Business

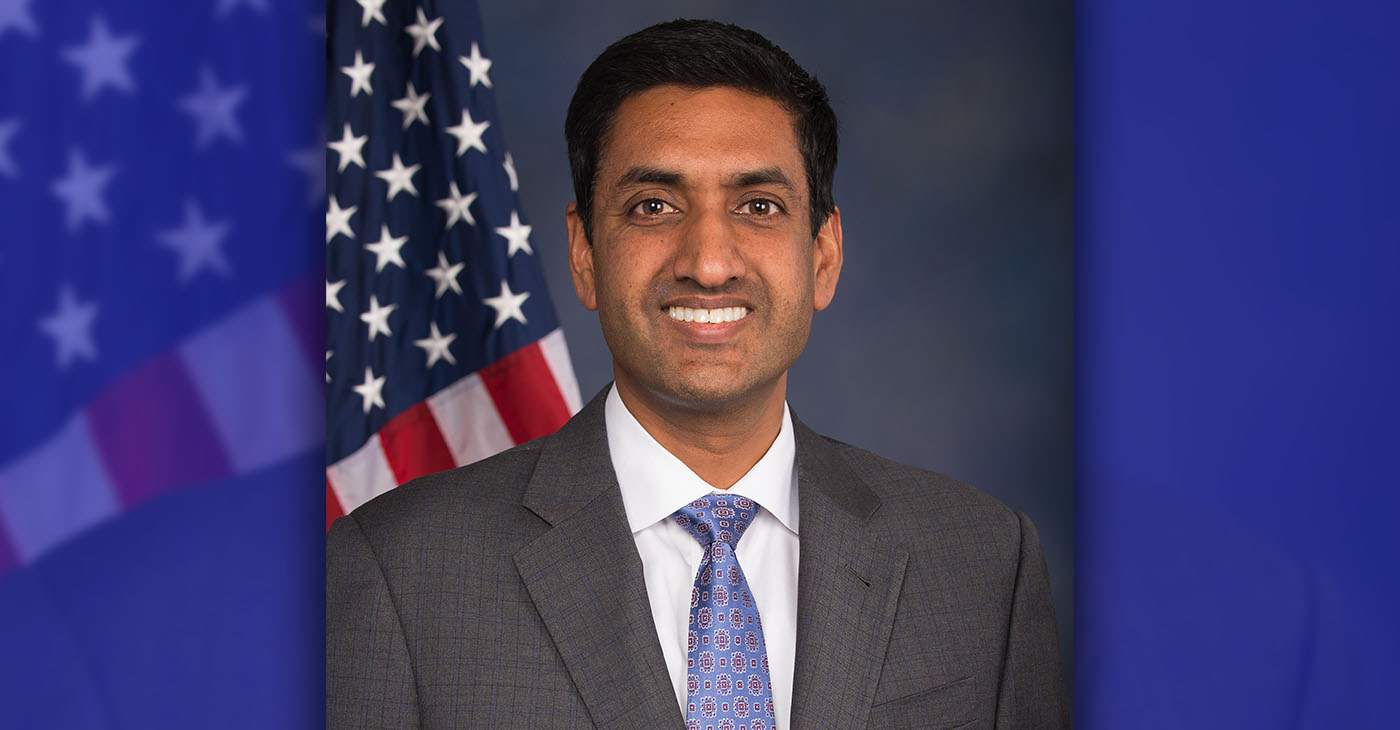

Silicon Valley Lawmaker Explores Legislation After Bank Collapse

Two weeks after Silicon Valley Bank’s collapse left thousands of businesses reeling, one Silicon Valley lawmaker is exploring legislation to ensure it doesn’t happen again. At a discussion in Santa Clara on Saturday with nonprofit and business leaders, Congressman Ro Khanna announced he’s crafting legislation that would require banks to pay higher premiums to the Federal Deposit Insurance Corporation (FDIC) to protect all account holders — including those with funds higher than $250,000. The revenue would protect deposits in case of a collapse.

Activism

Oakland Post: Week of February 25 – March 3, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 25 – March 3, 2026

Activism

Chase Oakland Community Center Hosts Alley-Oop Accelerator Building Community and Opportunity for Bay Area Entrepreneurs

Over the past three years, the Alley-Oop Accelerator has helped more than 20 Bay Area businesses grow, connect, and gain meaningful exposure. The program combines hands-on training, mentorship, and community-building to help participants navigate the legal, financial, and marketing challenges of small business ownership.

Activism

Oakland Post: Week of February 18 – 24, 2026

The printed Weekly Edition of the Oakland Post: Week of – February 18 – 24, 2026

-

Activism4 weeks ago

Activism4 weeks agoCommunity Celebrates Turner Group Construction Company as Collins Drive Becomes Turner Group Drive

-

Business4 weeks ago

Business4 weeks agoCalifornia Launches Study on Mileage Tax to Potentially Replace Gas Tax as Republicans Push Back

-

Activism4 weeks ago

Activism4 weeks agoDiscrimination in City Contracts

-

Arts and Culture4 weeks ago

Arts and Culture4 weeks agoBook Review: Books on Black History and Black Life for Kids

-

Activism4 weeks ago

Activism4 weeks agoCOMMENTARY: The Biases We Don’t See — Preventing AI-Driven Inequality in Health Care

-

Activism4 weeks ago

Activism4 weeks agoPost Newspaper Invites NNPA to Join Nationwide Probate Reform Initiative

-

Alameda County4 weeks ago

Alameda County4 weeks agoBlack History Events in the East Bay

-

Activism4 weeks ago

Activism4 weeks agoArt of the African Diaspora Celebrates Legacy and Community at Richmond Art Center