#NNPA BlackPress

Framing Our Future: Liberty Bank Celebrates 50 Years

NNPA NEWSWIRE — The elder McDonald, served as president & CEO of Liberty Bank from its founding in 1972, leading and growing the Black-owned bank for the better part of 50 years until earlier this year, when his son Todd, a Morehouse College graduate who earned his MBA from Northwestern University’s Kellogg School of Management, picked up the mantle to lead Liberty into the future.

The post Framing Our Future: Liberty Bank Celebrates 50 Years first appeared on BlackPressUSA.

Published

3 years agoon

By

admin

By Anitra D. Brown | The New Orleans Tribune

Alden J. McDonald and his son Todd have at least two things in common. The first is that neither saw himself as a bank president. In fact, Alden McDonald says it took a novena and Dr. Norman Francis asking him three times to become the president of what would be the newly founded Liberty Bank & Trust before he said “yes.”

“I didn’t’ know whether I was prepared to run a bank.” Alden McDonald once told The New Orleans Tribune. “No one else had walked that plank.”

The truth – he was ready. A graduate of the LSU School of Banking and of Columbia University’s Commercial Banking Management Program, McDonald began his career at International City Bank in New Orleans in 1966, rising to the position of vice president for consumer lending. And during those six years, he zealously learned all he could about the industry, working 12- to 14-hour days.

International City Bank didn’t want him to leave, offering him a senior vice president position to urge him to stay, he says. Instead, he followed advice given to him by the young lady he was dating at the time, Rhesa Ortique, whom he went on to marry. She was the one who suggested he go to a novena in search of guidance and direction.

“So, I did the novena, and I made the decision to do this, right. I am 29 at the time, and to be honest with you, I didn’t know what the hell I was thinking.”

In contrast, it didn’t take a special prayer service for Todd McDonald to know he wanted to be his own boss one day; still, he didn’t see banking in his future. The enterprising youngster, who washed his parents’ friends’ cars while they visited to make extra money, always saw himself as a businessman. However, he thought banking was static and that it would not offer the diverse opportunities he wanted to experience… that was until he had the opportunity to shadow one of his father’s friends, Joe Canizaro, the founder of First Bank & Trust. It was then he realized there was more to banking than, well, banking.

“He brought me into meetings, and I saw how he used the bank as a platform to go into many different businesses. I mean he was building a city in Mississippi; he had the hospitality company; he had a construction company; health care — all these different businesses. And I was like, so you could run a bank and have all of these tentacles out there at the same time. Okay, I would never get tired of doing this.”

At the time, a younger Todd McDonald didn’t really see his father doing all of that at Liberty; but he understood why.

In 1972, with Dr. Norman Francis on its Board of Directors, Alden McDonald as President & CEO and $2 million in assets, Liberty Bank was founded to more Black New Orleanians and other under-served members of the community achieve their dreams. Today, Liberty has branches in 11 states and has $1 billion in assets.

“It was for obvious reasons — a lack of capital,” he says. “I’m sure he could have ventured off in many different ways, as well. But that experience provided me with a vision for myself. How do we leverage a bank charter? You know, I’ve been around my dad for 41 years; but I’ve only been employed with the bank for 19. I heard the stories about him helping people. And so, I’m like, you know, once you start applying the ‘helping people’ with the ‘making money’ and ‘helping other people make money’, it was an easy sell. I’ve dedicated my life to this. I wake up thinking about it. I go to sleep thinking about it.”

And with that, the other thing father and son have in common is that despite each man’s initial misgivings, running a bank is precisely what he has done or is doing.

With his son’s rise to bank president, Alden McDonald, continues to serve as the head of the Liberty Financial Holding Company.

It’s Always Been Huge

The elder McDonald, served as president & CEO of Liberty Bank from its founding in 1972, leading and growing the Black-owned bank for the better part of 50 years until earlier this year, when his son Todd, a Morehouse College graduate who earned his MBA from Northwestern University’s Kellogg School of Management, picked up the mantle to lead Liberty into the future.

The pair took a little time to catch up with The New Orleans Tribune recently to talk about what is now the nation’s largest Black-owned bank. Sitting at a table in the community room of the bank’s headquarters in New Orleans East, the elder McDonald began by mentioning a significant milestone Liberty Bank reached in recent years – $1 billion dollars in assets.

“It was his idea, not mine,” he says with proud smile and a little laughter, nodding in Todd’s direction.

Todd chimes in through the laughter, “That’s what we have to do as a bank to survive. If we don’t get bigger, the cost of operating just gets bigger and you can’t manage the expense side. So, it was very important for us to reach that milestone.”

“It’s a lot of money,” Alden McDonald says. “How many other people do we know that have a billion-dollar company? How many in the city of New Orleans. Just, when you think about it… the significance of it. It’s… it’s…

“Huge,” Todd interjects, finishing the sentence his father started.

“Huge,” Alden McDonald repeats reflectively. “You know, Todd and I, we talked five years ago when he took a real an active role at the bank. He was in charge of strategic planning and visioning. And his vision went beyond my wildest dreams. When he was pushing for a billion dollars, he was looking to make sure we could survive in the banking industry. When I got in the banking industry, there were 35,000 banks. Today, there are less than 5,000 banks. When I got into the business, there were 100 Black banks. Today, there are less than 20. Everything in the industry says a $200 million bank is not going to survive. A $500 million bank is not going to survive. So the benchmark he came up with was a billion.”

The achievement took more than just reaching $1 billion in assets. As Alden McDonald explains, in the banking industry, the rule of thumb is an eight percent capital to asset ratio. In banking terms, capital is the total equity a company has — assets minus liability.

“And then, a couple of years ago, the feds started sending signals. They wanted a 10 percent ratio,” the senior McDonald says.

When Liberty set out to grow to a billion in assets it only had about $60 million in equity. It needed at least $90 million.

It was Todd, who, while serving as Liberty’s executive vice president of corporate strategy, developed national partnerships that produced several new revenue streams that raised $30 million in capital for the bank.

All of this was taking place over the last few years with the pandemic as a backdrop and in the wake of the murder of George Floyd, events that prompted shifts in the nation, one of which included a bit of pressure put on the big boys of banking to help minority banks grow.

And Liberty’s plan for raising the equity it needed to support its growth was realized.

“If it was me, I would asked JP Morgan for $5 million, Citibank for $5 million, Wells Fargo for $5 million and Bank of America for $5 million. Todd goes in, he asks JP Morgan for $30 million. I said, ‘boy, you’re crazy?’ They ended up giving $18 million. Wells gave $5 million. Citi gave $5 million. Bank of America gave $2 million,” the elder McDonald recounts. “I would have been pleased with whatever; but because of the young mind and the young vision, he ended up getting $30 million of non-voting capital. Non-voting. It does not dilute one bit of ownership,”

Perhaps the only thing huger than Liberty Bank reaching that milestone – more than $1 billion in assets the equity to back it up – is the force the bank has been for its customers in New Orleans and across the country.

Even when its assets weren’t, Liberty’s impact has been huge from the start.

Forging a Path to Financial Freedom

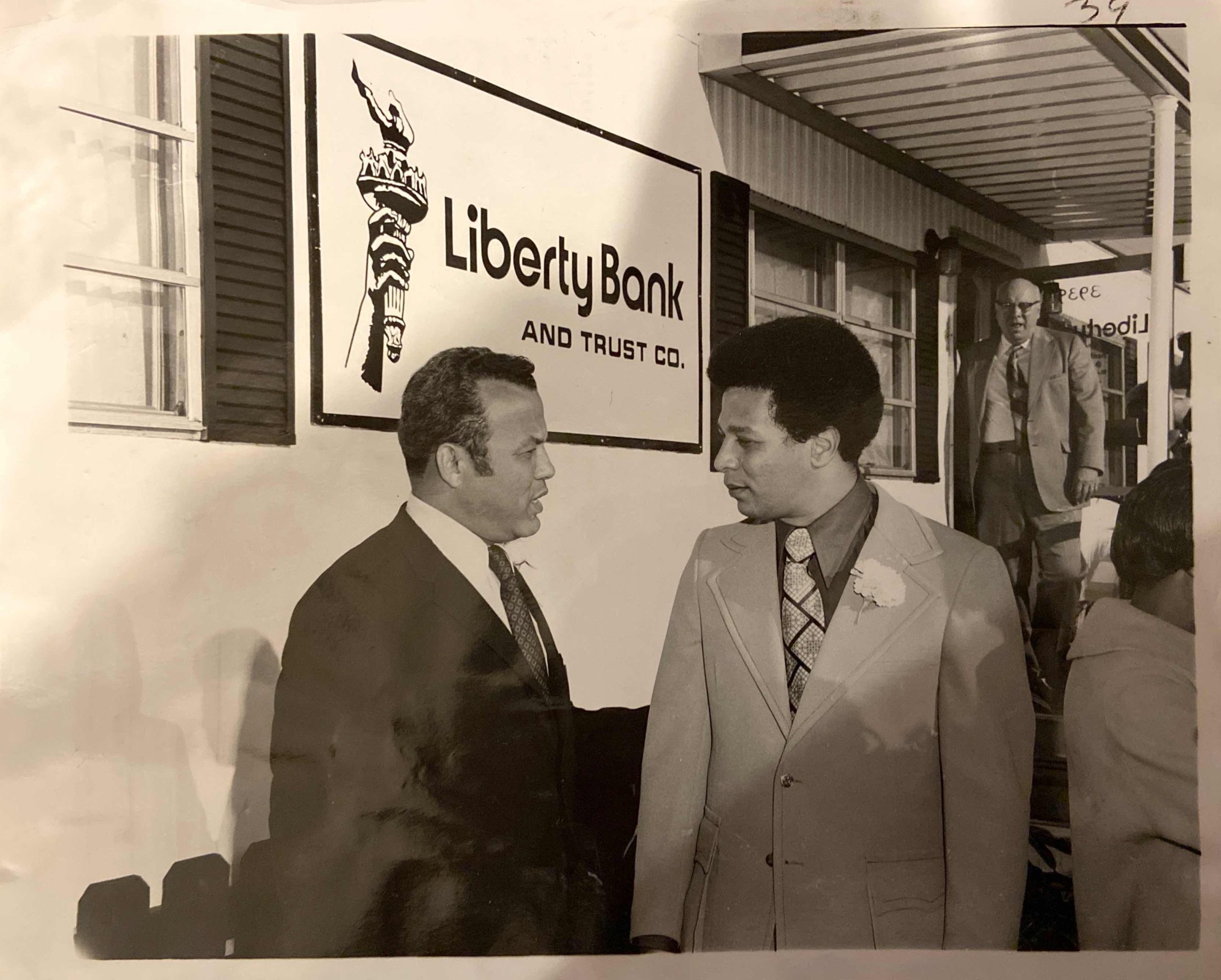

The first Liberty Bank branch was a repurposed construction trailer located on Tulane Avenue.

If Alden McDonald wasn’t ready to lead a Black-owned bank in 1972, Black New Orleans was ready for one.

Beginning in the early 1960s, Alden McDonald and Dr. Norman Francis saw a Black community growing increasingly dissatisfied with inequity and looking for increased opportunity, especially on the economic front. They wanted mortgage loans and loans to start businesses or launch political campaigns without higher interest rates or resorting to subprime finance companies. And if they couldn’t find what they wanted in the mainstream banking industry, they would have to create their own.

That is why Francis asked a young Alden McDonald to leave his comfortable job and start his own bank not once, not twice, but three times — there was a need for a bank that would help more Black New Orleanians and other under-served members of the community achieve their dreams.

Liberty Bank was one of 42 African American-owned banks to open in the U.S. between 1962 and 1979, according to the National Bankers Association. They opened to serve communities that had been all but shut out of the mainstream. When the other banks refused to loan African Americans money or loaned it to them at extraordinarily high interest rates, Black-owned banks were there; and their influence was tangible from the very early history.

There is no telling how many Black New Orleanians own homes and operate businesses because Liberty Bank exists.

Norman Francis once said, “We had a dream to do something special in New Orleans. We started a community bank with a focus on an under-served population.”

From a construction trailer on Tulane Avenue, Liberty now has branches in 11 states and the cyber ability to conduct banking operations nationwide. Liberty Bank has withstood natural disasters and weathered national and regional financial crises. It has not only existed for 50 years, it has thrived. From $2 million in assets in 1972 to the largest African American-owned financial institution in the United States.

More importantly, here in New Orleans, and in other cities across the country, Liberty has helped individuals achieve their financial goals and financial freedom. That is what is meant by “Framing Our Future”, the theme of the bank’s 50-year anniversary.

Big Things Popping

The bank is also a player in helping business owners and investors make major moves. On the day The Tribune met with the McDonalds, they were gearing up for a meeting with a customer about a major project in downtown Minneapolis — the redevelopment of a one-million-square-foot building, Alden McDonald tells.

Financing those types of multi-million-dollar endeavors have become common practice for Liberty Bank.

Just before the pandemic, Alden McDonald says the bank launched a new loan product designed specifically to help African American business owners get into the airport concessions business.

“We were lending money to African Americans with airport contracts,” he says. “Now, we got in it at the wrong time, but we still made out pretty good. We loaned about $30 million to business owners with concessions in airports in New York, New Jersey, Dallas, Los Angeles, and Chicago. We had them all over. It’s helped those businesses grow their capital. When you grow capital, you can hire more people, more Black people. So, the whole pie grows. Despite the pandemic, we only had a problem with one loan and we didn’t lose any money.”

Then there is the project in Houston.

“The mayor in Houston has put together a housing effort there to build maybe 500 homes using all Black folks — the contractors, the developers. And we are financing them. We think that’s going to be a real big signature project with anywhere between $30 million and $50 million in financing from us. And we do a little bit more than just lend the money. For example, this one developer didn’t have much experience, so we put them in touch with another developer we were financing in Houston to partner with him. Then the city gave him a contract that wasn’t to his advantage. So, when we read it, in putting his package together, we said, ‘this ain’t gonna work’. So we helped him to go back to the city, had the city to rework his contract where it made sense and protected him from losing money.”

There are other examples. Too many to include in a single article.

In addition to banking, Liberty has its own insurance agency and a heavy equipment leasing company. It also recently launched its own commercial insurance brokerage firm.

“We intend to be the largest Black-owned commercial insurance brokerage in the country in the next five years,” Alden McDonald says. “What does that mean? It means we are starting another company that will employ additional people. We are going to be able to help other companies in that business to write bigger policies. There is a network of smaller Black-owned commercial insurance brokers across the country, and we are going to help those businesses create more jobs and grow Black wealth. And we’re going to make some money. I always say that you can’t do good, if you don’t do well.”

And if Liberty Bank has its way, it will be doing both well and good into the future.

“We don’t plan on taking another 50 years to reach another $1 billion in assets. He plans on getting there in the next five years,” Alden says, again nodding at Todd.

“My perspective is we have a long runway,” says Todd. “I mean, we have decades ahead of us. You know, it is a lot of work and we’re just taking it step by step. We know organizationally, we can’t be everything to everybody. So, we’ve got to choose our lane and commit to it. We have an amazing underwriting muscle. As my dad mentioned earlier, typically Black-owned institutions didn’t have access to capital. So, the focus is what did we do the first 50 years and how do we leverage that to do it bigger the next 50 years.”

And while Liberty certainly has big things popping, it continues to provide access to basic financial services such as personal checking and savings accounts and multi-faceted products for both individuals and small businesses.

Even as it celebrates 50 years and touts more than a $1 billion in assets, helping everyday people achieve financial freedom is still a primary focus of the bank, says Todd McDonald.

In fact, the smallest loan Liberty offers is $500, it’s the sort of small dollar loan at a low interest rate that Liberty provides to customers to keep them from falling prey to predatory lenders like those in the payday loan industry.

“That’s the least amount of money you can borrow. But to me, that’s the most important product that we have,” says Todd. “I don’t say that a lot, but I prefer to help the average person get out of debt. If I can help someone consolidate from $1,000 a month in payments down to $300 a month in payments, saving them $700 dollars a month, it’s better than making a $1 million loan to me. Now if we repeat that and get a 1,000 people at a time refinancing debt, that’s $700,000 a month back into the pockets of people that look like you and me. Then, we could have the same thousand people start to buy their own homes. Now, if we coordinate efforts like that across the country, we could really pick up some ground. it’s off to the races from that standpoint. So, we’re not just looking at big transactions.”

Celebrating 50 Years with a Golden Jubilee

Liberty Bank’s story of resilience, profitability and empowerment was showcased on Friday, Dec. 2, at Liberty’s “Golden Jubilee” celebration at the Mahalia Jackson Theater. The event was produced by Bright Moments, LLC and was directed by celebrated theater icon Tommye Myrick.

Norman Robinson and Sally Ann Roberts narrated the event that explored the unique role Liberty Bank has played in closing the wealth gap in America. The evening featured song, dance, spoken word and visual renderings that tell the story the African American experience.

The show was led by the musical arrangements of the New Orleans Jazz Orchestra under the direction of Grammy award winner Adonis Rose and featured Irma Thomas, Leah Chase, Jr., Chase Kamata, Sharon Martin, Phillip Manuel, John Boutte, Tonya Boyd-Cannon, the Mystics, the Franklin Avenue Male Chorus, the C Sharpe Gospel Ensemble, the Kia Knight Dance Ensemble, Stilt Walkers, African Drummers, Harold Evans, Gwendolyn Foxworth, Lady Tambourine, Erica Falls, Peteh the Poet, and a host of others.

The post Framing Our Future: Liberty Bank Celebrates 50 Years appeared first on The New Orleans Tribune.

The post Framing Our Future: Liberty Bank Celebrates 50 Years first appeared on BlackPressUSA.

admin

You may like

-

A Nation in Freefall While the Powerful Feast: Trump Calls Affordability a ‘Con Job’

-

The Numbers Behind the Myth of the Hundred Million Dollar Contract

-

FBI Report Warns of Fear, Paralysis, And Political Turmoil Under Director Kash Patel

-

ACA Deadline Nears as 20 million Brace for Higher Health Costs

-

Money, the NCAA and College Athletics: Congress Considers Changes to Name, Image and Likeness Rules

-

WATCH: Unanswered Questions Around The National Guard Shooting

#NNPA BlackPress

A Nation in Freefall While the Powerful Feast: Trump Calls Affordability a ‘Con Job’

BLACKPRESSUSA NEWSWIRE — There are seasons in this country when the struggle of ordinary Americans is not merely a condition but a kind of weather that settles over everything.

Published

2 months agoon

December 3, 2025

By Stacy M. Brown

Black Press USA Senior National Correspondent

There are seasons in this country when the struggle of ordinary Americans is not merely a condition but a kind of weather that settles over everything. It enters the grocery aisle, the overdue bill, the rent notice, and the long nights spent calculating how to get through the next week. The latest numbers show that this season has not passed. It has deepened.

Private employers cut 32,000 jobs in November, according to ADP. Because the nation has been hemorrhaging jobs since President Trump took office, the administration has halted publishing the traditional monthly report. The ADP report revealed that small businesses suffered the heaviest losses. Establishments with fewer than 50 workers shed 120,000 positions, including 74,000 from companies with 20 to 49 workers. Larger firms added 90,000 jobs, widening the split between those rising and those falling.

Meanwhile, wealth continues to climb for the few who already possess most of it. Federal Reserve data shows the top 1 percent now holds $52 trillion. The top 10 percent added $5 trillion in the second quarter alone. The bottom half gained only 6 percent over the past year, a number so small it fades beside the towering fortunes above it.

“Less educated and poorer people tend to make worse mistakes,” John Campbell said to CBS News, while noting that the complexity of the system leaves many families lost before they even begin. Campbell, a Harvard University economist and coauthor of a book examining the country’s broken personal finance structure, pointed to a system built to confuse and punish those who lack time, training, or access.

“Creditors are just breathing down their necks,” Carol Fox told Bloomberg News, while noting that rising borrowing costs, shrinking consumer spending, and trade battles under the current administration have left owners desperate. Fox serves as a court-appointed Subchapter V trustee in Southern Florida and has watched the crisis unfold case by case.

During a cabinet meeting on Tuesday, Trump told those present that affordability “doesn’t mean anything to anybody.” He added that Democrats created a “con job” to mislead the public.

However, more than $30 million in taxpayer funds reportedly have supported his golf travel. Reports show Kristi Noem and FBI Director Kash Patel have also made extensive use of private jets through government and political networks. The administration approved a $40 billion bailout of Argentina. The president’s wealthy donors recently gathered for a dinner celebrating his planned $300 million White House ballroom.

During an appearance on CNBC, Mark Zandi, an economist, warned that the country could face serious economic threats. “We have learned that people make many mistakes,” Campbell added. “And particularly, sadly, less educated and poorer people tend to make worse mistakes.”

Stacy M. Brown

#NNPA BlackPress

The Numbers Behind the Myth of the Hundred Million Dollar Contract

BLACKPRESSUSA NEWSWIRE — Odell Beckham Jr. did not spark controversy on purpose. He sat on The Pivot Podcast and tried to explain the math behind a deal that looks limitless from the outside but shrinks fast once the system takes its cut.

Published

2 months agoon

December 3, 2025

By Stacy M. Brown

Black Press USA Senior National Correspondent

Odell Beckham Jr. did not spark controversy on purpose. He sat on The Pivot Podcast and tried to explain the math behind a deal that looks limitless from the outside but shrinks fast once the system takes its cut. He looked into the camera and tried to offer a truth most fans never hear. “You give somebody a five-year $100 million contract, right? What is it really? It is five years for sixty. You are getting taxed. Do the math. That is twelve million a year that you have to spend, use, save, invest, flaunt,” said Beckham. He added that buying a car, buying his mother a house, and covering the costs of life all chip away at what people assume lasts forever.

The reaction was instant. Many heard entitlement. Many heard a millionaire complaining. What they missed was a glimpse into a professional world built on big numbers up front and a quiet erasing of those numbers behind the scenes.

The tax data in Beckham’s world is not speculation. SmartAsset’s research shows that top NFL players often lose close to half their income to federal taxes, state taxes, and local taxes. The analysis explains that athletes in California face a state rate of 13.3 percent and that players are also taxed in every state where they play road games, a structure widely known as the jock tax. For many players, that means filing up to ten separate returns and facing a combined tax burden that reaches or exceeds 50 percent.

A look across the league paints the same picture. The research lists star players in New York, Philadelphia, Chicago, Detroit, and Cleveland, all giving up between 43 and 47 percent of their football income before they ever touch a dollar. Star quarterback Phillip Rivers, at one point, was projected to lose half of his playing income to taxes alone.

A second financial breakdown from MGO CPA shows that the problem does not only affect the highest earners. A $1 million salary falls to about $529,000 after federal taxes, state and city taxes, an agent fee, and a contract deduction. According to that analysis, professional athletes typically take home around half of their contract value, and that is before rent, meals, training, travel, and support obligations are counted.

The structure of professional sports contracts adds another layer. A study of major deals across MLB, the NBA, and the NFL notes that long-term agreements lose value over time because the dollar today has more power than the dollar paid in the future. Even the largest deals shrink once adjusted for time. The study explains that contract size alone does not guarantee financial success and that structure and timing play a crucial role in a player’s long-term outcomes.

Beckham has also faced headlines claiming he is “on the brink of bankruptcy despite earning over one hundred million” in his career. Those reports repeated his statement that “after taxes, it is only sixty million” and captured the disbelief from fans who could not understand how money at that level could ever tighten.

Other reactions lacked nuance. One article wrote that no one could relate to any struggle on eight million dollars a year. Another described his approach as “the definition of a new-money move” and argued that it signaled poor financial choices and inflated spending.

But the underlying truth reaches far beyond Beckham. Professional athletes enter sudden wealth without preparation. They carry the weight of family support. They navigate teams, agents, advisors, and expectations from every direction. Their earning window is brief. Their career can end in a moment. Their income is fragmented, taxed, and carved up before the public ever sees the real number.

The math is unflinching. Twenty million dollars becomes something closer to $8 million after federal taxes, state taxes, jock taxes, agent fees, training costs, and family responsibilities. Over five years, that is about $40 million of real, spendable income. It is transformative money, but not infinite. Not guaranteed. Not protected.

Beckham offered a question at the heart of this entire debate. “Can you make that last forever?”

Stacy M. Brown

#NNPA BlackPress

FBI Report Warns of Fear, Paralysis, And Political Turmoil Under Director Kash Patel

BLACKPRESSUSA NEWSWIRE — Six months into Kash Patel’s tenure as Director of the Federal Bureau of Investigation, a newly compiled internal report from a national alliance of retired and active-duty FBI agents and analysts delivers a stark warning about what the Bureau has become under his leadership.

Published

2 months agoon

December 2, 2025

Six months into Kash Patel’s tenure as Director of the Federal Bureau of Investigation, a newly compiled internal report from a national alliance of retired and active-duty FBI agents and analysts delivers a stark warning about what the Bureau has become under his leadership. The 115-page document, submitted to Congress this month, is built entirely on verified reporting from inside field offices across the country and paints a picture of an agency gripped by fear, divided by ideology, and drifting without direction.

The report’s authors write that they launched their inquiry after receiving troubling accounts from inside the Bureau only four months into Patel’s tenure. They describe their goal as a pulse check on whether the ninth FBI director was reforming the Bureau or destabilizing it. Their conclusion: the preliminary findings were discouraging.

Reports Describe Widespread Internal Distrust and Open Hostility Toward President Trump

Sources across the country told investigators that a large number of FBI employees openly express hostility toward President Donald Trump. One source reported seeing an “increasing number of FBI Special Agents who dislike the President,” adding that these employees were exhibiting what they called “TDS” and had lost “their ability to think critically about an issue and distinguish fact from fiction.” Another source described employees making off-color comments about the administration during office conversations.

The sentiment reportedly extends beyond domestic lines. Law enforcement and intelligence partners in allied countries have privately expressed fear that the Trump administration could damage long-term international cooperation according to a sub-source who reported those concerns directly to investigators.

Pardon Backlash and Fear of Retaliation

The President’s January 20 pardons of individuals convicted for their roles in the January 6 attack ignited what the report calls demoralization inside the Bureau. One FBI employee said they were “demoralized” that individuals “rightfully convicted” were pardoned and feared that some of those individuals or their supporters might target them or their family for carrying out their duties. Another source described widespread anger that lists of personnel who worked on January 6 investigations had been provided to the Justice Department for review, noting that agents “were just following orders” and now worry those lists could leak publicly.

Morale In Decline

Morale among FBI employees appears to be sinking fast. There were a few scattered positive notes, but the weight of the reporting describes morale as low, bad, or terrible. Agents with more than a decade of service told investigators they feel marginalized or ignored. Some are counting the days until they can retire. One even uses a countdown app on their phone.

Culture Of Fear

Layered over that unhappiness is something far more corrosive. A culture of fear. Sources say Patel, though personable, created mistrust from the start because of harsh remarks he made about the FBI before taking office. Agents took those comments personally. They now work in an atmosphere where employees keep their heads down and speak carefully. Managers wait for directions because they are afraid a wrong move could cost them their jobs. One source said agents dread coming to work because nobody knows who will be reassigned or fired next.

Leadership Concerns

The report also paints a picture of leaders unprepared for the jobs they hold. Multiple sources said Patel is in over his head and lacks the breadth of experience required to understand the Bureau’s complex programs. Some said Deputy Director Dan Bongino should never have been appointed because the role requires deep institutional knowledge of FBI operations. A sub-source recounted Bongino telling employees during a field office visit that “the truth is for chumps.” Employees who heard it were stunned and offended.

Social Media and Communication Breakdowns

Communication inside the Bureau has become another source of frustration. Sources said Patel and Bongino spend too much time posting on social media and not enough time communicating with employees in clear and official ways. Several told investigators they learn more about FBI operations from tweets than from internal channels.

ICE Assignments Raise Alarm

Nothing has sparked more frustration inside the FBI than the orders requiring agents to assist Immigration and Customs Enforcement. The reporting shows widespread resentment and fear over these assignments. Agents say they have little training in immigration law and were ordered into operations without proper planning. Some said they were put in tactically unsafe positions. They also warned that being pulled away from counterterrorism and counterintelligence investigations threatens national security. One sub-source asked, “If we’re not working CT and CI, then who is?”

DEI Program Removal

Even the future of diversity programs became a point of division. Some agents praised Patel’s removal of DEI initiatives. Others said the old system left them afraid to speak honestly because they worried about being labeled racist. The reporting shows a deep and unresolved conflict over whether DEI strengthened the organization or weakened it.

Notable Incidents

The document also details several incidents that have become part of FBI lore. Patel ordered all employees to remove pronouns and personal messages from their email signatures yet used the number nine in his own. Agents laughed at what they saw as hypocrisy. In another episode, FBI employees who discussed Patel’s request for an FBI-issued firearm were ordered to take polygraph examinations, which one respected source described as punitive. And in Utah, Patel refused to exit a plane without a medium-sized FBI raid jacket. A team scrambled to find one and finally secured a female agent’s jacket. Patel still refused to step out until patches were added. SWAT members removed patches from their own uniforms to satisfy the demand.

A Bureau at a Crossroad

The Alliance warns that the Bureau stands at a difficult crossroads. They write that the FBI faces some of the most daunting challenges in its history. But even in despair, a few voices say something different. One veteran source said “It is early, but most can see the mission is now the priority. Case work and threats are the focus again. Reform is headed in the right direction.”

Stacy M. Brown

SEARCH POST NEWS GROUP

CHECK OUT THE LATEST ISSUE OF THE OAKLAND POST

ADVERTISEMENT

WORK FROM HOME

Home-based business with potential monthly income of $10K+ per month. A proven training system and website provided to maximize business effectiveness. Perfect job to earn side and primary income. Contact Lynne for more details: Lynne4npusa@gmail.com 800-334-0540

OP-ED: AB 1349 Puts Corporate Power Over Community

Oakland Post: Week of December 31, 2025 – January 6, 2026

Big God Ministry Gives Away Toys in Marin City

First 5 Alameda County Distributes Over $8 Million in First Wave of Critical Relief Funds for Historically Underpaid Caregivers

2025 in Review: Seven Questions for Assemblymember Lori Wilson — Advocate for Equity, the Environment, and More

2025 in Review: Seven Questions for Assemblymember Tina McKinnor, Champion of Reparations, Housing and Workers’ Rights

2025 in Review: Seven Questions for Sen. Laura Richardson, Who Made Legislative History This Year

2025 in Review: Seven Questions for Sen. Lola Smallwood-Cuevas – an Advocate for Jobs and Justice

Alfred Cralle: Inventor of the Ice Cream Scoop

BOOK REVIEW: Let Me Be Real With You

Oakland Post: Week of December 24 – 30, 2025

Bling It On: Holiday Lights Brighten Dark Nights All Around the Bay

Oakland Council Expands Citywide Security Cameras Despite Major Opposition

Lu Lu’s House is Not Just Toying Around with the Community

Desmond Gumbs — Visionary Founder, Mentor, and Builder of Opportunity

Post Salon to Discuss Proposal to Bring Costco to Oakland Community meeting to be held at City Hall, Thursday, Dec. 18

Mayor Lee, City Leaders Announce $334 Million Bond Sale for Affordable Housing, Roads, Park Renovations, Libraries and Senior Centers

Oakland Post: Week of December 10 – 16, 2025

Oakland School Board Grapples with Potential $100 Million Shortfall Next Year

Fayeth Gardens Holds 3rd Annual Kwanzaa Celebration at Hayward City Hall on Dec. 28

2025 in Review: Seven Questions for Black Women’s Think Tank Founder Kellie Todd Griffin

Ann Lowe: The Quiet Genius of American Couture

COMMENTARY: If You Don’t Want Your ‘Black Card’ Revoked, Watch What You Bring to Holiday Dinners

Desmond Gumbs — Visionary Founder, Mentor, and Builder of Opportunity

Support Your Child’s Mental Health: Medi-Cal Covers Therapy, Medication, and More

BRIDGE Housing President and CEO Ken Lombard Scores Top Honors for Affordable Housing Leadership

Families Across the U.S. Are Facing an ‘Affordability Crisis,’ Says United Way Bay Area

Oakland Council Expands Citywide Security Cameras Despite Major Opposition

Black Arts Movement Business District Named New Cultural District in California

Bling It On: Holiday Lights Brighten Dark Nights All Around the Bay

Hyundai Ioniq 5 Parking, Safety, and 360 View #shorts

2025 Ioniq 5 New Wiper & Powerful Performance! #shorts

Electric SUV Range: Is 259 Miles Enough? #shorts

EV Charging: How Fast Can You Charge an Electric Vehicle? #shorts

Biometric Cooling… Messaging Seats…Come on! 2025 Infiniti QX80 Autograph 4WD

Charged Up: Witness the Magic of a Fully Electric Car! #shorts

Range Rover Sport PHEV Included…: See What’s Inside This Luxury SUV! #shorts

Invisible Hood View: Perfect Parking with X-Ray Vision! #shorts

AI Is Reshaping Black Healthcare: Promise, Peril, and the Push for Improved Results in California

ESSAY: Technology and Medicine, a Primary Care Point of View

Sanctuary Cities

The RESISTANCE – FREEDOM NOW

STATE OF THE PEOPLE: Freddie

ECONOMIC BOYCOTT DAY!!!!!

I told You So

Trending

-

Activism4 weeks ago

Activism4 weeks agoDesmond Gumbs — Visionary Founder, Mentor, and Builder of Opportunity

-

Activism4 weeks ago

Activism4 weeks agoFamilies Across the U.S. Are Facing an ‘Affordability Crisis,’ Says United Way Bay Area

-

Alameda County4 weeks ago

Alameda County4 weeks agoOakland Council Expands Citywide Security Cameras Despite Major Opposition

-

Activism4 weeks ago

Activism4 weeks agoBlack Arts Movement Business District Named New Cultural District in California

-

Alameda County4 weeks ago

Alameda County4 weeks agoBling It On: Holiday Lights Brighten Dark Nights All Around the Bay

-

Activism4 weeks ago

Activism4 weeks agoLu Lu’s House is Not Just Toying Around with the Community

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of December 17 – 23, 2025

-

Activism3 weeks ago

Activism3 weeks agoFirst 5 Alameda County Distributes Over $8 Million in First Wave of Critical Relief Funds for Historically Underpaid Caregivers