Featured

There Could Be More Income Tax Return Cash on the Table for You

For people who have not yet filed their tax returns, the United States Treasury Department and the Internal Revenue Service (IRS) announced March 21 that they are moving the 2019 income tax filing due date from April 15 to July 15 this year, a three-month extension.

After the IRS’s announcement, the state of California postponed its tax deadlines until July 15 due to the COVID-19 pandemic. That update superseded the California Franchise Tax Board’s (FTB) previous announcement that extended the period for filing and payment of taxes until June 15, 2020.

With the approval of the federal government’s $2 trillion stimulus package, designed to ease the financial impact of the global Coronavirus pandemic, taxpayers can take full advantage of several breaks federal and state agencies are offering.

Two tax credits specifically, one federal and the other in California, are aimed at giving families and businesses a lifeline.

For starters, eligibility for the California Earned Income Tax Credit (CalEITC) has been expanded. People who earned less than $30,000 in 2019 — including through self-employment — may qualify, and those who also have a child under age six may be eligible to claim the Young Child Tax Credit (YCTC).

California’s YCTC was introduced in 2019. Upon qualifications for CalEITC and having a child under the age of six as of the end of the tax year, taxpayers could qualify for up to $1,000 through this particular tax credit.

Between CalEITC and YCTC, FTB anticipates returning $1 billion to taxpayers this year.

Taxpayers earning less than $55,952 may also qualify for the federal EITC. Through a combination of CalEITC, YCTC, and the federal EITC, a family can receive up to $8,053.

You can submit retroactive claims for this credit for up to the last four years. The Volunteer Income Tax Assistance (VITA) program provides free tax help for those uncomfortable with submitting tax filings and earn less than $54,000 a year.

Responding to the economic challenges of the Coronavirus crisis, the federal government passed legislation that will provide up to a $1,200 payment for single individuals, $2,400 for married couples and various tax credits to businesses.

The legislation authorizes the IRS to issue to individuals with incomes of up to $75,000 a one-time $1,200 payment, phasing out at a rate of 5% for every $100 in income above $75,000.

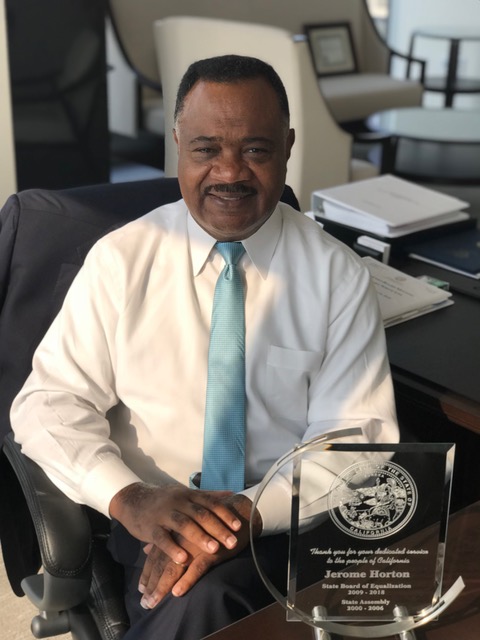

The most important key to this tax credit for families and businesses is that emphasis is put on filing the 2018 tax returns, Horton said. They must be filed and the parties filing do not have to worry about previous hardships that prevented them from doing it.

Individuals with disabilities, the elderly and limited English speaking abilities need help filling out tax returns qualify. All income-eligible Californians who need help filing a Personal Income Tax (PIT) return can find it through the VITA program at sites statewide until July 15. All VITA volunteers are IRS-certified and can be trusted not to charge money for their services.

This tax season, the FTB expects to process 20 million PIT returns, and the IRS expects to process more than 150 million PIT returns.

Activism

Oakland Post: Week of December 24 – 30, 2025

The printed Weekly Edition of the Oakland Post: Week of – December 24 – 30, 2025

To enlarge your view of this issue, use the slider, magnifying glass icon or full page icon in the lower right corner of the browser window.

Alameda County

Bling It On: Holiday Lights Brighten Dark Nights All Around the Bay

On the block where I grew up in the 1960s, it was an unwritten agreement among the owners of those row homes to put up holiday lights: around the front window and door, along the porch banister, etc. Some put the Christmas tree in the window, and you could see it through the open slats of the blinds.

By Wanda Ravernell

I have always liked Christmas lights.

From my desk at my front window, I feel a quiet joy when the lights on the house across the street come on just as night falls.

On the block where I grew up in the 1960s, it was an unwritten agreement among the owners of those row homes to put up holiday lights: around the front window and door, along the porch banister, etc. Some put the Christmas tree in the window, and you could see it through the open slats of the blinds.

My father, the renegade of the block, made no effort with lights, so my mother hung a wreath with two bells in the window. Just enough to let you know someone was at home.

Two doors down was a different story. Mr. King, the overachiever of the block, went all out for Christmas: The tree in the window, the lights along the roof and a Santa on his sleigh on the porch roof.

There are a few ‘Mr. Kings’ in my neighborhood.

In particular is the gentleman down the street. For Halloween, they erected a 10-foot skeleton in the yard, placed ‘shrunken heads’ on fence poles, pumpkins on steps and swooping bat wings from the porch roof. They have not held back for Christmas.

The skeleton stayed up this year, this time swathed in lights, as is every other inch of the house front. It is a light show that rivals the one in the old Wanamaker’s department store in Philadelphia.

I would hate to see their light bill…

As the shortest day of the year approaches, make Mr. King’s spirit happy and get out and see the lights in your own neighborhood, shopping plazas and merchant areas.

Here are some places recommended by 510 Families and Johnny FunCheap.

Oakland

Oakland’s Temple Hill Holiday Lights and Gardens is the place to go for a drive-by or a leisurely stroll for a religious holiday experience. Wear a jacket, because it’s chilly outside the Church of Jesus Christ of Latter-day Saints, at 4220 Lincoln Ave., particularly after dark. The gardens are open all day from 9 a.m. to 9 p.m. with the lights on from dusk until closing.

Alameda

Just across the High Street Bridge from Oakland, you’ll find Christmas Tree Lane in Alameda.

On Thompson Avenue between High Street and Fernside drive, displays range from classic trees and blow-ups to a comedic response to the film “The Nightmare Before Christmas.” Lights turn on at dusk and can be seen through the first week in January.

Berkeley

The Fourth Street business district from University Avenue to Virginia Street in Berkeley comes alive with lights beginning at 5 p.m. through Jan. 1, 2026.

There’s also a display at one house at 928 Arlington St., and, for children, the Tilden Park Carousel Winter Wonderland runs through Jan. 4, 2026. Closed Christmas Day. For more information and tickets, call (510) 559-1004.

Richmond

The Sundar Shadi Holiday Display, featuring a recreation of the town of Bethlehem with life-size figures, is open through Dec. 26 at 7501 Moeser Lane in El Cerrito.

Marin County

In Marin, the go-to spot for ‘oohs and ahhs’ is the Holiday Light Spectacular from 4-9 p.m. through Jan. 4, 2026, at Marin Center Fairgrounds at 10 Ave of the Flags in San Rafael through Jan. 4. Displays dazzle, with lighted walkways and activities almost daily. For more info, go to: www.marincounty.gov/departments/cultural-services/department-sponsored-events/holiday-light-spectacular

The arches at Marin County Civic Center at 3501 Civic Center Dr. will also be illuminated nightly.

San Francisco

Look for light installations in Golden Gate Park, chocolate and cheer at Ghirardelli Square, and downtown, the ice rink in Union Square and the holiday tree in Civic Center Plaza are enchanting spots day and night. For neighborhoods, you can’t beat the streets in Noe Valley, Pacific Heights, and Bernal Heights. For glee and over-the-top glitz there’s the Castro, particularly at 68 Castro Street.

Livermore

The winner of the 2024 Great Light Flight award, Deacon Dave has set up his display with a group of creative volunteers at 352 Hillcrest Avenue since 1982. See it through Jan. 1, 2026. For more info, go to https://www.casadelpomba.com

Fremont

Crippsmas Place is a community of over 90 decorated homes with candy canes passed out nightly through Dec. 31. A tradition since 1967, the event features visits by Mr. and Mrs. Claus on Dec. 18 and Dec. 23 and entertainment by the Tri-M Honor Society at 6 p.m. on Dec. 22. Chrippsmas Place is located on: Cripps Place, Asquith Place, Nicolet Court, Wellington Place, Perkins Street, and the stretch of Nicolet Avenue between Gibraltar Drive and Perkins Street.

Alameda County

Oakland Council Expands Citywide Security Cameras Despite Major Opposition

In a 7-1 vote in favor of the contract, with only District 3 Councilmember Carroll Fife voting no, the Council agreed to maintain its existing network of 291 cameras and add 40 new “pan-tilt-zoom cameras.”

By Post Staff

The Oakland City Council this week approved a $2.25 million contract with Flock Safety for a mass surveillance network of hundreds of security cameras to track vehicles in the city.

In a 7-1 vote in favor of the contract, with only District 3 Councilmember Carroll Fife voting no, the Council agreed to maintain its existing network of 291 cameras and add 40 new “pan-tilt-zoom cameras.”

In recent weeks hundreds of local residents have spoken against the camera system, raising concerns that data will be shared with immigration authorities and other federal agencies at a time when mass surveillance is growing across the country with little regard for individual rights.

The Flock network, supported by the Oakland Police Department, has the backing of residents and councilmembers who see it as an important tool to protect public safety.

“This system makes the Department more efficient as it allows for information related to disruptive/violent criminal activities to be captured … and allows for precise and focused enforcement,” OPD wrote in its proposal to City Council.

According to OPD, police made 232 arrests using data from Flock cameras between July 2024 and November of this year.

Based on the data, police say they recovered 68 guns, and utilizing the countywide system, they have found 1,100 stolen vehicles.

However, Flock’s cameras cast a wide net. The company’s cameras in Oakland last month captured license plate numbers and other information from about 1.4 million vehicles.

Speaking at Tuesday’s Council meeting, Fife was critical of her colleagues for signing a contract with a company that has been in the national spotlight for sharing data with federal agencies.

Flock’s cameras – which are automated license plate readers – have been used in tracking people who have had abortions, monitoring protesters, and aiding in deportation roundups.

“I don’t know how we get up and have several press conferences talking about how we are supportive of a sanctuary city status but then use a vendor that has been shown to have a direct relationship with (the U.S.) Border Control,” she said. “It doesn’t make sense to me.”

Several councilmembers who voted in favor of the contract said they supported the deal as long as some safeguards were written into the Council’s resolution.

“We’re not aiming for perfection,” said District 1 Councilmember Zac Unger. “This is not Orwellian facial recognition technology — that’s prohibited in Oakland. The road forward here is to add as many amendments as we can.”

Amendments passed by the Council prohibit OPD from sharing camera data with any other agencies for the purpose of “criminalizing reproductive or gender affirming healthcare” or for federal immigration enforcement. California state law also prohibits the sharing of license plate reader data with the federal government, and because Oakland’s sanctuary city status, OPD is not allowed to cooperate with immigration authorities.

A former member of Oakland’s Privacy Advisory Commission has sued OPD, alleging that it has violated its own rules around data sharing.

So far, OPD has shared Flock data with 50 other law enforcement agencies.

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoLIHEAP Funds Released After Weeks of Delay as States and the District Rush to Protect Households from the Cold

-

Alameda County3 weeks ago

Alameda County3 weeks agoSeth Curry Makes Impressive Debut with the Golden State Warriors

-

Activism4 weeks ago

Activism4 weeks agoOakland Post: Week of November 26 – December 2, 2025

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoSeven Steps to Help Your Child Build Meaningful Connections

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTrinidad and Tobago – Prime Minister Confirms U.S. Marines Working on Tobago Radar System

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoThanksgiving Celebrated Across the Tri-State

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoTeens Reject Today’s News as Trump Intensifies His Assault on the Press