Business

Waters Outlines Agenda in First Policy Speech as Committee Chairwoman

NNPA NEWSWIRE — “…Millions of families that rely on HUD rental assistance programs are perilously close to losing their homes due to projected lapses in funding. What’s more, it was recently reported that HUD, under Secretary Carson’s leadership, has failed to follow its own contingency plan, and as a result 1,150 project-based rental assistance contracts have expired, with hundreds more hanging in the balance if this shutdown does not end.”

WASHINGTON — Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, delivered the following remarks during her first policy speech in the 116th Congress:

As Prepared for Delivery

Thank you for the very warm welcome, and to the Center for American Progress for holding this event. CAP’s research and policy work are highly respected and a valued resource for Members of Congress and our staffs. I am very pleased to be here with you today to discuss the new Congress and my priorities as Chairwoman of the House Financial Services Committee.

I am deeply honored to have been selected by my colleagues to become the first woman and the first African American to serve as Chair of the Financial Services Committee. I have served on the Committee since 1991, and since 1995, I have served as Ranking Member or Chairwoman of every Subcommittee under the Committee’s jurisdiction, and have taken on important issues on behalf of consumers, investors, and vulnerable families.

So, I consider it a privilege to hold the gavel, and I am looking forward to working with my colleagues on the Committee on the many critical issues we are responsible for.

Trump Shutdown

Now, given the current circumstances in Washington, I would first like to address the shutdown and its impact on the important programs under the Financial Services Committee’s jurisdiction. We are now in the midst of the longest government shutdown in history – all because this President is throwing a tantrum about a senseless border wall.

The Trump shutdown is harming hardworking Americans and our financial markets. The shutdown has all but closed the doors of the Securities and Exchange Commission (SEC), which is Wall Street’s cop on the block. As a result of the shutdown, the SEC is unable to carry out most enforcement actions against bad actors. Businesses planning to enter the stock market for the first time through an Initial Public Offering (IPO) may also be delayed because the SEC cannot approve their documents, harming American entrepreneurs and job creation.

The shutdown also has a serious impact on critical housing programs. 95% of the Department of Housing and Urban Development’s staff has been furloughed. Millions of families that rely on HUD rental assistance programs are perilously close to losing their homes due to projected lapses in funding. What’s more, it was recently reported that HUD, under Secretary Carson’s leadership, has failed to follow its own contingency plan, and as a result 1,150 project-based rental assistance contracts have expired, with hundreds more hanging in the balance if this shutdown does not end.

Families aspiring to the American dream of homeownership may have their Federal Housing Administration (FHA) or rural housing loans delayed or be unable to close on their loans during the shutdown.

And in rural communities, very low-income, elderly homeowners who rely on HUD grants and loans to address health and safety hazards may not receive disbursements and as a result, may be forced to live in dangerous conditions.

These are just a few examples of the serious ways that this shutdown is harming American families and businesses. This shutdown must end immediately. I call on Republicans in Congress to join with us and put a stop to it and open the government so that we can put an end to all of the harm that this shutdown is causing.

The Consumer Financial Protection Bureau and Financial Regulation

An ongoing priority for me is ensuring that we have a strong Consumer Financial Protection Bureau and strong financial regulation that protects consumers, investors and our economy.

Let’s talk about why the Consumer Bureau is so important. We all remember how devastating the financial crisis was: 11 million Americans lost their homes, $13 trillion in wealth was lost, nearly 9 million Americans lost their jobs, and the unemployment rate hit 10 percent. It was catastrophic for communities across the country. The crisis was a result of Wall Street running amok, with abusive institutions peddling toxic products like no-doc loans, interest-only mortgages, and other predatory products, with no agency responsible for prioritizing consumer protection. Ultimately, the economy was sent tumbling into the abyss.

In response, Democrats crafted the Dodd-Frank Wall Street Reform and Consumer Protection Act, to improve accountability in the financial system and protect consumers, investors, and the economy from abusive Wall Street practices. As the centerpiece of that law, we created the Consumer Financial Protection Bureau, which is the only federal agency solely dedicated to protecting consumers from being ripped off by financial firms.

Under former Director Richard Cordray, the Consumer Bureau returned $12 billion to more than 30 million harmed consumers; handled over 1.3 million consumer complaints about financial institutions; implemented much needed rules on mortgages, prepaid cards, payday loans, and auto title loans; required clear disclosures from financial institutions; and, provided consumers with easy-to-understand materials to empower them to make the best decisions.

But Congressional Republicans and the Trump Administration have been determined to undermine and destroy the Consumer Bureau. Trump installed Mick Mulvaney, his budget director, to serve as Acting Director of the Consumer Bureau, and during his tenure, Mulvaney made it a priority to dismantle the Consumer Bureau from within. To name just a few of his actions, Mulvaney fired all members of the Consumer Advisory Board and requested zero dollars in operating funds for the Consumer Bureau from the Federal Reserve. He also created an Office of Cost Benefit Analysis as a way to internally block important regulations under the guise of cost benefit analysis.

He also moved to strip the Consumer Bureau’s Office of Fair Lending and Equal Opportunity of its enforcement and supervisory authority. But that’s not all. Mulvaney closed the Office of Students and Young Consumers at a time when 44 million student borrowers collectively carry over $1.5 trillion in student loan debt. He also helped out payday lenders. For example, he withdrew a lawsuit against a group of deceptive payday lenders who allegedly failed to disclose the true cost of loans, which carried interest rates as high as 950 percent a year.

Now, Kathy Kraninger was confirmed as the new Director in December, and we will see what she does. Mulvaney has since moved on to become this President’s Acting Chief of Staff. But I’ve written to Mr. Mulvaney to inform him that while his time running the Consumer Bureau may be over, the time for accountability for his actions is about to begin.

This Congress, I am going to be working diligently to undo the damage that Mulvaney has wrought during his time at the Consumer Bureau. I have a bill, the Consumers First Act, that reverses many of his known harmful actions, which I will soon be reintroducing.

But it’s not just Mick Mulvaney who I will be paying attention to. I will be keeping a watchful eye on all of the financial regulators to make sure that they are carrying out their statutory duties, including holding bad actors accountable, and promoting financial stability.

As we saw during the 2008 financial crisis, large Wall Street banks that aren’t subject to strong oversight and safeguards to protect our economy can do a lot of damage, and so in Dodd-Frank we put in place robust reforms for our largest and most complex financial institutions, including increased capital, reduced leverage, improved liquidity, vigorous stress testing, and thorough living wills, all designed to improve financial stability. Dodd-Frank established the Financial Stability Oversight Council to eliminate regulatory gaps and improve oversight of the entire financial system, including shadow banking. Dodd-Frank also established the Volcker Rule to ensure that big banks don’t gamble away their customers’ deposits. All of these reforms were designed to help prevent a future financial crisis. The Committee will be paying close attention to whether financial regulators try to weaken these important reforms, and keeping an eye on the big banks and their activities, including by holding many hearings.

Regulators also need to address the evolving financial marketplace appropriately. One emerging area the Financial Services Committee will be paying very close attention to is the growth of financial technology, or so-called “fintech” firms. As Americans are banking and accessing credit in new ways, it is important that we encourage responsible innovation with the appropriate safeguards in place to protect consumers and without displacing community banks and credit unions. I have great hopes that fintech firms can open up opportunities for those who have been excluded from access to responsible credit, but I strongly believe that there must be strong protections for consumers of these financial products, and that abusive payday lending practices must not be allowed. As the fintech sector grows, there are opportunities for unmet credit needs to be addressed, as well as risks that minority communities may be preyed upon or discriminated against by some of these companies. So we will be closely examining these issues in Committee to make sure that our regulators eliminate the risks, and meet the opportunities.

Credit reporting is another issue I will be scrutinizing. In the wake of the Equifax data breach, it’s absolutely critical for Congress to reform the nation’s credit reporting system. We need to shift the burden of removing mistakes from credit reports onto the credit bureaus and furnishers, and away from consumers. We also need to place limits on credit checks for employment purposes, reduce the time period that negative items stay on credit reports, and make other reforms to fix the serious problems with the credit reporting sector. For the sake of consumers across the country, credit reporting needs a comprehensive overhaul.

Housing

A very important issue we will be bringing renewed attention to in the Financial Services Committee is housing.

This country is experiencing a housing affordability and homelessness crisis. Today, there are over half a million people experiencing homelessness here in the richest country in the world, over one-fifth of whom are children. This includes veterans who we failed to support when they returned home after serving our country, women fleeing domestic violence, people who have left prison after serving their debt to society, and people who have simply fallen on hard times. It is simply shameful, and Congress has a responsibility to act.

To tackle the homelessness crisis, Congress needs to provide a surge of funding and resources. Just as Congress puts billions of dollars into defense spending, we must provide the funding necessary to ensure that all Americans have access to safe, decent and affordable housing.

So I will soon be reintroducing my bill, the Ending Homelessness Act, which would help to ensure that every American has a safe, decent, and affordable place to call home. The bill provides $13.27 billion in new funding over five years to federal programs and initiatives to prevent homelessness.

In addition, we will be holding Committee hearings on homelessness and important housing issues that have gone ignored during the last Congress, in order to elevate housing issues into a national discussion and present proactive solutions and remedies.

The Committee also has a responsibility to look at our housing finance system and address the fates of Fannie Mae and Freddie Mac, the government sponsored enterprises. The GSEs have been in government conservatorship for more than a decade.

Contrary to Republican claims, Fannie Mae and Freddie Mac did not cause the financial crisis. The Financial Crisis Inquiry Commission and others have made that clear. The financial crisis was driven by predatory lending, the private market packaging those toxic, risky loans into securities and then selling those securities to unsuspecting investors. Fannie and Freddie did not drive those actions, but the events that transpired during the crisis made clear the need for their reform. When it comes to housing finance reform, I have advocated for core principles that I believe should be part of legislative efforts to address the future of housing finance reform. The principles include:

- maintaining access to the 30-year fixed rate mortgage;

- ensuring sufficient private capital is in place to protect taxpayers;

- providing stability and liquidity so that we can withstand any future financial crisis;

- ensuring a smooth transition to a new finance system;

- requiring transparency and standardization in a way that ensures a level playing field for all financial institutions, especially credit unions and community banks;

- maintaining access for all qualified borrowers that can sustain homeownership and serving homeowners of the future; and

- ensuring access to affordable rental housing.

It is particularly important to ensure that underserved borrowers and communities are not overlooked. This means housing finance reform will need to include a comprehensive strategy around access to affordable mortgage credit, as well as access to affordable rental housing.

Also important for housing access is the rigorous enforcement of our fair housing laws. Unfortunately, our fight to make progress on fair housing has become much more challenging under the Trump Administration. Let’s not forget that President Trump himself was sued by the government for serious violations of the Fair Housing Act. Under Trump’s leadership, the affirmatively furthering fair housing mandate under the Fair Housing Act was badly undercut when Secretary Carson halted implementation of the Obama administration’s affirmatively furthering fair housing rule. In fact, Secretary Carson once likened the rule to a “failed social experiment.” Secretary Carson has also reportedly proposed taking the words “free from discrimination” out of HUD’s mission statement. He also reportedly halted several fair housing investigations, and sidelined top advisors in HUD’s Office of Fair Housing Enforcement. These are unprecedented attacks on fair housing that we will not stand for.

To that end, in addition to conducting robust oversight of the Trump Administration’s activities at HUD, I will be reintroducing the Restoring Fair Housing Protections Act, my bill to reverse the harmful steps taken by Secretary Carson and the Trump Administration to undermine fair housing. I promise to continue to stand up for fair housing opportunities for all people.

Diversity and Inclusion

Another very important issue that I am going to continue to work on as Chairwoman is diversity and inclusion. As a nation, we are becoming increasingly diverse, racially and ethnically. The U.S. Census Bureau estimates that more than half of all Americans will belong to a minority group by the year 2044. At the same time, there is a growing body of research showing a connection between the level of diversity at a company and the strength of its financial performance. Despite these facts, the Government Accountability Office (GAO) has found a continued trend of low representation of minorities and women in the financial services industry.

Minorities and women have particularly low representation at the senior management levels within the financial services industry. This needs to change. Diverse representation in these institutions, and particularly at the management level, is essential to ensure that all consumers have fair access to credit, capital and banking and financial services.

Now, as many of you know, I believe that it is essential to promote better workforce and supplier diversity. I am one of the proud authors of Section 1116 of the Housing and Economic Recovery Act and Section 342 of the Dodd-Frank Act. Together, these provisions direct most of the federal financial services agencies to create Offices of Minority and Women Inclusion, which we refer to as “OMWIs.” OMWIs have the important responsibility of overseeing all diversity matters in management, employment, and business activities at their agencies. The creation of these offices was a major step forward. But, we all know that laws that promote racial, ethnic, and gender equality are only as strong as the implementation and enforcement of those laws. And congressional oversight is essential to ensure that implementation and enforcement are strong.

So I am very pleased and very proud to announce that I will be creating a Subcommittee on Diversity and Inclusion. The Subcommittee will be the first in its kind in Congress, dedicated to looking at diversity and inclusion issues under the Committee’s jurisdiction.

International Affairs

Turning to the international jurisdiction of the Committee, I plan to focus on the important work of the World Bank and the regional development banks in ending global poverty. We have in the past worked in a bipartisan fashion to support the International Monetary Fund or IMF in times of crisis, at the same time that we pressed the Fund to pay more attention to the social dimension of problems when decisions about economic assistance are made. While the spirit of cooperation on issues related to global economic governance in Congress has been lacking, I am optimistic that this Congress will see renewed bipartisan attention.

Under my leadership, the Financial Services Committee will ensure that accountability and effectiveness at the international financial institutions remain strong, that broad public debate about the IMF’s and the multilateral development banks’ policies remains active, and that the international interests of poverty alleviation, growth, and economic stability continue to be advanced.

Sanctions

Another area that I hope will be bipartisan is the issue of protecting American interests and democratic institutions from assault both internally and from abroad. This brings me to the issue of U.S. sanctions against Russia for its hostile actions and its efforts to undermine the U.S. presidential election.

I believe the Administration’s approach to Russia sanctions has been haphazard and weak, as well as inconsistent with its approach to sanctions imposed on other countries, such as Iran.

I am very concerned about the Treasury Department’s recent actions to lift sanctions on businesses connected to Oleg Deripaska. Deripaska is a Russian oligarch with close ties to Vladimir Putin, who also has a history with Paul Manafort, former Trump campaign chairman who has been convicted of serious financial crimes uncovered as a result of Special Counsel Mueller’s investigation into Russian interference in the last presidential election.

What’s more, Deripaska has faced numerous allegations of criminal activity and was cited by the Treasury Department in April as saying he does not separate himself from the Russian state.

I believe the delisting agreement for Deripaska’s companies is too favorable to Deripaska, including by allowing him to benefit from potentially tens of millions of dollars in debt forgiveness by transferring some of his shares to a Russian bank to satisfy debts that Deripaska owes that bank. I also don’t believe Deripaska should be allowed to retain any influence or level of control over these companies.

I look forward to working with my colleagues in both chambers and across the aisle to closely monitor all further developments on Russia sanctions, to hold the Administration accountable for its actions in this area, and to ensure that the strongest possible sanctions against Russia are implemented and remain in place.

Bipartisanship

I would like to take a few minutes to address how I will approach working with my colleagues on the other side of the aisle as Chairwoman. Throughout my career, I have looked for opportunities to build consensus and work across the aisle on commonsense solutions to benefit hardworking Americans.

As Chairwoman I will continue to find areas where we can all work together. Ranking Member McHenry and I have a relationship, and just last Congress we worked together on several bills: the Fix Crowdfunding Act, to boost crowdfunding and enhance investor protections, and the Supporting America’s Innovators Act, to make it easier for more angel investors to finance startup companies and small businesses. The Supporting America’s Innovators Act became law.

Previously, we also worked together on the Promoting Transparent Standards for Corporate Insiders Act, a bill to limit the ability of corporate insiders to illegally trade on non-public information. I am very pleased to announce that Ranking Member McHenry and I are reintroducing the Promoting Transparent Standards for Corporate Insiders Act together.

So I am very hopeful that we will be able to get some good bipartisan work done in Committee. Some of the big issues we are going to try to work on a bipartisan basis include long-term reauthorization and reform of the National Flood Insurance Program (NFIP), Terrorism Risk Insurance (TRIA), and the reauthorization of the job-creating Export-Import Bank.

And so, it is a new day in Congress and for the Financial Services Committee.

As Chairwoman, I will continue to work every day to create opportunities for hardworking Americans, ensure fairness, and protect the economic wellbeing of all Americans. I will also continue to hold this Administration and its appointees accountable.

Thank you again to the Center for American Progress for having me today!

Activism

Books for Ghana

We effectively facilitated cross-continent community building! We met the call and provided 400 books for ASC’s students at the call of the Minister of Education. We supported the work of a new African writer whose breakout novel is an action-packed depiction of a young woman steeped in Ghanaian culture who travels to the USA for college, all the while experiencing the twists, turns, and uncertainties that life brings.

By Min. Rauna Thurston, Chief Mpuntuhene Afua Ewusiwa I

My travels to Afrika began in June 2022, on a tour led by Prof. Manu Ampim, Director of the organization Advancing The Research. I was scheduled to become an ordained Minister by Wo’se Community of the Sacred African Way. It was vital that my feet touch the soil of Kemet and my spirit connect with the continent’s people before ordination.

Since 2022, I’ve made six trips to Afrika. During my travels, I became a benefactor to Abeadze State College (ASC) in Abeadze Dominase, Ghana, originally founded by Daasebre Kwebu Ewusi VII, Paramount Chief of Abeadze Traditional Area and now run by the government. The students there were having trouble with English courses, which are mandatory. The Ghanaian Minister of Education endorsed a novel written by 18-year-old female Ghanaian first-time writer, Nhyira Esaaba Essel, titled Black Queen Sceptre. The idea was that if the students had something more interesting to read, it would evoke a passion for reading; this seemed reasonable to me. Offer students something exciting and imaginative, combined with instructors committed to their success and this could work.

The challenge is how to acquire 800 books?!

I was finishing another project for ASC, so my cash was thin and I was devoid of time to apply for annual grants. I sat on my porch in West Oakland, as I often do, when I’m feeling for and connecting to my ancestors. On quiet nights, I reminisce about the neighborhood I grew up in. Across the street from my house was the house that my Godfather, Baba Dr. Wade Nobles and family lived in, which later became The Institute for the Advanced Study of Black Family Life & Culture (IASBFLC). Then, it came to me…ancestors invited me to reach out to The Association of Black Psychologists – Bay Area Chapter (ABPsi-Bay Area)! It was a long shot but worth it!

I was granted an audience with the local ABPsi Board, who ultimately approved funding for the book project with a stipulation that the Board read the book and a request to subsequently offer input as to how the book would be implemented at ASC. In this moment, my memory jet set to my first ABPsi convention around 2002, while working for IASBFLC. Returning to the present, I thought, “They like to think because it feels good, and then, they talk about what to do about what they think about.” I’m doomed.

However, I came to understand why reading the book and offering suggestions for implementation were essential. In short: ABPsi is an organization that operates from the aspirational principles of Ma’at with aims of liberating the Afrikan Mind, empowering the Afrikan character, and enlivening: illuminating the Afrikan spirit. Their request resulted in a rollout of 400 books in a pair-share system. Students checked out books in pairs, thereby reducing our bottom line to half of the original cost because we purchased 50% fewer units. This nuance promoted an environment of Ujima (collective work & responsibility) and traditional Afrikan principles of cooperation and interdependence. The student’s collaborative approach encouraged shared responsibility, not only for the physical book but for each other’s success. This concept was Dr. Lawford Goddard’s, approved by the Board, with Dr. Patricia “Karabo” Nunley at the helm.

We effectively facilitated cross-continent community building! We met the call and provided 400 books for ASC’s students at the call of the Minister of Education. We supported the work of a new African writer whose breakout novel is an action-packed depiction of a young woman steeped in Ghanaian culture who travels to the USA for college, all the while experiencing the twists, turns, and uncertainties that life brings. (A collectible novel for all ages). A proposed future phase of this collaborative project is for ASC students to exchange reflective essays on Black Queen Sceptre with ABPsi Bay Area members.

We got into good trouble. To order Black Queen Sceptre, email esselewurama14@gmail.com.

I became an ordained Minister upon returning from my initial pilgrimage to Afrika. Who would have imagined that my travels to Afrika would culminate in me becoming a citizen of Sierra Leone and recently being named a Chief Mpuntuhene under Daasebre Kwebu Ewusi VII, Paramount Chief of Abeadze Traditional Area in Ghana, where I envision continued collaborations.

Min. Rauna/Chief Mpuntuhene is a member of ABPsi Bay Area, a healing resource committed to providing the Post Newspaper readership with monthly discussions about critical issues in Black Mental Health, Wealth & Wellness. Readers are welcome to join us at our monthly chapter meetings every 3rd Saturday via Zoom and contact us at bayareaabpsi@gmail.com.

Black History

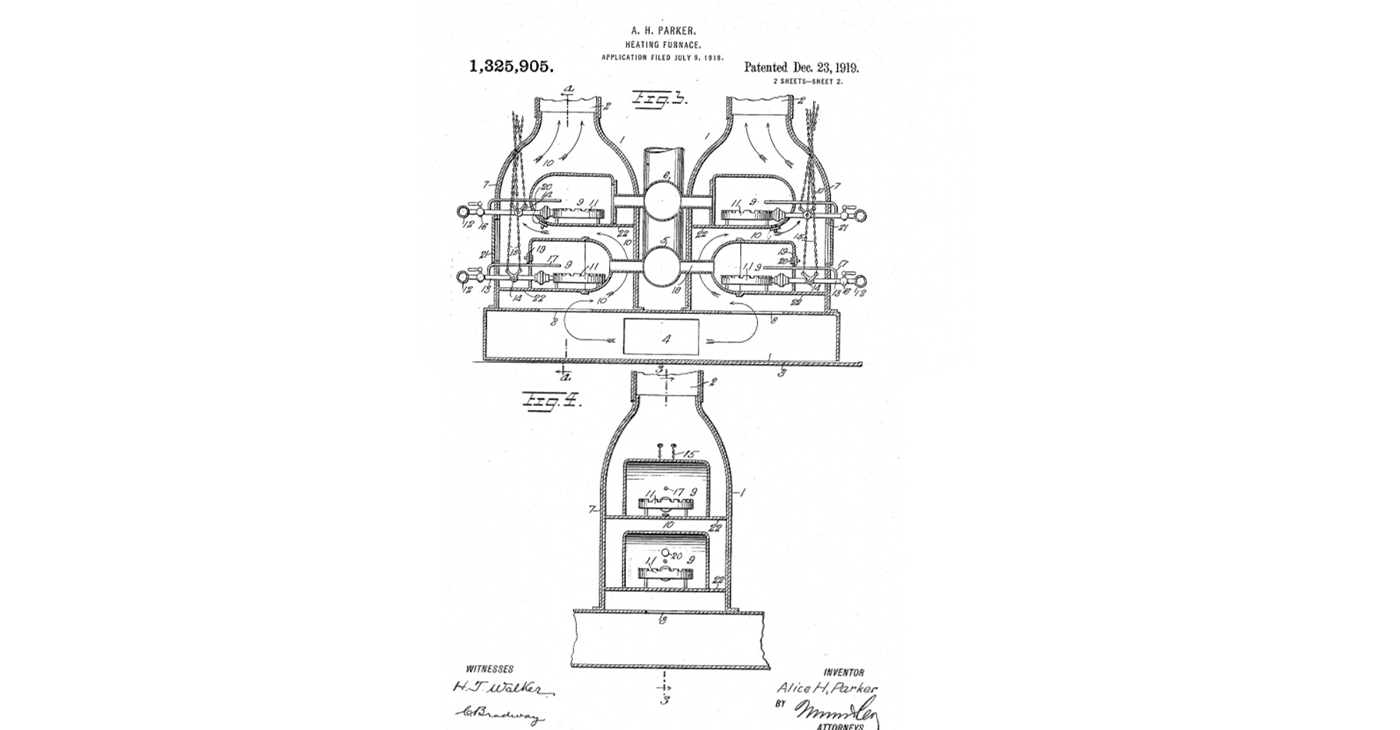

Alice Parker: The Innovator Behind the Modern Gas Furnace

Born in Morristown, New Jersey, in 1895, Alice Parker lived during a time when women, especially African American women, faced significant social and systemic barriers. Despite these challenges, her contributions to home heating technology have had a lasting impact.

By Tamara Shiloh

Alice Parker was a trailblazing African American inventor whose innovative ideas forever changed how we heat our homes.

Born in Morristown, New Jersey, in 1895, Parker lived during a time when women, especially African American women, faced significant social and systemic barriers. Despite these challenges, her contributions to home heating technology have had a lasting impact.

Parker grew up in New Jersey, where winters could be brutally cold. Although little is documented about her personal life, her education played a crucial role in shaping her inventive spirit. She attended Howard University, a historically Black university in Washington, D.C., where she may have developed her interest in practical solutions to everyday challenges.

Before Parker’s invention, most homes were heated using wood or coal-burning stoves. These methods were labor-intensive, inefficient, and posed fire hazards. Furthermore, they failed to provide even heating throughout a home, leaving many rooms cold while others were uncomfortably warm.

Parker recognized the inefficiency of these heating methods and imagined a solution that would make homes more comfortable and energy-efficient during winter.

In 1919, she patented her design for a gas-powered central heating system, a groundbreaking invention. Her design used natural gas as a fuel source to distribute heat throughout a building, replacing the need for wood or coal. The system allowed for thermostatic control, enabling homeowners to regulate the temperature in their homes efficiently.

What made her invention particularly innovative was its use of ductwork, which channeled warm air to different parts of the house. This concept is a precursor to the modern central heating systems we use today.

While Parker’s design was never fully developed or mass-produced during her lifetime, her idea laid the groundwork for modern central heating systems. Her invention was ahead of its time and highlighted the potential of natural gas as a cleaner, more efficient alternative to traditional heating methods.

Parker’s patent is remarkable not only for its technical innovation but also because it was granted at a time when African Americans and women faced severe limitations in accessing patent protections and recognition for their work. Her success as an inventor during this period is a testament to her ingenuity and determination.

Parker’s legacy lives on in numerous awards and grants – most noticeably in the annual Alice H. Parker Women Leaders in Innovation Award. That distinction is given out by the New Jersey Chamber of Commerce to celebrate outstanding women innovators in Parker’s home state.

The details of Parker’s later years are as sketchy as the ones about her early life. The specific date of her death, along with the cause, are also largely unknown.

Activism

2024 in Review: Seven Questions for Frontline Doulas

California Black Media (CBM) spoke with Frontline Doulas’ co-founder Khefri Riley. She reflected on Frontline’s accomplishments this year and the organization’s goals moving forward.

By Edward Henderson, California Black Media

Frontline Doulas provides African American families non-medical professional perinatal services at no cost.

This includes physical, emotional, informational, psychosocial and advocacy support during the pregnancy, childbirth and postpartum period. Women of all ages — with all forms of insurance — are accepted and encouraged to apply for services.

California Black Media (CBM) spoke with co-founder Khefri Riley. She reflected on Frontline’s accomplishments this year and the organization’s goals moving forward.

Responses have been edited for clarity and length.

Looking back at 2024, what stands out to you as your most important achievement and why?

In 2024, we are humbled to have been awarded the contract for the Los Angeles County Medical Doula Hub, which means that we are charged with creating a hub of connectivity and support for generating training and helping to create the new doula workforce for the medical doula benefit that went live in California on Jan. 1, 2023.

How did your leadership and investments contribute to improving the lives of Black Californians?

We believe that the revolution begins in the womb. What we mean by that is we have the potential and the ability to create intentional generational healing from the moment before a child was conceived, when a child was conceived, during this gestational time, and when a child is born.

And there’s a traditional saying in Indigenous communities that what we do now affects future generations going forward. So, the work that we do with birthing families, in particular Black birthing families, is to create powerful and healthy outcomes for the new generation so that we don’t have to replicate pain, fear, discrimination, or racism.

What frustrated you the most over the last year?

Working in reproductive justice often creates a heavy burden on the organization and the caregivers who deliver the services most needed to the communities. So, oftentimes, we’re advocating for those whose voices are silenced and erased, and you really have to be a warrior to stand strong and firm.

What inspired you the most over the last year?

My great-grandmother. My father was his grandmother’s midwife assistant when he was a young boy. I grew up with their medicine stories — the ways that they healed the community and were present to the community, even amidst Jim Crow.

What is one lesson you learned in 2024 that will inform your decision-making next year?

I find that you have to reach for your highest vision, and you have to stand firm in your value. You have to raise your voice, speak up and demand, and know your intrinsic value.

In a word, what is the biggest challenge Black Californians face?

Amplification. We cannot allow our voices to be silent.

What is the goal you want to achieve most in 2025?

I really would like to see a reduction in infant mortality and maternal mortality within our communities and witness this new birth worker force be supported and integrated into systems. So, that way, we fulfill our goal of healthy, unlimited birth in the Black community and indeed in all birthing communities in Los Angeles and California.

-

California Black Media4 weeks ago

California Black Media4 weeks agoCalifornia to Offer $43.7 Million in Federal Grants to Combat Hate Crimes

-

Black History4 weeks ago

Black History4 weeks agoEmeline King: A Trailblazer in the Automotive Industry

-

California Black Media4 weeks ago

California Black Media4 weeks agoCalifornia Department of Aging Offers Free Resources for Family Caregivers in November

-

California Black Media4 weeks ago

California Black Media4 weeks agoGov. Newsom Goes to Washington to Advocate for California Priorities

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of November 27 – December 3, 2024

-

Activism4 weeks ago

Activism4 weeks agoOCCUR Hosts “Faith Forward” Conference in Oakland

-

Activism4 weeks ago

Activism4 weeks agoRichmond Seniors Still Having a Ball After 25 Years

-

Bay Area4 weeks ago

Bay Area4 weeks agoRichmond’s New Fire Chief Sworn In

3 Comments