Politics

House Votes to Expand College Accounts Obama Wanted to Scrap

President Barack Obama speaks about the economy, Friday, Oct. 31, 2014, at Rhode Island College in Providence, R.I. (AP Photo/Evan Vucci)

STEPHEN OHLEMACHER, Associated Press

WASHINGTON (AP) — The House voted Wednesday to expand the benefits of popular college savings plans that President Barack Obama failed to scale back.

The bill would let students use money from college savings accounts to buy computers and other technology, something they cannot do now with tax-free distributions from the accounts.

“Computers are an absolutely essential part of higher education, and the law should be updated to reflect that,” said Rep. Lynn Jenkins, R-Kansas, the bill’s sponsor. “I believe this is a common-sense modernization measure.”

The bill would add $51 million to the budget deficit over the next decade, according to the Joint Committee on Taxation, which provides official estimates for Congress.

The House passed the bill by a 401-20. A bipartisan group of senators has introduced a similar bill.

While the measure highlights a political misstep by the president, White House spokesman Josh Earnest said Wednesday the administration does not oppose the legislation.

Still, he added: “We believe there is more that we can do that would be a whole lot more effective and more fiscally responsible to ensure that we’re opening up a college education to even more middle-class families.”

About 12 million families take advantage of the 529 college savings plans, named after a section in federal tax law.

Contributions to the accounts are not tax-deductible. But once the money is invested, it can grow and eventually be withdrawn with no tax on the earnings as long as the money is spent on tuition, fees, books and supplies needed to attend postsecondary school.

The savings plans are sponsored by states and also can be used to prepay college tuition.

Ahead of Obama’s State of the Union Address in January, he proposed eliminating the tax benefits of future contributions to the accounts as part of an education package that would simplify an often confusing array of tax breaks for college students.

Families could continue contributing to college savings accounts under Obama’s proposal. But students would have had to pay taxes on the earnings once the money was withdrawn.

The White House said the college savings plans mostly benefit wealthier families. But Obama was forced to quickly withdraw the proposal after both Republicans and Democrats panned it.

“When it comes to education tax benefits, our highest priority should be to expand, improve and simplify tax benefits for the middle class,” Earnest said. “The president’s nearly $50 billion investment in the middle class, which builds on bipartisan legislation and is fully offset, would cut taxes for 8.5 million students and families and simplify taxes for every single student who relies on education tax credits to help pay for college.”

“The proposal before Congress would not achieve these goals and instead focuses exclusively on education savings plans that are used by less than 3 percent of American families,” Earnest added.

A recent Associated Press-GfK poll found that just 19 percent of people in the U.S. supported the president’s proposal to scale back the benefits of the college accounts.

“We fundamentally disagree with the direction of the president’s policy proposal, and instead we want to make 529 college savings plans more consumer-friendly and reflective of the realities faced by students today,” Jenkins said.

The bill would make some technical changes to the accounts. For example, if a student uses money from an account to pay tuition that is later refunded for some reason, the bill would allow the student to deposit the money back into the account without paying a penalty.

___

Associated Press writer Darlene Superville contributed to this report.

___

Follow Stephen Ohlemacher on Twitter: http://twitter.com/stephenatap

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Activism

Oakland Post: Week of April 23 – 29, 2025

The printed Weekly Edition of the Oakland Post: Week of April 23 – 29, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Activism

Oakland Post: Week of April 16 – 22, 2025

The printed Weekly Edition of the Oakland Post: Week of April 16 – 22, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Activism

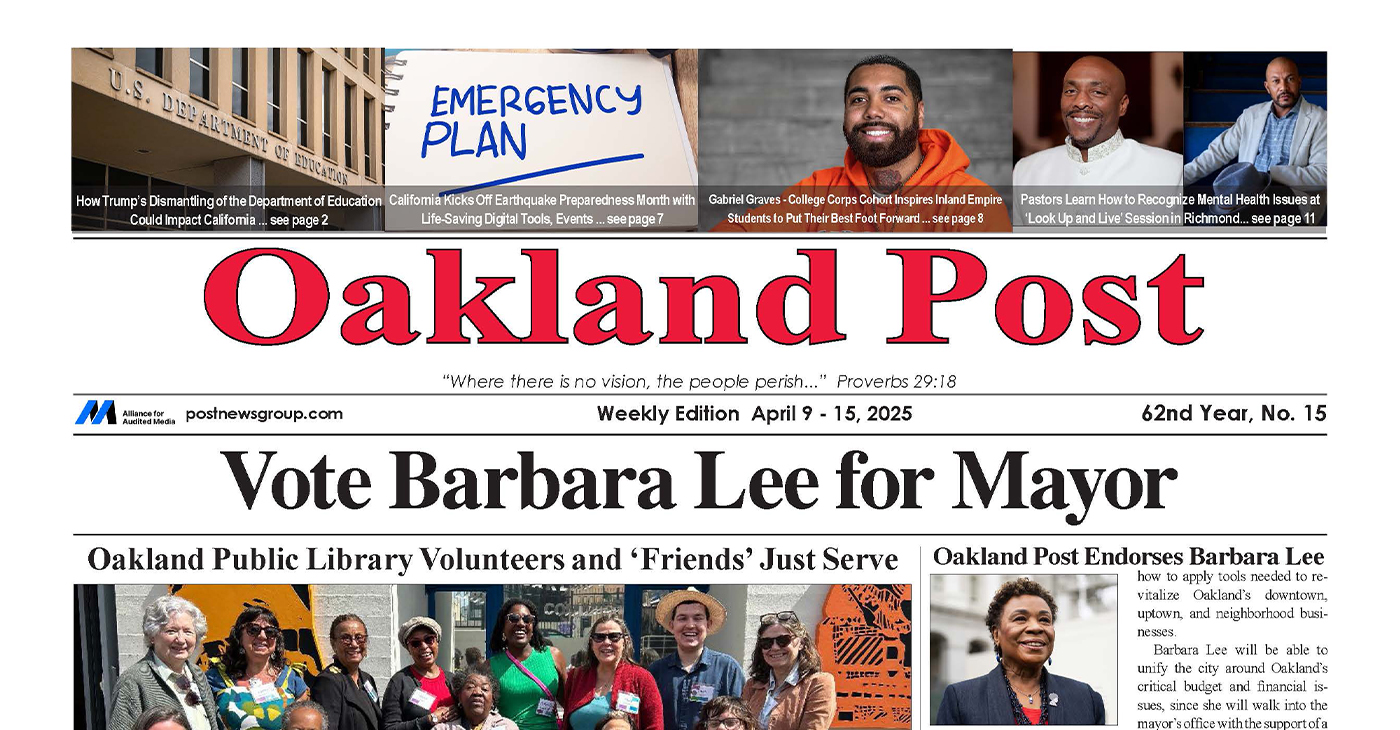

Oakland Post: Week of April 9 – 15, 2025

The printed Weekly Edition of the Oakland Post: Week of April 9 – 15, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

-

Activism4 weeks ago

Activism4 weeks agoOakland Post Endorses Barbara Lee

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 28 – April 1, 2025

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of April 2 – 8, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump Profits, Black America Pays the Price

-

Activism2 weeks ago

Activism2 weeks agoOakland Post: Week of April 9 – 15, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoHarriet Tubman Scrubbed; DEI Dismantled

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoTrump Targets a Slavery Removal from the National Museum of African-American History and Culture

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoLawmakers Greenlight Reparations Study for Descendants of Enslaved Marylanders