Economics

Is Oakland Ready for a Publically Owned Bank?

Councilmember Rebecca Kaplan is organizing a forum to discuss the benefits of creating a publicly owned bank in Oakland, Thursday, Feb. 9, 6 p.m. – 8 p.m. in Hearing Room 3 at Oakland City Hall.Presenters at the forum will be Marc Armstrong, co-founder and past President of the Public Banking Institute, and co-founder and president of Commonomics USA;

Tom Sgouros, author of “Checking the Banks: The Nuts and Bolts of Banking for People Who Want to Fix It,” and senior policy advisor to the Rhode Island Treasurer;

Nichoe Lichen, member of Santa Fe’s, Brass Tacks Team “public banking facts that stick,” and board member of the Public Banking Institute; and

Henry Wykowski, past prosecutor for the U.S. Attorney’s Office in Northern California, currently Harborside Health Center’s lead attorney, speaking on cannabis law as it relates to public banking.

The Oakland City Council in December unanimously approved a feasibility study to establish a public bank that would operate in the public interest, giving low-interest loans to small and medium-sized businesses and help fund affordable housing.

The council decision directs city staff to seek input from community stakeholders about the feasibility study, including suggestions of potential contractors and funding sources; and makes it clear that the study should cover the legality and feasibility of providing banking to the cannabis industry.

The City Administrator’s report is due March 1.

A public bank, where the City of Oakland, other cities, agencies and businesses could place their money, would an alternative turning over millions of dollars to one of the gigantic Wall Street banks, many of which have been found guilty of criminal and unethical practices.

According to Susan Harman of Friends of the Public Bank of Oakland, she and others are basing their proposal on the public bank in North Dakota, which has been operating for 100 years.

“That bank has been successful, and we are trying to follow that pattern,” she said.

The Oakland bank, in which other cities could participate, would be a wholesale bank. That is, it would not have ATMs, tellers or make loans to individuals but would partner with community banks and back them up so they could provide more services to individuals, she said.

“Partnering with community banks is another way to keep money local and not send it off to Wall Street,” Harman said.

Activism

Oakland Post: Week of April 2 – 8, 2025

The printed Weekly Edition of the Oakland Post: Week of April 2 – 8, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Activism

Oakland Post: Week of March 28 – April 1, 2025

The printed Weekly Edition of the Oakland Post: Week of March 28 – April 1, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Bay Area

Five Years After COVID-19 Began, a Struggling Child Care Workforce Faces New Threats

Five years ago, as COVID-19 lockdowns and school closures began, most early educators continued to work in person, risking their own health and that of their families. “Early educators were called essential, but they weren’t provided with the personal protective equipment they needed to stay safe,” said CSCCE Executive Director Lea Austin. “There were no special shopping hours or ways for them to access safety materials in those early and scary months of the pandemic, leaving them to compete with other shoppers. One state even advised them to wear trash bags if they couldn’t find PPE.”

UC Berkeley News

In the first eight months of the COVID-19 pandemic alone, 166,000 childcare jobs were lost across the nation. Significant recovery didn’t begin until the advent of American Rescue Plan Act (ARPA) Child Care Stabilization funds in April 2021.

Today, child care employment is back to slightly above pre-pandemic levels, but job growth has remained sluggish at 1.4% since ARPA funding allocations ended in October 2023, according to analysis by the Center for the Study of Child Care Employment (CSCCE) at UC Berkeley. In the last six months, childcare employment has hovered around 1.1 million.

Yet more than two million American parents report job changes due to problems accessing child care. Why does the childcare sector continue to face a workforce crisis that has predated the pandemic? Inadequate compensation drives high turnover rates and workforce shortages that predate the pandemic. Early childhood educators are skilled professionals; many have more than 15 years of experience and a college degree, but their compensation does not reflect their expertise. The national median hourly wage is $13.07, and only a small proportion of early educators receive benefits.

And now a new round of challenges is about to hit childcare. The low wages paid in early care and education result in 43% of early educator families depending on at least one public support program, such as Medicaid or food stamps, both of which are threatened by potential federal funding cuts. Job numbers will likely fall as many early childhood educators need to find jobs with healthcare benefits or better pay.

In addition, one in five child care workers are immigrants, and executive orders driving deportation and ICE raids will further devastate the entire early care and education system. These stresses are part of the historical lack of respect the workforce faces, despite all they contribute to children, families, and the economy.

Five years ago, as COVID-19 lockdowns and school closures began, most early educators continued to work in person, risking their own health and that of their families. “Early educators were called essential, but they weren’t provided with the personal protective equipment they needed to stay safe,” said CSCCE Executive Director Lea Austin. “There were no special shopping hours or ways for them to access safety materials in those early and scary months of the pandemic, leaving them to compete with other shoppers. One state even advised them to wear trash bags if they couldn’t find PPE.”

The economic impact was equally dire. Even as many providers tried to remain open to ensure their financial security, the combination of higher costs to meet safety protocols and lower revenue from fewer children enrolled led to job losses, increased debt, and program closures.

Eventually, the federal government responded with historic short-term investments through ARPA, which stabilized childcare programs. These funds provided money to increase pay or provide financial relief to early educators to improve their income and well-being. The childcare sector began to slowly recover. Larger job gains were made in 2022 and 2023, and as of November 2023, national job numbers had slightly surpassed pre-pandemic levels, though state and metro areas continued to fluctuate.

Many states have continued to support the workforce after ARPA funding expired in late 2024. In Maine, a salary supplement initiative has provided monthly stipends of $240-$540 to educators working in licensed home- or center-based care, based on education and experience, making it one of the nation’s leaders in its support of early educators. Early educators say the program has enabled them to raise wages, which has improved staff retention. Yet now, Governor Janet Mills is considering cutting the stipend program in half.

“History shows that once an emergency is perceived to have passed, public funding that supports the early care and education workforce is pulled,” says Austin. “You can’t build a stable childcare workforce and system without consistent public investment and respect for all that early educators contribute.”

The Center for the Study of Childcare Employment is the source of this story.

-

Activism3 weeks ago

Activism3 weeks agoWe Fought on Opposite Sides of the Sheng Thao Recall. Here’s Why We’re Uniting Behind Barbara Lee for Oakland Mayor

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoRev. Dr. Jamal Bryant’s Black Church Target Boycott Mobilizes 150,000

-

Activism4 weeks ago

Activism4 weeks agoSan Francisco Is Investing Millions to Address Food Insecurity. Is Oakland Doing the Same?

-

Activism3 weeks ago

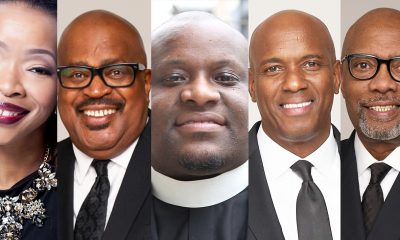

Activism3 weeks agoFaith Leaders Back Barbara Lee for Mayor, Criticize Candidate Loren Taylor for Dishonest Campaigning

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoRecently Approved Budget Plan Favors Wealthy, Slashes Aid to Low-Income Americans

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of March 12 – 18, 2025

-

Activism3 weeks ago

Activism3 weeks agoGroup Takes First Steps to Recall District Attorney Diana Becton

-

Activism3 weeks ago

Activism3 weeks agoSen. Lola Smallwood-Cuevas Honors California Women in Construction with State Proclamation, Policy Ideas