Bay Area

Opinion: Recovering from Covid-19 With Public Banking

The response to COVID-19 has laid bare, once again, the glaring economic inequalities we live with every day. An essential new institution is public banking — new to most of us in America, but a proven institution globally for the past few hundred years.

If cities had public banks, they would be able to multiply their impact by leveraging the bank’s capital. This would allow cities to quickly and efficiently deploy recovery efforts, distribute assistance and make low-interest loans to small- and medium-sized businesses to help them get back on their feet.

The COVID-19 crisis is likely to last for many months or years, bringing about profound changes to our society. While many may wish for a rapid return to “normal,” let us remember what has been “normal” in the past:

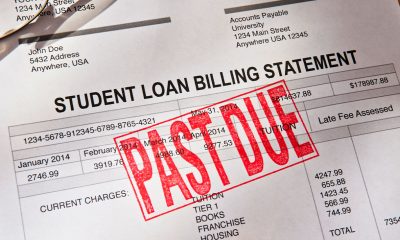

• People drowning in debt to pay medical bills, fund college educations, and simply survive;

• Global climate crisis glaring at us with rapidly melting glaciers, fires, droughts and tumultuous floods;

• Rampant numbers of unhoused living on the streets;

• Thousands at risk of losing their homes to evictions and foreclosures;

• 40 million Americans living below the poverty line, with 40% unable to weather a $400 financial emergency.

In 2019, the California Public Banking Alliance ushered through the California Legislature historic legislation, AB 857, the Public Banking Act. This law allows municipalities across the state to set up public banks in their communities. What does this have to do with COVID-19 or other disasters that may strike?

If public banks existed today, they would be a ready source of funds in our communities to help people and businesses sustain themselves through these hard times and rebuild. Public banks, like all banks, are able to multiply the impact of the dollars on deposit through making multiple loans. They provide the most efficient means of expeditiously deploying scarce funds into the community. If cities had public banks, they would be able to multiply their resources quickly to help with recovery efforts.

Public banks offer other important benefits Wall Street banks are unable to deliver. Public bankers are local and accountable to the people that live in their communities. They are more responsive to those most in need following disasters. If there were public banks in our communities today, rescue funds from the Federal Reserve Bank would be distributed through them focused on rebuilding communities rather than rebuilding astronomical profits of Wall Street banks.

Public banks will invest funds into making communities more resilient to disasters. They will be obligated to fund affordable housing minimizing the number of unhoused who are most vulnerable. Public banks will be responsive to community demands for capital improvements such as hospitals and community clinics to provide accessible healthcare for daily needs, as well as for disaster preparedness.

Public banking will enable a return to conservative banking practices focused on realistic projects that build communities, rather than risky, remote projects, like drilling for oil in the Arctic, that may reap huge financial profits but entail enormous environmental costs and entail huge financial risk.

Financing investments for sustainable energy production, conservation and delivery may not be sexy with extraordinary returns, but it is financially secure and environmentally sound. Political leaders must use emergency powers to rapidly create public banks able to rebuild resilient communities capable of thriving in a “new normal” future.

Activism

Ann Lowe: The Quiet Genius of American Couture

Lowe was born in Clayton, Alabama, into a family of gifted seamstresses. Her mother and grandmother were well-known dressmakers who created exquisite gowns for women in the area. By the time Lowe was a young girl, she was already showing extraordinary talent — cutting, sewing, and decorating fabric with a skill that far exceeded her age. When her mother died unexpectedly, Lowe – only 16 years old then – took over her mother’s sewing business, completing all the orders herself.

By Tamara Shiloh

Ann Cole Lowe, born Dec.14, 1898, was a pioneering American fashion designer whose extraordinary talent shaped some of the most widely recognized and celebrated gowns in U.S. history.

Although she designed dresses for society’s wealthiest families and created masterpieces worn at historic events, Lowe spent much of her life in the shadows — uncredited, underpaid, yet unmatched in skill. Today, she is celebrated as one of the first nationally recognized African American fashion designers and a true visionary in American couture.

Lowe was born in Clayton, Alabama, into a family of gifted seamstresses. Her mother and grandmother were well-known dressmakers who created exquisite gowns for women in the area. By the time Lowe was a young girl, she was already showing extraordinary talent — cutting, sewing, and decorating fabric with a skill that far exceeded her age. When her mother died unexpectedly, Lowe – only 16 years old then – took over her mother’s sewing business, completing all the orders herself. This early responsibility would prepare her for a lifetime of professional excellence.

In 1917, Lowe moved to New York City to study at the S.T. Taylor Design School. Although she was segregated from White students and forced to work separately, she, of course, excelled, graduating earlier than expected. Her instructors quickly recognized that her abilities were far above the typical student, especially her skill in hand-sewing, applique, and intricate floral embellishment – techniques that would become her signature.

Throughout the 1920s and 1930s, she designed gowns for high-society women in Florida and New York, operating boutiques and working for prestigious department stores. Her reputation for craftsmanship, originality, and elegance grew increasingly. She was known for creating gowns that moved beautifully, featured delicate hand-made flowers, and looked sculpted rather than sewn. Many wealthy clients specifically requested “an Ann Lowe gown” for weddings, balls, and galas.

Her most famous creation came in 1953: the wedding gown worn by Jacqueline Bouvier when she married Massachusetts Sen. John F. Kennedy. The dress – crafted from ivory silk taffeta with dozens of tiny, pleated rosettes – became one of the most photographed bridal gowns in American history. Despite this achievement, Lowe received no public credit at the time. When a flood destroyed her completed gowns 10 days before the wedding, she and her seamstresses worked day and night to remake everything – at her own expense. Her dedication and perfectionism never wavered.

She eventually opened “Ann Lowe Originals,” her own salon on New York’s Madison Avenue. She served clients such as the Rockefellers, DuPonts, Vanderbilts, and actresses like Olivia de Havilland. Yet even with her wealthy clientele, she struggled financially, often undercharging because she wanted every dress to be perfect, even if it meant losing money.

Lowe’s contributions were finally recognized later in life. Today, her exquisite gowns are preserved in museums, including the Smithsonian National Museum of African American History and Culture and the Metropolitan Museum of Art.

In the last five years of her life, Lowe lived with her daughter Ruth in Queens, N.Y. She died at her daughter’s home on Feb. 25, 1981, at the age of 82, after an extended illness.

Activism

BRIDGE Housing President and CEO Ken Lombard Scores Top Honors for Affordable Housing Leadership

The Development Company of the Year honor represents a milestone for BRIDGE Housing, which received the Gold award—its top designation—in a category that included both affordable and market-rate developers. The recognition caps what has been one of the strongest growth periods in the organization’s 42-year history.

By the Oakland Post Staff

San Francisco-based BRIDGE Housing and its president and CEO, Ken Lombard, have been named among the nation’s housing industry standouts, earning two of the top prizes at the 2025 Multi-Housing News Excellence Awards.

BRIDGE Housing was named Development Company of the Year, while Lombard received Executive of the Year, recognition that places the nonprofit affordable housing provider alongside leading national developers of both affordable and market-rate housing.

The awards were announced in New York for the accomplishments achieved during 2024.

Multi-Housing News is one of the industry’s most respected publications. Award winners are selected by a panel of housing professionals, including multifamily developers, architects, and owners.

“BRIDGE Housing is deeply honored to be recognized by Multi-Housing News and our industry peers,” Lombard said. “These awards are a testament to the high-impact, mission-driven work by BRIDGE’s exceptional team to deliver quality affordable housing and support services that empower residents to improve their lives.”

The Development Company of the Year honor represents a milestone for BRIDGE Housing, which received the Gold award—its top designation—in a category that included both affordable and market-rate developers. The recognition caps what has been one of the strongest growth periods in the organization’s 42-year history.

In 2024, BRIDGE significantly expanded its footprint across California, Oregon, and Washington. That momentum continued into 2025, with portfolio growth of 9%, including the addition of nine new communities and 1,187 new or acquired affordable housing units. The nonprofit also added three new projects to its development pipeline as it nears a portfolio of 16,000 units.

The growth reflects a broader strategy aimed at accelerating both acquisitions and ground-up development, supported by partnerships with major financial institutions and innovative capital markets strategies. BRIDGE has also emphasized high-quality design and deep community engagement as central elements of its approach.

BRIDGE became the first affordable housing developer to issue tax-exempt construction bonds for one of the largest affordable housing projects in Portland, Ore., leveraging its strong credit rating.

Earlier this year, the nonprofit launched the BRIDGE Housing Impact Fund, with a goal of investing $1 billion to preserve and create affordable housing. It also closed on $175 million in taxable general-obligation bonds after increasing the offering in response to strong investor demand.

The company’s performance also underscores the role of Lombard, who has led BRIDGE since 2021 and was honored individually for his leadership.

Under Lombard’s tenure, BRIDGE has built a new leadership team with experience drawn from both the nonprofit and private sectors, with a particular focus on what the organization describes as efforts to “break the status quo,” especially in affordable housing finance. Those initiatives have helped reduce capital and construction costs, strengthen relationships with institutional investors, and expand resident support services.

Today, BRIDGE Housing serves more than 33,000 residents across 139 communities on the West Coast.

“Ken has dedicated his career to innovative real estate solutions that improve the quality of life in underserved neighborhoods,” said Kenneth Novack, chair of BRIDGE Housing’s board of directors. “His visionary leadership and the work of our incredible team have positioned BRIDGE for long-term growth that will extend our impact throughout the West Coast.”

Founded in 1983, BRIDGE Housing has helped create more than 23,000 affordable homes with a total development cost of $6 billion.

Activism

Oakland School Board Grapples with Potential $100 Million Shortfall Next Year

The school board approved Superintendent Denise Saddler’s plan for major cuts to schools and the district office, but they are still trying to avoid outside pressure to close flatland schools.

By Post Staff

The Oakland Board of Education is continuing to grapple with a massive $100 million shortfall next year, which represents about 20% of the district’s general fund budget.

The school board approved Superintendent Denise Saddler’s plan for major cuts to schools and the district office, but they are still trying to avoid outside pressure to close flatland schools.

Without cuts, OUSD is under threat of being taken over by the state. The district only emerged from state receivership in July after 22 years.

“We want to make sure the cuts are away from the kids,” said Kampala Taiz-Rancifer, president of the Oakland Education Association, the teachers’ union. “There are too many things that are important and critical to instruction, to protecting our most vulnerable kids, to safety.”

The school district has been considering different scenarios for budget cuts proposed by the superintendent, including athletics, libraries, clubs, teacher programs, and school security.

The plan approved at Wednesday’s board meeting, which is not yet finalized, is estimated to save around $103 million.

Staff is now looking at decreasing central office staff and cutting extra-curricular budgets, such as for sports and library services. It will also review contracts for outside consultants, limiting classroom supplies and examine the possibility of school closures, which is a popular proposal among state and county officials and privatizers though after decades of Oakland school closures, has been shown to save little if any money.

-

Activism4 weeks ago

Activism4 weeks agoIN MEMORIAM: William ‘Bill’ Patterson, 94

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of November 19 – 25, 2025

-

#NNPA BlackPress3 weeks ago

#NNPA BlackPress3 weeks agoBeyoncé and Jay-Z make rare public appearance with Lewis Hamilton at Las Vegas Grand Prix

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoLewis Hamilton set to start LAST in Saturday Night’s Las Vegas Grand Prix

-

#NNPA BlackPress2 weeks ago

#NNPA BlackPress2 weeks agoLIHEAP Funds Released After Weeks of Delay as States and the District Rush to Protect Households from the Cold

-

Alameda County2 weeks ago

Alameda County2 weeks agoSeth Curry Makes Impressive Debut with the Golden State Warriors

-

Activism3 weeks ago

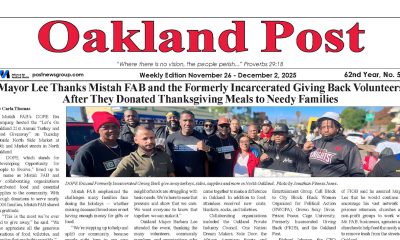

Activism3 weeks agoOakland Post: Week of November 26 – December 2, 2025

-

#NNPA BlackPress2 weeks ago

#NNPA BlackPress2 weeks agoSeven Steps to Help Your Child Build Meaningful Connections