Charleston Chronicle

Increasing H.O.P.E. Announces Annual Free Financial Literacy Month Event

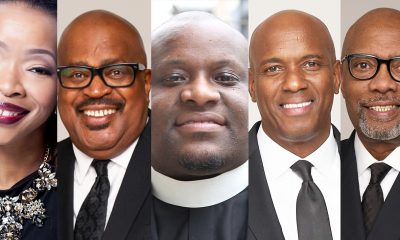

CHARLESTON CHRONICLE — The Increasing H.O.P.E. Financial Training Center is pleased to announce its 14th presentation of Money Fair Saturday, April 13, 2019, from 10:00 am – 2:00 pm at the Royal Life Center at 4750 Abraham Avenue in North Charleston. In addition to providing financial literacy and education during its annual community outreach, the non-profit organization will host the 2nd Annual Pastors & Leaders Money Roundtable at 11:00 am.

By The Charleston Chronicle

The Increasing H.O.P.E. Financial Training Center is pleased to announce its 14th presentation of Money Fair Saturday, April 13, 2019, from 10:00 am – 2:00 pm at the Royal Life Center at 4750 Abraham Avenue in North Charleston. In addition to providing financial literacy and education during its annual community outreach, the non-profit organization will host the 2nd Annual Pastors & Leaders Money Roundtable at 11:00 am.

Money Fair 2019 is a free interactive community event with something for the entire family. Attendees will have the opportunity to ask financial experts questions about a variety of topics that include, homeownership, credit restoration, banking, insurance, and investments. Children will have fun meeting and greeting Increasing H.O.P.E.’s mascot “Mo Money” as he makes learning about money fun.

“We’ve got some big news to announce at this year’s Money Fair, and are excited to be partnered with some of the top financial service providers in the nation.” says Dorothea Bernique, Executive Director of Increasing H.O.P.E. “This event serves one purpose, to provide hope, education, and empowerment that will help our attendees move from debt and delinquencies to deeds and deposits. explains Bernique.

In celebration of Financial Literacy Month, Increasing HOPE will have lots of activities for attendees. There will be food vendors, games, and giveaways throughout the entire day. Money Fair 2019 is free and open to the public, but attendees are asked to visit www.ItsMyMoneyFair.com to register.

Increasing H.O.P.E. Financial Training Center has had a 10 Million Dollar impact in the Tri-county area over the past 13 years. The nonprofit organization has a passion for seeing individuals and families become educated, enriched and empowered in the area of personal finance. H.O.P.E. is an acronym for Helping Others Prosper Economically.

Corporate Sponsors include: BB&T, South State Bank, Pinnacle Financial Partners, Woodforest National Bank, South Carolina Federal Credit Union, SunTrust, Bank of America, The Royal Foundation, and D-Free.

For more information about Money Fair 19, sponsorship or vendor opportunities call 843-225-4343 or visit www.itsmymoneyfair.com.

This article originally appeared in the Charleston Chronicle.

Black History

Women’s Suffrage Forged by Founding Sisters: Happy Birthday to Ida B.

CHARLESTON CHRONICLE — So proclaimed Ida B. Wells-Barnett, who fearlessly shined a light with words on the abominable dark days after slavery and into the 20th century. Journalist, publisher, author, activist, and suffragist leader, Ida B.’s spirit soars. July 16 marks the 157th anniversary of her birth. Blood, sweat, and ink sealed her legacy and the future of a nation still struggling to be whole.

By Gwen McKinney

By Gwen McKinney

“The people must know before they can act, and there is no educator to compare with the press.”

So proclaimed Ida B. Wells-Barnett, who fearlessly shined a light with words on the abominable dark days after slavery and into the 20th century.

Journalist, publisher, author, activist, and suffragist leader, Ida B.’s spirit soars. July 16 marks the 157th anniversary of her birth. Blood, sweat, and ink sealed her legacy and the future of a nation still struggling to be whole.

Ida B. revered the Black press as an organizing tool. Though her newspaper The Memphis Free Speech was destroyed by racist mobs, she was never silenced. During her life, she would publish three newspapers and authored “Southern Horrors: Lynch Law in All Its Phases” and “The Red Record,” investigative reports that remain definitive sources on racist violence more than 100 years later.

Small in stature but huge in courage, Wells, an emancipated slave, joined a cadre of Black contemporaries – scholars, activists, and thought leaders – who pledged to change the trajectory of bondage and demand that Black women have a voice.

They defy the clichés and caricatures planted in popular culture with their searing voices. Their cadence would not be paraphrased or translated into the often quoted “Ain’t I A Woman” reprise. But forever burdened by their womanhood and Blackness, their path – then and now – is littered with obstacles.

Educator and writer Mary Church Terrell observed, “Nobody wants to know a colored woman’s opinion about her own status [or] that of her group. When she dares express it, no matter how mild or tactful…, it is called ‘propaganda,’ or is labeled ‘controversial.’”

Poet, teacher, and Baltimore abolitionist Frances Ellen Harper was among the suffragists who pleaded the case for linked fate unity. “We are all bound up together in one great bundle of humanity,” she said. “Society cannot trample on the weakest and feeblest of its members without receiving the curse in its own soul.”

These Founding Sisters forged civil rights organizations with Black men, sororities, and service clubs with their women peers, and joined “woke” White women against lynching and disenfranchisement and for education and economic development.

It was Ida B. and a coterie of Black women publishers, writers, and teachers of the era who led the movement for universal suffrage even when Black women were shunned and excluded.

Nonetheless, women’s suffrage, deeply rooted in abolitionism, is depicted in a single dimension as the jumpstart for the white feminist/voting rights movement.

Regarded as social reformers, White suffragist – many of them supporters of abolition – confronted a fork in the road, conflicted between the “Negro question” and universal suffrage.

With passage of the 15th Amendment in 1870 granting Black men voting rights, universal suffrage would be sacrificed on the altar of patriarchy and white supremacy. Defended or oversimplified, the words of Susan B. Anthony, crowned the mother of women’s suffrage, illustrate the entrenched stranglehold of whiteness.

Though she counted abolitionist Frederick Douglas as an admired cohort, Anthony’s contradictions can only be measured today in the context of racism and exclusion.

“I would sooner cut off this right arm of mine before I would ever work for or demand the ballot for the black man and not the woman,” she said. One might conclude that she was seduced by the divide-and-conquer tactics of the male proponents of the 15th Amendment. But Anthony’s view was widely embraced by the White women’s suffrage movement.

Her friend and suffrage leader Elizabeth Cady Stanton, arguing against the 15th Amendment, protested: “It’s better to be the slave of an educated white man than of a degraded black one.”

One year away from the centennial of the 19th Amendment giving women the right to vote, how much ground have we gained as women and a nation? How much of the conversation about gender equality denies the overlapping impact of white nationalism, patriarchy, and privilege? Where and when do the voices of Black and Brown women enter?

But first and foremost, when do Black women get the recognition that they have earned in their unbroken march to freedom?

Our compass should be guided by that path forged by Ida B. Wells and other courageous Black women whose intersectional quest to make America stand upright changed the world.

This opening salvo embraces Suffrage. Race. Power. Spurred by my collaboration with a small collective of women that is Black-led, cross-generational, and supported by “woke” White women, we’ve named ourselves “Founding Sisters.” This space will offer regular installments that honor our Founding Sisters of the last centuries and spotlight the unfinished business of Suffrage. Race. Power.

To kick it off: Happy birthday Ida B.!

Gwen McKinney is President and Founder of McKinney & Associates Public Relations, for which she is responsible for translating the vision of “public relations with a conscience” into a sustained, bold and tested suite of communications services and activities. She is also the founder and lead collaborator for Suffrage.Race.Power.

This article originally appeared in the Charleston Chronicle.

Charleston Chronicle

Home Telecom Partners with Berkeley County School District to Roll Out Free Internet to K-12 Student Households in Cross Schools

CHARLESTON CHRONICLE — Award-winning Lowcountry technology provider Home Telecom announces the rollout of free internet to households with school-age children in the Cross community this upcoming school year. As part of their partnership with the Berkeley County School District (BCSD) who has support from Google via a grant, Home Telecom will be making network improvements that make the free service available to households with children from kindergarten through 12th grade that are attending Cross Elementary or Cross High Schools.

By The Charleston Chronicle

Award-winning Lowcountry technology provider Home Telecom announces the rollout of free internet to households with school-age children in the Cross community this upcoming school year. As part of their partnership with the Berkeley County School District (BCSD) who has support from Google via a grant, Home Telecom will be making network improvements that make the free service available to households with children from kindergarten through 12th grade that are attending Cross Elementary or Cross High Schools.

Previously, BCSD implemented the One Berkeley Connects initiative by supplying students in the district with Chromebooks to be used in school and at home to assist in the learning process. In order to benefit from this initiative, it is important to have reliable broadband internet access in students’ homes. Access to the internet for the betterment of education is a priority for Home Telecom.

Home Telecom began a project in late 2017 to invest a significant amount of capital into making higher speed internet available to the Cross community. Currently, only 60% of homes with school-age children in that area have internet service. Additional capital is being invested by Home Telecom to improve the internet speed available, and to provide access to at least 95% of the remaining homes without internet access.

BCSD is partnering with Home Telecom to provide greatly discounted high-speed internet service with in-home WiFi to 365 addresses identified by BCSD as being occupied by Cross school students. Funding provided by a Google grant will allow internet service to be provided to these homes at no charge for the 2019-2020 school year.

BCSD has begun notifying eligible families and requesting they contact Home Telecom to begin the process to set up the free internet service in their homes. From now through August, Home Telecom technicians will be performing necessary construction and installations to ensure these homes are internet-ready by August 2019.

Residents in the designated area with school-age children who currently have Home Telecom internet services that are slower than 10Mbps may upgrade to 10Mbps in order to take full advantage of this program. Residents who are capable and desire to have speeds higher than 10Mbps will be able to upgrade at a discounted price.

This article originally appeared in the Charleston Chronicle.

Charleston Chronicle

Regulatory rollback on student loans takes away borrower protections

CHARLESTON CHRONICLE — Every Fourth of July celebrates this nation’s founding. But this year, only a few days before the annual freedom celebration, an ill-advised governmental action will financially doom rather than free millions of student loan borrowers – as of July 1. Moreover, this action arrives as the cost of higher education continues to soar and household incomes remain largely stagnant.

By Charlene Crowell

By Charlene Crowell

Every Fourth of July celebrates this nation’s founding. But this year, only a few days before the annual freedom celebration, an ill-advised governmental action will financially doom rather than free millions of student loan borrowers – as of July 1. Moreover, this action arrives as the cost of higher education continues to soar and household incomes remain largely stagnant.

Charlene Crowell

On June 28, the Department of Education announced the end of an important student loan regulation that since 2015 has held colleges with career training programs accountable for failure to provide an education that resulted in marketable skills and earnings high enough to repay student loans.

Known as the Gainful Employment rule, it required career and technical training programs that receive federal financial aid to prove that students would receive the education promised or forfeit future federal funding dollars. Additionally, covered institutions and programs were required to disclose to prospective students the career earnings and student debts of recent graduates.

In other words, the rule was intended to rein in abusive schools before they could harm students or waste taxpayer-funded aid.

Finalized in 2014, the rule was too late to help the tens of thousands of student borrowers affected by the failures of huge for-profit institutions, Corinthian Colleges, and ITT Technical Institute. Borrowers at these now-shuttered colleges were left without degrees, or credits that could be transferred, but carried with them unaffordable debts that have devastated the stability of their families. These closures also resulted in massive losses to taxpayers who fund federal financial aid.

Even so, the Gainful Employment rule has been effective in two other ways. First, it pushed many other for-profit institutions to cut their worst performing programs. Secondly, it controlled tuition costs. Either violation brought regulatory sanctions.

Now, instead of these protections, consumers are left on their own — directed to an expanded web resources known as a ‘College Scorecard’ where information on student debt and earnings now includes 2,100 certificate-granting programs.

“These important reforms are a more complete and effective way to hold all types of higher education institutions accountable and make sure that students have a full suite of data when making a decision about their education,” said Secretary DeVos in a statement.

Saying that information is the equivalent of regulation is simply not true. Effective regulations impose penalties, fines, and conditions on future actions – all to deter bad actors from repeating behaviors. By contrast, information only discloses with no guarantee that what is shared will be truthful, complete, or current.

Elected officials and consumer advocates were quick to point out the shortcomings of student loan deregulation.

“[B]y eliminating this rule without enforcing any alternative standard the Education Department is giving low-quality, for-profit colleges a free pass to charge high tuition for worthless credentials that leave students with insurmountable debt,” noted U.S. Representative Bobby Scott, chairman of the House Committee on Education and Labor.

“Students need protection against unaffordable loans,” said James Kvaal, President of The Institute for College Access & Success (TICAS). “This rule rolls back the clock on those very protections. At a time when millions of borrowers are struggling with debt they cannot afford, the Department’s repeal of the gainful employment rule is reckless and irresponsible.”

The ills that TICAS’ Kvaal points out are well-documented.

A 2018 research report entitled, The State of For-Profit Colleges, by the Center for Responsible Lending (CRL) analyzed student debt on a state-by-state basis. It concluded that investing in a for-profit education is almost always a risky proposition. Undergraduate borrowing by state showed that the percentage of students that borrow from the federal government generally ranged between 40 to 60 percent for public colleges, compared to 50 to 80 percent at for-profit institutions.

CRL also found that women and Blacks suffer disparate impacts, particularly at for-profit institutions, where they are disproportionately enrolled in most states. For example, enrollment at Mississippi’s for-profit colleges was 78 percent female and nearly 66 percent Black. Other states with high Black enrollment at for-profits included Georgia (57 percent), Louisiana (55 percent), Maryland (58 percent) and North Carolina (54 percent).

“Betsy DeVos’ decision to eliminate this important education protection is a disservice to the public and only serves to put corporate interests ahead of struggling students and taxpayers,” said Debbie Goldstein a CRL Executive Vice President, following the recent rescission of the Gainful Employment rule. “Completely removing oversight of these programs and leaving parents and students to navigate the college loan system is irresponsible and wastes federal money on programs that aren’t performing.”

Similarly to CRL, the National Consumer Law Center (NCLC) has found that for-profit college students borrow more, and more often. More than 80% of for-profit college graduates incurred nearly $40,000 in debt at the time of graduation. Further, Black and Latino student loan borrowers were found to default on their loans at twice the rate of similarly situated whites.

“Repealing the Gainful Employment rule will cost taxpayers over $6 billion over the next decade, and ending this rule will worsen the student loan debt crisis, especially for the people of color and low-income students who disproportionately attend career education programs and who are often targets of predatory recruitment practices,” said Abby Shafroth, an NCLC attorney who works with its Student Loan Borrower Assistance Project. “The Department’s unfounded claims that students will benefit from “more access” as a result of the repeal are bogus: Students don’t need access to more failing schools, they need a student loan system that doesn’t set them up to fail.”

With 44 million student borrowers owing $1.5 trillion nationwide at the end of 2019’s first quarter, removing federal guard rails against future borrower risk is as costly as it is unsustainable. As the federal government turns its back on these borrowers, perhaps another level of government can and will fill the void.

“Now more than ever,” concluded Goldstein, “states have important roles to play in regulation, oversight, and enforcement.

Charlene Crowell is the Center for Responsible Lending’s Communications Deputy Director. She can be reached at Charlene.crowell@responsiblelending.org.

This article originally appeared in the Charleston Chronicle.

-

Activism3 weeks ago

Activism3 weeks agoWe Fought on Opposite Sides of the Sheng Thao Recall. Here’s Why We’re Uniting Behind Barbara Lee for Oakland Mayor

-

Activism4 weeks ago

Activism4 weeks agoSan Francisco Is Investing Millions to Address Food Insecurity. Is Oakland Doing the Same?

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoRev. Dr. Jamal Bryant’s Black Church Target Boycott Mobilizes 150,000

-

Activism3 weeks ago

Activism3 weeks agoFaith Leaders Back Barbara Lee for Mayor, Criticize Candidate Loren Taylor for Dishonest Campaigning

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 12 – 18, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoRecently Approved Budget Plan Favors Wealthy, Slashes Aid to Low-Income Americans

-

Activism3 weeks ago

Activism3 weeks agoGroup Takes First Steps to Recall District Attorney Diana Becton

-

Activism2 weeks ago

Activism2 weeks agoOakland’s Most Vulnerable Neighborhoods Are Struggling to Eat and Stay Healthy