interest rates or resorting to subprime finance companies. And if they couldn’t find what they wanted in the mainstream banking industry, they would have to create their own.

That is why Francis asked a young Alden McDonald to leave his comfortable job and start his own bank not once, not twice, but three times — there was a need for a bank that would help more Black New Orleanians and other under-served members of the community achieve their dreams.

Liberty Bank was one of 42 African American-owned banks to open in the U.S. between 1962 and 1979, according to the National Bankers Association. They opened to serve communities that had been all but shut out of the mainstream. When the other banks refused to loan African Americans money or loaned it to them at extraordinarily high interest rates, Black-owned banks were there; and their influence was tangible from the very early history.

There is no telling how many Black New Orleanians own homes and operate businesses because Liberty Bank exists.

Norman Francis once said, “We had a dream to do something special in New Orleans. We started a community bank with a focus on an under-served population.”

From a construction trailer on Tulane Avenue, Liberty now has branches in 11 states and the cyber ability to conduct banking operations nationwide. Liberty Bank has withstood natural disasters and weathered national and regional financial crises. It has not only existed for 50 years, it has thrived. From $2 million in assets in 1972 to the largest African American-owned financial institution in the United States.

More importantly, here in New Orleans, and in other cities across the country, Liberty has helped individuals achieve their financial goals and financial freedom. That is what is meant by “Framing Our Future”, the theme of the bank’s 50-year anniversary.

Big Things Popping

The bank is also a player in helping business owners and investors make major moves. On the day The Tribune met with the McDonalds, they were gearing up for a meeting with a customer about a major project in downtown Minneapolis — the redevelopment of a one-million-square-foot building, Alden McDonald tells.

Financing those types of multi-million-dollar endeavors have become common practice for Liberty Bank.

Just before the pandemic, Alden McDonald says the bank launched a new loan product designed specifically to help African American business owners get into the airport concessions business.

“We were lending money to African Americans with airport contracts,” he says. “Now, we got in it at the wrong time, but we still made out pretty good. We loaned about $30 million to business owners with concessions in airports in New York, New Jersey, Dallas, Los Angeles, and Chicago. We had them all over. It’s helped those businesses grow their capital. When you grow capital, you can hire more people, more Black people. So, the whole pie grows. Despite the pandemic, we only had a problem with one loan and we didn’t lose any money.”

Then there is the project in Houston.

“The mayor in Houston has put together a housing effort there to build maybe 500 homes using all Black folks — the contractors, the developers. And we are financing them. We think that’s going to be a real big signature project with anywhere between $30 million and $50 million in financing from us. And we do a little bit more than just lend the money. For example, this one developer didn’t have much experience, so we put them in touch with another developer we were financing in Houston to partner with him. Then the city gave him a contract that wasn’t to his advantage. So, when we read it, in putting his package together, we said, ‘this ain’t gonna work’. So we helped him to go back to the city, had the city to rework his contract where it made sense and protected him from losing money.”

There are other examples. Too many to include in a single article.

In addition to banking, Liberty has its own insurance agency and a heavy equipment leasing company. It also recently launched its own commercial insurance brokerage firm.

“We intend to be the largest Black-owned commercial insurance brokerage in the country in the next five years,” Alden McDonald says. “What does that mean? It means we are starting another company that will employ additional people. We are going to be able to help other companies in that business to write bigger policies. There is a network of smaller Black-owned commercial insurance brokers across the country, and we are going to help those businesses create more jobs and grow Black wealth. And we’re going to make some money. I always say that you can’t do good, if you don’t do well.”

And if Liberty Bank has its way, it will be doing both well and good into the future.

“We don’t plan on taking another 50 years to reach another $1 billion in assets. He plans on getting there in the next five years,” Alden says, again nodding at Todd.

“My perspective is we have a long runway,” says Todd. “I mean, we have decades ahead of us. You know, it is a lot of work and we’re just taking it step by step. We know organizationally, we can’t be everything to everybody. So, we’ve got to choose our lane and commit to it. We have an amazing underwriting muscle. As my dad mentioned earlier, typically Black-owned institutions didn’t have access to capital. So, the focus is what did we do the first 50 years and how do we leverage that to do it bigger the next 50 years.”

And while Liberty certainly has big things popping, it continues to provide access to basic financial services such as personal checking and savings accounts and multi-faceted products for both individuals and small businesses.

Even as it celebrates 50 years and touts more than a $1 billion in assets, helping everyday people achieve financial freedom is still a primary focus of the bank, says Todd McDonald.

In fact, the smallest loan Liberty offers is $500, it’s the sort of small dollar loan at a low interest rate that Liberty provides to customers to keep them from falling prey to predatory lenders like those in the payday loan industry.

“That’s the least amount of money you can borrow. But to me, that’s the most important product that we have,” says Todd. “I don’t say that a lot, but I prefer to help the average person get out of debt. If I can help someone consolidate from $1,000 a month in payments down to $300 a month in payments, saving them $700 dollars a month, it’s better than making a $1 million loan to me. Now if we repeat that and get a 1,000 people at a time refinancing debt, that’s $700,000 a month back into the pockets of people that look like you and me. Then, we could have the same thousand people start to buy their own homes. Now, if we coordinate efforts like that across the country, we could really pick up some ground. it’s off to the races from that standpoint. So, we’re not just looking at big transactions.”

Celebrating 50 Years with a Golden Jubilee

Liberty Bank’s story of resilience, profitability and empowerment was showcased on Friday, Dec. 2, at Liberty’s “Golden Jubilee” celebration at the Mahalia Jackson Theater. The event was produced by Bright Moments, LLC and was directed by celebrated theater icon Tommye Myrick.

Norman Robinson and Sally Ann Roberts narrated the event that explored the unique role Liberty Bank has played in closing the wealth gap in America. The evening featured song, dance, spoken word and visual renderings that tell the story the African American experience.

The show was led by the musical arrangements of the New Orleans Jazz Orchestra under the direction of Grammy award winner Adonis Rose and featured Irma Thomas, Leah Chase, Jr., Chase Kamata, Sharon Martin, Phillip Manuel, John Boutte, Tonya Boyd-Cannon, the Mystics, the Franklin Avenue Male Chorus, the C Sharpe Gospel Ensemble, the Kia Knight Dance Ensemble, Stilt Walkers, African Drummers, Harold Evans, Gwendolyn Foxworth, Lady Tambourine, Erica Falls, Peteh the Poet, and a host of others.

The post Framing Our Future: Liberty Bank Celebrates 50 Years appeared first on The New Orleans Tribune.

The post Framing Our Future: Liberty Bank Celebrates 50 Years first appeared on BlackPressUSA.

admin

You may like

-

COMMENTARY: Women of Color Shape Our Past and Future

-

Woman’s Search for Family’s Roots Leads to Ancestor John T. Ward – A Successful Entrepreneur and Conductor on the Underground Railroad

-

Advocates Raise Alarm Over ICE Operation, MOU and Detention Risks in Baltimore County

-

Pete Buttigieg to Join Mayor Randall Woodfin for Community Town Hall in Birmingham

-

WATCH: Week One – NNPA’s “Leadership Matters” Video Series

-

OP-ED: NNPA Launches 2026 “Leadership Matters” Video Series

#NNPA BlackPress

COMMENTARY: Women of Color Shape Our Past and Future

MINNESOTA SPOKESMAN RECORDER — Every March, Women’s History Month invites us to pause and honor the women whose courage, intellect, and leadership have shaped our world. This year, that invitation feels especially urgent. We are living in a time when history is being rewritten, when DEI is being recast as a threat, and when the stories we choose to uplift matter more than ever. The stories of women of color must be centered, celebrated, and carried forward with intention.

Published

2 days agoon

March 9, 2026By

admin

Women of Color Leadership Shapes the Legacy of Women’s History Month

By Dr. Sharon M. Holder | Minnesota Spokesman Recorder

Women’s History Month offers an opportunity to recognize the enduring impact of women of color leadership across history and in the present day. From Harriet Tubman and Shirley Chisholm to today’s leaders in science, politics and culture, women of color continue to shape movements, institutions and communities through courage, collaboration and vision.

Every March, Women’s History Month invites us to pause and honor the women whose courage, intellect, and leadership have shaped our world. This year, that invitation feels especially urgent. We are living in a time when history is being rewritten, when DEI is being recast as a threat, and when the stories we choose to uplift matter more than ever. The stories of women of color must be centered, celebrated, and carried forward with intention.

For centuries, women of color have been architects of progress, even when history tried to confine them to the margins. They have led movements, built institutions, transformed culture, and expanded the boundaries of justice, leadership, and community. Their contributions are not postscripts; they are landmarks. Yet too often, their brilliance has been acknowledged only in hindsight. Women’s History Month offers a chance to correct that imbalance, not only by remembering the past, but by recognizing their leadership unfolding before us.

This legacy lives in Harriet Tubman, whose courage and strategic brilliance transformed the Underground Railroad into one of the boldest freedom operations in American history. In Barbara Jordan, whose moral clarity reshaped the nation’s understanding of justice and constitutional responsibility. In Madam C. J. Walker, expanding both the beauty industry and the economic horizons of Black women. It dances in Josephine Baker, who challenged racism and resisted fascism. In Ida B. Wells and Dolores Huerta, who wielded truth and determination in pursuit of justice. In Chien-Shiung Wu, whose experiments altered science, and Shirley Chisholm, whose political courage expanded the very definition of leadership. These women did more than break barriers; they built new worlds.

A powerful throughline in the leadership of women of color is how they lead: collaboratively, creatively, relationally, and with deep responsibility to community. Their leadership is grounded not in hierarchy but in connection, in the belief that progress is something we build together.

We see this in Kamala Harris, whose presence expands the boundaries of possibility; in Ketanji Brown Jackson; in Oprah Winfrey; and in Toni Morrison, who insisted that the interior lives of Black women are essential to the human story. It resonates in Simone Biles and Serena Williams, redefining strength through excellence and self-belief.

Today, women of color continue to drive breakthroughs in medicine, technology, the arts, politics, and environmental justice. Their leadership appears not only in boardrooms or public office, but in mentorship, advocacy, and the daily navigation of systems never designed for them. The spirit shines in Mae Jemison and Ellen Ochoa; in Michelle Obama; and in the brilliance of Katherine Johnson, Dorothy Vaughan, Mary Jackson, and Christine Darden, whose work helped launch a nation into space.

Celebration is important, but it is not enough. Honoring women of color requires intentional action rooted in equity. It means creating environments where their voices are valued, challenging the biases that shape who is recognized, and ensuring progress is shared.

As we celebrate Women’s History Month, let us honor women of color not as symbols, but as leaders whose work continues to guide us. When we uplift women of color, we honor history and shape the future.

Dr. Sharon M. Holder lives in South Carolina. She holds a PhD/MPhil in Gerontology from the Center for Research on Aging at the University of Southampton, UK; a Master of Science in Gerontology from the Institute of Gerontology at King’s College London, UK; and a Master of Social Work from the Graduate College of Social Work at the University of Houston, Texas.

Dr. Holder discovered her love of poetry at the University of Houston–Downtown, where she published in The Bayou Review and the Anthology of Poetry. Today, she writes poetry as a practice of gratitude alongside her academic research.

admin

#NNPA BlackPress

Woman’s Search for Family’s Roots Leads to Ancestor John T. Ward – A Successful Entrepreneur and Conductor on the Underground Railroad

THE AFRO — For years, she wanted to know more about her ancestor John T. Ward, she said, and her curiosity eventually became an obsession, leading her to become the genealogist for her family. And so, for more than a decade, she set out to trace her family’s roots and discovered a story that would change her life and the way she viewed American history.

Published

2 days agoon

March 9, 2026By

admin

By D. Kevin McNeir | Special to The AFRO

Shanna Ward, the owner of a publishing company and insurance agency located in Columbus, Ohio, said the elders in her family often say she inherited her entrepreneurial spirit from one of their ancestors – a formerly enslaved child from Virginia whose freedom came through manumission in 1827.

For years, she wanted to know more about her ancestor John T. Ward, she said, and her curiosity eventually became an obsession, leading her to become the genealogist for her family. And so, for more than a decade, she set out to trace her family’s roots and discovered a story that would change her life and the way she viewed American history.

John T. Ward would help others secure their freedom and justice in his roles as a conductor on the Underground Railroad, an abolitionist, and political activist. But realizing that economic freedom was essential to his and his family’s survival, he and his son founded the Ward Transfer Line in 1881 (now E.E. Ward Moving) – one of America’s oldest Black-owned businesses. While it has transferred ownership, the business remains in operation today.

Shanna Ward recently published a book about her ancestor, “The Bequest of John T. Ward,” which she hopes can be added to other unheralded tales of Black resistance that occurred during America’s antebellum period.

“Originally, I just wanted to write a 100-page story when I first began digging and was encouraged after I found a copy of a will dated 1827 which included him and was a rare example of a mass manumission,” Shanna Ward said. “Three of the slaves, including John’s grandfather, were given about 294 acres of land in the will, but all the former slaves were supposed to remain on the plantation until their 21st birthday. Some refused to remain. That’s how our family got to Ohio.”

Ward said she learned that newly freed Blacks, including her ancestors in Ohio, had to fend for themselves and often did so with amazing results given the obstacles they faced.

“In those days there were no civil rights organizations, and in local communities, Blacks formed and supported Black-owned businesses, took their own census recordings, and became involved in local politics – all without White involvement,” she said.

BOOK COVER: The cover of the book “The Bequest of John T. Ward,” written by Shanna Ward about her ancestor who, as a child, was granted his freedom in 1827 and went on to become a successful business owner in Ohio, a political activist, and a conductor on the historic Underground Railroad.

“There is part of Ohio where, during the days of slavery, if you successfully crossed the river you were free,” she said. “That was where Black life began – across the river in freedom. When we understand ourselves as more than property and uncover tales of survival which are the foundation of our legacy, then we can better understand who we are and what our ancestors endured. We are stronger than we are often led to believe.”

Efforts among African Americans to learn their family roots have increased over the past several decades, particularly given the success of the PBS documentary, “Finding Your Roots,” hosted and narrated by Harvard University professor Dr. Henry Louis Gates Jr.

On the show’s website, Gates said he developed the show in 2012 in efforts to continue his quest to “get into the DNA of American culture.”

In each episode, celebrities view ancestral histories and share their emotional experience with viewers. Gates attributes the success of the show to a significant surge in interest among Black Americans in tracing their family roots and a desire to reconnect with ancestral history that was severed by slavery.

JOHN T. WARD: John T. Ward, the historic patriarch in a family whose roots can be traced to the days of slavery in Virginia, is the subject of a new book written by a member of his proud family, Shanna Ward, called “The Bequest of John T. Ward.”

“Advancements in DNA testing have increased accessibility of records and led to a cultural push to reclaim identity beyond the ‘brick wall’ of 1870,” said Gates who noted that the 1870 U.S. Census represents the first time former slaves were listed by name and, unfortunately, serves as the point where records of their lives often stop and cannot be traced any earlier.

In a recent paper published in the journal “American Anthropologist,” University of Illinois Urbana-Champaign anthropology professor LaKisha David posits that by using genetic genealogy, African Americans now have the real possibility of restoring family narratives that were disrupted, severed and destroyed by institutional slavery.

“For African Americans who have grown up with a sense of ancestral loss and disconnection, this reclamation of family history is deeply humanizing and healing,” she writes. “It replaces the genealogical unknown with tangible knowledge of ancestral histories and kinship ties.

“Identifying African ancestors and living relatives is an act of restorative justice. It is ultimately about (re)claiming the humanity, dignity, and agency of enslaved Africans and their descendants, which is an essential component of repairing the harms of slavery.”

Ward said by uncovering her family’s truth, she has established a platform for education and empowerment for herself, her children, and today’s youth.

“I realized how important it is to pass down our own stories to the next generation,” Ward said. “There’s so much our children need to know about the Underground Railroad, the quilt codes created by Black women, and other examples of unrecorded heroics and bravery exhibited by Black men and women. Their collective efforts led to the end of Jim Crow laws and the securing of equal rights in the U.S. Constitution for African Americans. If you look hard enough, I believe everyone has someone like Harriet Tubman or Frederick Douglass in their family.”

admin

#NNPA BlackPress

Advocates Raise Alarm Over ICE Operation, MOU and Detention Risks in Baltimore County

THE AFRO — “This is highly problematic given many of the charges that land people in county correctional facilities to begin with are for misdemeanors of which they may not even ultimately be proven guilty and convicted,” said Cathryn Ann Paul Jackson, public policy director for We Are CASA. “It results in a subversion of the local criminal justice system as a means to further racial profiling and do ICE’s dirty work.”

Published

2 days agoon

March 9, 2026By

admin

By Megan Sayles | AFRO Staff Writer

msayles@afro.com

As U.S. Immigration Customs and Enforcement (ICE) operations intensify nationwide, community organizations have become the eyes and ears of their neighborhoods—monitoring the agency’s presence and alerting residents to protect themselves and their neighbors.

In Baltimore County, nonprofits like We Are CASA have observed a spectrum of enforcement actions.

“We have seen a range of activity, including traffic stops and ICE showing up in neighborhoods or in seeming response to tips,” said Cathryn Ann Paul Jackson, public policy director for We Are CASA. “Beyond actual ICE activity in Baltimore County, we have seen many detentions of Baltimore County residents across the DMV, as community members tend to travel across counties and cities for work.”

We Are CASA, a national nonprofit headquartered in Maryland, is dedicated to empowering and improving the quality of life for working-class Black, Latino, Afro-descendent, Indigenous and immigrant communities. Jackson’s personal connection to this mission led her to the organization. A daughter of immigrants from Guyana and Trinidad, she said she grew up witnessing firsthand how immigration policy can define families’ safety, opportunity and sense of belonging.

She said the locations and times of ICE operations in Baltimore County have varied over time.

“We have consistently seen ICE arrest people at their check-in appointments, which were ironically created as an alternative to detention and are now being abused to trap people into custody,” said Jackson. “For a period of time, we were witnessing a significant amount of arrests along the Baltimore-Washington Parkway by U.S. Park Police, who were using a previously rarely enforced law against driving commercial vehicles on this road as a pretext to profile immigrant drivers, detain them and hand them over to ICE.”

Last fall, Baltimore County entered into a Memorandum of Understanding (MOU) with ICE, removing the locality from the Department of Justice’s (DOJ) sanctuary jurisdictions list and formalizing a policy for notifying ICE before the release of inmates with federal immigration detainers or judge-signed warrants.

The agreement codified an existing practice within the Baltimore County Department of Corrections. The MOU is not a 287(g) agreement, which is a partnership between local law enforcement and ICE to delegate immigration enforcement authority to police officers. Those agreements were banned by the state of Maryland on Feb. 17.

However, Jackson criticized the policy memorialized in the MOU, saying that although it is carefully drafted to avoid legal violations, it effectively allows detention centers to hold people past their court-ordered release so that ICE can take them into custody.

“This is highly problematic given many of the charges that land people in county correctional facilities to begin with are for misdemeanors of which they may not even ultimately be proven guilty and convicted,” said Jackson. “It results in a subversion of the local criminal justice system as a means to further racial profiling and do ICE’s dirty work.”

Baltimore County has said it entered into the MOU in an effort to preserve its access to federal funding. The locality explained its reasoning on a FAQ page about its removal from the DOJ’s sanctuary jurisdictions list.

“Inclusion on DOJ’s list could risk significant federal funding, on which the county and constituents depend,” the entry read. “Signing the MOU ensures that the county avoids risks to federal funding that is used to provide needed services.”

Baltimore County’s removal is not unique, as neither Maryland nor any of its counties appear on the DOJ’s list. Still, community members worry that the county’s MOU with ICE could lead to wrongful detentions and the misidentification of residents.

Immigration detainers are not always confirmation of a person’s immigration status—or lack thereof. They are requests by ICE that can be issued without a judicial determination and do not, on their own, establish a person’s legal status.

“We’re very concerned about errors occurring here in the county because of the amped up nature of this mass deportation push,” said Patterson. “This is a replacement theory-driven immigration policy. That means that at the same time we are importing White South African Afrikaaners—who at one time essentially colonized South Africa and oppressed Black South Africans—we are fast deporting people of color. All of us who are the minority can be mistaken for ‘unlawful immigrants.’”

The recent escalation in Minneapolis has heightened Patterson’s concern. He said the city has effectively been made a battleground.

Patterson said the Baltimore County NAACP wants the public to recognize that ICE operates as a militarized organization, unlike local police. He urged people to consider avoiding areas where ICE is active whenever possible and to exercise caution if they encounter agents. If approached, Patterson stressed that people verify warrants are properly signed and directed at them, assert their right to remain silent and contact an attorney before answering questions or consenting to searches.

He also encouraged residents to notify the Baltimore County NAACP of any encounters with ICE.

“We don’t want to wait for Minnesota in Maryland before speaking out about this,” said Patterson. “We want to equip our people to protect themselves behaviorally, consciously and conscientiously because these things are coming to pass. The imprint is among us and we need, therefore, to be aware.”

admin

SEARCH POST NEWS GROUP

CHECK OUT THE LATEST ISSUE OF THE OAKLAND POST

ADVERTISEMENT

WORK FROM HOME

Home-based business with potential monthly income of $10K+ per month. A proven training system and website provided to maximize business effectiveness. Perfect job to earn side and primary income. Contact Lynne for more details: Lynne4npusa@gmail.com 800-334-0540

COMMENTARY: Women of Color Shape Our Past and Future

Woman’s Search for Family’s Roots Leads to Ancestor John T. Ward – A Successful Entrepreneur and Conductor on the Underground Railroad

Advocates Raise Alarm Over ICE Operation, MOU and Detention Risks in Baltimore County

Pete Buttigieg to Join Mayor Randall Woodfin for Community Town Hall in Birmingham

WATCH: Week One – NNPA’s “Leadership Matters” Video Series

Oakland Post: Week of March 4 – 10, 2026

OP-ED: NNPA Launches 2026 “Leadership Matters” Video Series

PRESS ROOM: PMG and Cranbrook Horizons-Upward Bound Launch Journey Fellowship Cohort 2

Los Angeles Summit Brings Together Leaders to Tackle Poverty and Affordability

Civil Rights TV Launches 24/7 Network Focused on Black History, Education and Equity

REVIEW: The Ultimate Hot Girl Summer Getaway: Sunseeker Resort Florida

COMMENTARY: How You Stop a Prescription Medicine is as Important as How You Start

PRESS ROOM: From Congress to Corporate America: NNPA Spotlights Visionaries in New Video Series

Poll Shows Support for Policies That Help Families Afford Child Care

Oakland Post: Week of February 25 – March 3, 2026

Oakland Post: Week of January 28, 2025 – February 3, 2026

Life Expectancy in Marin City, a Black Community, Is 15-17 Years Less than the Rest of Marin County

Community Celebrates Turner Group Construction Company as Collins Drive Becomes Turner Group Drive

California Launches Study on Mileage Tax to Potentially Replace Gas Tax as Republicans Push Back

Discrimination in City Contracts

Book Review: Books on Black History and Black Life for Kids

Oakland Post: Week of January 21 – 27, 2026

COMMENTARY: The Biases We Don’t See — Preventing AI-Driven Inequality in Health Care

Post Newspaper Invites NNPA to Join Nationwide Probate Reform Initiative

Black History Events in the East Bay

Medi-Cal Cares for You and Your Baby Every Step of the Way

Art of the African Diaspora Celebrates Legacy and Community at Richmond Art Center

COMMENTARY: The National Protest Must Be Accompanied with Our Votes

New Bill, the RIDER Safety Act, Would Support Transit Ambassadors and Safety on Public Transit

After Don Lemon’s Arrest, Black Officials Raise Concerns About Independent Black Media

Hyundai Ioniq 5 Parking, Safety, and 360 View #shorts

2025 Ioniq 5 New Wiper & Powerful Performance! #shorts

Electric SUV Range: Is 259 Miles Enough? #shorts

EV Charging: How Fast Can You Charge an Electric Vehicle? #shorts

Biometric Cooling… Messaging Seats…Come on! 2025 Infiniti QX80 Autograph 4WD

Charged Up: Witness the Magic of a Fully Electric Car! #shorts

Range Rover Sport PHEV Included…: See What’s Inside This Luxury SUV! #shorts

Invisible Hood View: Perfect Parking with X-Ray Vision! #shorts

AI Is Reshaping Black Healthcare: Promise, Peril, and the Push for Improved Results in California

ESSAY: Technology and Medicine, a Primary Care Point of View

Sanctuary Cities

The RESISTANCE – FREEDOM NOW

STATE OF THE PEOPLE: Freddie

ECONOMIC BOYCOTT DAY!!!!!

I told You So

Trending

-

Activism4 weeks ago

Activism4 weeks agoCommunity Celebrates Turner Group Construction Company as Collins Drive Becomes Turner Group Drive

-

Business4 weeks ago

Business4 weeks agoCalifornia Launches Study on Mileage Tax to Potentially Replace Gas Tax as Republicans Push Back

-

Activism4 weeks ago

Activism4 weeks agoDiscrimination in City Contracts

-

Arts and Culture4 weeks ago

Arts and Culture4 weeks agoBook Review: Books on Black History and Black Life for Kids

-

Activism4 weeks ago

Activism4 weeks agoCOMMENTARY: The Biases We Don’t See — Preventing AI-Driven Inequality in Health Care

-

Activism4 weeks ago

Activism4 weeks agoPost Newspaper Invites NNPA to Join Nationwide Probate Reform Initiative

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoCOMMENTARY: The National Protest Must Be Accompanied with Our Votes

-

Activism4 weeks ago

Activism4 weeks agoNew Bill, the RIDER Safety Act, Would Support Transit Ambassadors and Safety on Public Transit