Advice

Questions your financial advisor would not expect you to ask

NASHVILLE VOICE — Have a meeting scheduled soon with your financial advisor? If so, it could be time to ask a few probing questions that might surprise and challenge him or her, but could help you be better prepared if the U.S. economy takes a turn for the worse that some economic forecasters are predicting.

By Pride Newsdesk

Have a meeting scheduled soon with your financial advisor?

If so, it could be time to ask a few probing questions that might surprise and challenge him or her, but could help you be better prepared if the U.S. economy takes a turn for the worse that some economic forecasters are predicting.

But first, before that meeting and before you start posing those questions, it’s important to understand some of the factors affecting the economy’s future and why there are potential problems that likely won’t go away, says Nahum Daniels, a Certified Financial Planner and Retirement Income Certified Professional.

“Many Americans today have anxiety confronting retirement,” says Daniels , author of Retire Reset!: What You Need to Know and Your Financial Advisor May Not Be Telling You. “And in an unfortunate turn for baby boomers, the U.S. economy is struggling to recover from one of the worst downturns in generations.

“When closely examined, the retirement challenges we face as a society are actually much more complex than they first appear. The mainstream media skate along the surface, pointing to baby boomers with inadequate personal savings who are looking to a fragile (if not insolvent) Social Security system unable to make up the difference.

“But upon deeper analysis, there’s much more to the problem in the U.S. and globally. That includes slowing population growth, shrinking consumer demand, exploding debt, inflated financial bubbles in the stocks and bonds market, deflationary wage and employment pressures, and overspent governments. The connectivity of these global forces may be forming a tsunami.”

Daniels says those in retirement or nearing it are going to want answers from their advisors on how to avoid pitfalls in a possibly volatile future economy. And it starts, he says, by asking the right, penetrating questions. The answers may depend on your particular situation, but the important thing is that you and your advisor have a deeper conversation about your situation and that you are satisfied with the answers:

Do you think our economy faces the risk of an extended period of secular stagnation and, if you do, how do you think my nest egg should be positioned to counteract any negative effects?

Is the possibility of a volatile economic future during my retirement years worthy of hedging against and, if so, how?

Do you believe that our low rates of economic growth reflect bad tax policy predominantly and that corporate tax relief in the U.S. will turn our economy around for the long term?

How reliable are my Social Security and pension benefits, and do you think I should start taking them, or would it be better to defer them for as long as possible?

Can I retire before paying off all of my debt, or should I keep working until I’m completely debt free?

“Some prominent economists predict a long-term slowdown in economic activity, productivity and innovation,” Daniels said. “And neither fiscal (tax) nor monetary (Fed) policies alone may be able to reverse it. Consequently, our personal nest eggs have taken on a level of importance they haven’t previously had.”

This article originally appeared in the Nashville Voice.

Advice

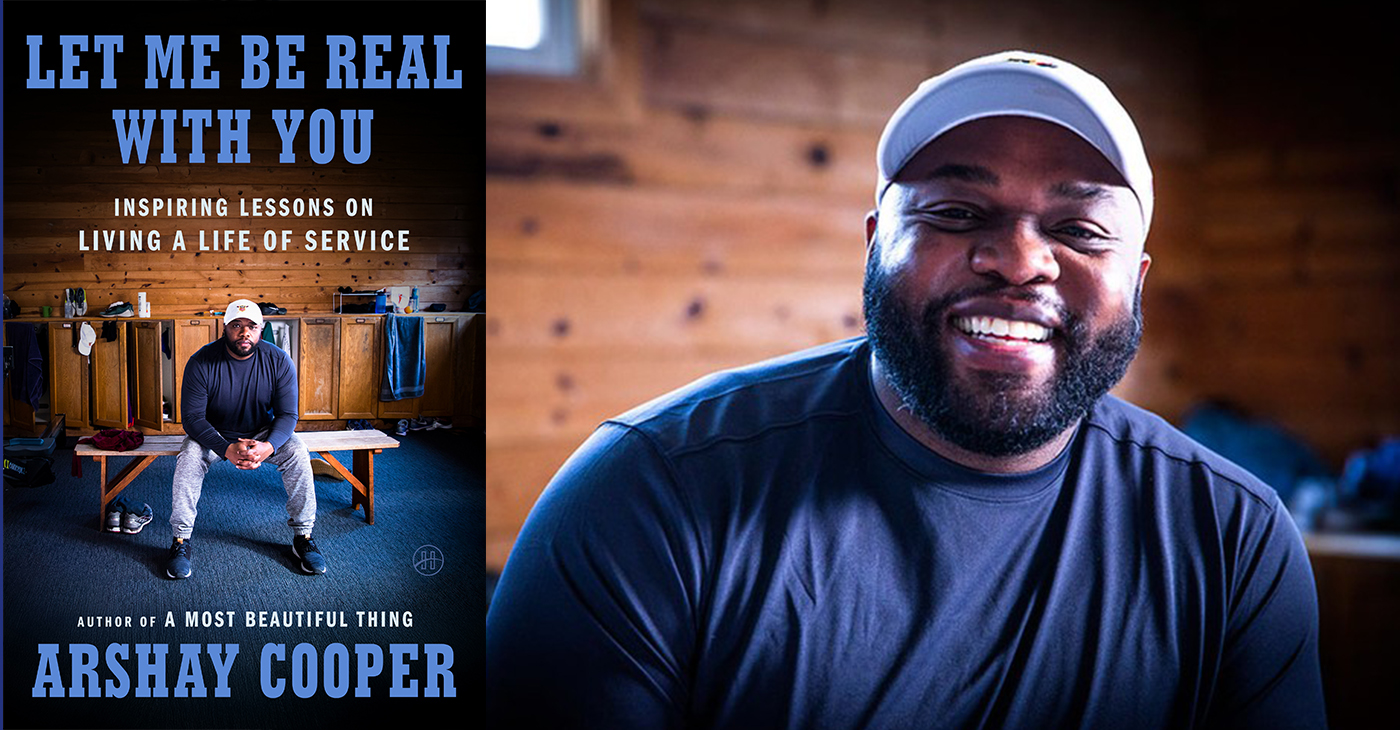

BOOK REVIEW: Let Me Be Real With You

At first look, this book might seem like just any other self-help offering. It’s inspirational for casual reader and business reader, both, just like most books in this genre. Dig a little deeper, though, and you’ll spot what makes “Let Me Be Real With You” stand out.

By Terri Schlichenmeyer

Author: Arshay Cooper, Copyright: c.2025, Publisher: HarperOne, SRP: $26.00, Page Count: 40 Pages

The hole you’re in is a deep one.

You can see the clouds above, and they look like a storm; you sense the wind, and it’s cold. It’s dark down there, and lonesome, too. You feel like you were born there — but how do you get out of the deep hole you’re in? You read the new book “Let Me Be Real With You” by Arshay Cooper. You find a hand-up and bring someone with you.

In the months after his first book was published, Cooper received a lot of requests to speak to youth about his life growing up on the West Side of Chicago, his struggles, and his many accomplishments. He was poor, bullied, and belittled, but he knew that if he could escape those things, he would succeed. He focused on doing what was best, and right. He looked for mentors and strove to understand when opportunities presented themselves.

Still, his early life left him with trauma. Here, he shows how it’s overcome-able.

We must always have hope, Cooper says, but hope is “merely the catalyst for action. The hope we receive must transform into the hope we give.”

Learn to tell your own story, as honestly as you know it. Be open to suggestions, and don’t dismiss them without great thought. Know that masculinity doesn’t equal stoicism; we are hard-wired to need other people, and sharing “pain and relatability can dissipate shame and foster empathy in powerful ways.”

Remember that trauma is intergenerational, and it can be passed down from parent to child. Let your mentors see your potential. Get therapy, if you need it; there’s no shame in it, and it will help, if you learn to trust it. Enjoy the outdoors when you can. Learn self-control. Give back to your community. Respect your financial wellness. Embrace your intelligence. Pick your friends and relationships wisely. “Do it afraid.”

And finally, remember that “You were born to soar to great heights and rule the sky.”

You just needed someone to tell you that.

At first look, this book might seem like just any other self-help offering. It’s inspirational for casual reader and business reader, both, just like most books in this genre. Dig a little deeper, though, and you’ll spot what makes “Let Me Be Real With You” stand out.

With a willingness to discuss the struggles he tackled in the past, Cooper writes with a solidly honest voice that’s exceptionally believable, and not one bit dramatic. You won’t find unnecessarily embellished stories or tall tales here, either; Cooper instead uses his real experiences to help readers understand that there are few things that are truly insurmountable. He then explains how one’s past can shape one’s future, and how today’s actions can change the future of the world.

“Let Me Be Real With You” is full of motivation, and instruction that’s do-able for adults and teens. If you need that, or if you’ve vowed to do better this coming year, it might help make you whole.

Advice

Support Your Child’s Mental Health: Medi-Cal Covers Therapy, Medication, and More

Advertorial

When children struggle emotionally, it can affect every part of their lives — at home, in school, with friends, and even their physical health. In many Black families, we’re taught to be strong and push through. But our kids don’t have to struggle alone. Medi-Cal provides mental health care for children and youth, with no referral or diagnosis required.

Through California Advancing and Innovating Medi-Cal (CalAIM), the state is transforming how care is delivered. Services are now easier to access and better connected across mental health, physical health, and family support systems. CalAIM brings care into schools, homes, and communities, removing barriers and helping children get support early, before challenges escalate.

Help is Available, and it’s Covered

Under Medi-Cal, every child and teen under age 19 has the right to mental health care. This includes screenings, therapy, medication support, crisis stabilization, and help coordinating services. Parents, caregivers, and children age 12 or older can request a screening at any time, with no diagnosis or referral required.

Medi-Cal’s Mental Health and Substance Use Disorder Program

For children and youth with more serious mental health needs, including those in foster care or involved in the justice system, Medi-Cal offers expanded support, including:

- Family-centered and community-based therapy to address trauma, behavior challenges, or system involvement.

- Wraparound care teams that help keep children safely at home or with relatives.

- Activity funds that support healing through sports, art, music, and therapeutic camps.

- Initial joint behavioral health visits, where a mental health provider and child welfare worker meet with the family early in a case.

- Child welfare liaisons in Medi-Cal health plans who help caregivers and social workers get services for children faster

Keeping Kids Safe from Opioids and Harmful Drugs

DHCS is also working to keep young people safe as California faces rising risks from opioids and counterfeit pills. Programs like Elevate Youth California and Friday Night Live give teens mentorship, leadership opportunities, and positive outlets that strengthen mental well-being.

Through the California Youth Opioid Response, families can learn how to avoid dangerous substances and get treatment when needed. Song for Charlie provides parents and teens with facts and tools to talk honestly about mental health and counterfeit pills.

DHCS also supports groups like Young People in Recovery, which helps youth build skills for long-term healing, and the Youth Peer Mentor Program, which trains teens with lived experience to support others. These efforts are part of California’s strategy to protect young people, prevent overdoses, and help them make healthier choices.

Support for Parents and Caregivers

Children thrive when their caregivers are supported. Through CalAIM’s vision of whole-person care, Medi-Cal now covers dyadic services, visits where a child and caregiver meet together with a provider to strengthen bonding, manage stress, and address behavior challenges.

These visits may include screening the caregiver for depression or anxiety and connecting them to food, housing, or other health-related social needs, aligning with CalAIM’s Community Supports framework. Notably, only the child must be enrolled in Medi-Cal to receive dyadic care.

Family therapy is also covered and can take place in clinics, schools, homes, or via telehealth, reflecting CalAIM’s commitment to flexible, community-based care delivery.

Additionally, BrightLife Kids offers free tools, resources, and virtual coaching for caregivers and children ages 0–12. Families can sign up online or through the BrightLife Kids app. No insurance, diagnosis, or referral is required.

For teens and young adults ages 13–25, California offers Soluna, a free mental health app where young people can chat with coaches, learn coping skills, journal, or join supportive community circles. Soluna is free, confidential, available in app stores, and does not require insurance.

CalHOPE also provides free emotional support to all Californians through a 24/7 support line at (833) 317-HOPE (4673), online chat, and culturally responsive resources.

Support at School — Where Kids Already Are

Schools are often the first place where emotional stress is noticed. Through the Children and Youth Behavioral Health Initiative (CYBHI), public schools, community colleges, and universities can offer therapy, counseling, crisis support, and referrals at no cost to families.

Services are available during school breaks and delivered on campus, by phone or video, or at community sites. There are no copayments, deductibles, or bills.

Medi-Cal Still Covers Everyday Care

Medi-Cal continues to cover everyday mental health care, including therapy for stress, anxiety, depression, or trauma; medication support; crisis stabilization; hospital care when needed; and referrals to community programs through county mental health plans and Medi-Cal health plans.

How to Get Help

- Talk to your child’s teacher, school counselor, or doctor.

- In Alameda County call 510-272-3663 or the toll-free number 1-800-698-1118 and in San Francisco call 855-355-5757 to contact your county mental health plan to request an assessment or services.

- If your child is not enrolled in Medi-Cal, you can apply at com or my.medi-cal.ca.gov.

- In a mental health emergency, call or text 988, the Suicide and Crisis Lifeline.

Every child deserves to grow up healthy and supported. Medi-Cal is working to transform care so it’s accessible, equitable, and responsive to the needs of every family.

Advice

COMMENTARY: If You Don’t Want Your ‘Black Card’ Revoked, Watch What You Bring to Holiday Dinners

From Thanksgiving to Christmas to New Year’s Day, whether it’s the dining room table or the bid whist (Spades? Uno, anyone?) table, your card may be in danger.

By Wanda Ravernell

Post Staff

From the fourth week of November to the first week in January, if you are of African descent, but particularly African American, certain violations of cultural etiquette will get your ‘Black card’ revoked.

From Thanksgiving to Christmas to New Year’s Day, whether it’s the dining room table or the bid whist (Spades? Uno, anyone?) table, your card may be in danger.

It could take until Super Bowl Sunday for reinstatement.

I don’t know much about the card table, but for years I was on probation by the ‘Aunties,’ the givers and takers of Black cards.

How I Got into Trouble

It was 1970-something and I was influenced by the health food movement that emerged from the hippie era. A vegetarian (which was then considered sacrilegious by most Black people I knew) prepared me a simple meal: grated cheese over steamed broccoli, lentils, and brown rice.

I introduced the broccoli dish at the Friday night supper with my aunt and grandfather. She pronounced the bright green broccoli undone, but she ate it. (I did not, of course, try brown rice on them.)

I knew that I would be allowed back in the kitchen when she attempted the dish, but the broccoli had been cooked to death. (Y’all remember when ALL vegetables, not just greens, were cooked to mush?)

My Black card, which had been revoked was then reattained because they ate what I prepared and imitated it.

Over the decades, various transgressions have become normalized. I remember when having a smoked turkey neck instead of a ham hock in collard greens was greeted with mumblings and murmurings at both the dining room and card tables. Then came vegan versions with just olive oil (What? No Crisco? No bacon, at least?) and garlic. And now my husband stir fries his collards in a wok.

But No Matter How Things Have Changed…

At holiday meals, there are assigned tasks. Uncle Jack chopped raw onions when needed. Uncle Buddy made the fruit salad for Easter. My mother brought the greens in winter, macaroni salad in summer. Aunt Deanie did the macaroni and cheese, and the great aunts, my deceased grandmother’s sisters, oversaw the preparation of the roast beef, turkey, and ham. My father, if he were present, did the carving.

These designations/assignments were binding agreements that could stand up in a court of law. Do not violate the law of assignments by bringing some other version of a tried-and-true dish, even if you call it a new ‘cheese and noodle item’ to ‘try out.’ The auntie lawgivers know what you are trying to do. It’s called a menu coup d’état, and they are not having it.

The time for experiments is in your own home: your spouse and kids are the Guinea pigs.

My mother’s variation of a classic that I detested from that Sunday to the present was adding crushed pineapple to mashed sweet potatoes. A relative stops by, tries it, and then it can be introduced as an add-on to the standard holiday menu.

My Aunt Vivian’s concoctions from Good Housekeeping or Ladies’ Home Journal magazine also made it to the Black people’s tables all over the country in the form of a green bean casserole.

What Not to Do and How Did It Cross Your Mind?

People are, of all things holy, preparing mac ‘n’ cheese with so much sugar it tastes like custard with noodles in it.

Also showing up in the wrong places: raisins. Raisins have been reported in the stuffing (makes no sense unless it’s in a ‘sweet meats’ dish), in a pan of corn bread, and – heresy in the Black kitchen – the MAC ‘n’ CHEESE.

These are not mere allegations: There is photographic evidence of these Black card violations, but I don’t want to defame witnesses who remained present at the scene of the crimes.

The cook – bless his/her heart – was probably well-meaning, if ignorant. Maybe they got the idea from a social media influencer, much like Aunt Viv got recipes from magazines.

Thankfully, a long-winded blessing of the food at the table can give the wary attendee time to locate the oddity’s place on the table and plan accordingly.

But who knows? Innovation always prevails, for, as the old folks say, ‘waste makes want.’ What if the leftovers were cut up, dipped in breadcrumbs and deep fried? The next day, that dish might make it to the TV tray by the card table.

An older cousin – on her way to being an Auntie – in her bonnet, leggings, T-shirt, and bunny slippers and too tired to object, might try it and like it….

And if she ‘rubs your head’ after eating it, the new dish might be a winner and (Whew!) everybody, thanks God, keeps their Black cards.

Until the next time.

-

Alameda County4 weeks ago

Alameda County4 weeks agoSeth Curry Makes Impressive Debut with the Golden State Warriors

-

Bay Area2 weeks ago

Bay Area2 weeks agoPost Salon to Discuss Proposal to Bring Costco to Oakland Community meeting to be held at City Hall, Thursday, Dec. 18

-

#NNPA BlackPress4 weeks ago

#NNPA BlackPress4 weeks agoFBI Report Warns of Fear, Paralysis, And Political Turmoil Under Director Kash Patel

-

Activism2 weeks ago

Activism2 weeks agoMayor Lee, City Leaders Announce $334 Million Bond Sale for Affordable Housing, Roads, Park Renovations, Libraries and Senior Centers

-

Activism3 weeks ago

Activism3 weeks agoOakland Post: Week of December 10 – 16, 2025

-

Arts and Culture2 weeks ago

Arts and Culture2 weeks agoFayeth Gardens Holds 3rd Annual Kwanzaa Celebration at Hayward City Hall on Dec. 28

-

Activism2 weeks ago

Activism2 weeks agoOakland School Board Grapples with Potential $100 Million Shortfall Next Year

-

Activism2 weeks ago

Activism2 weeks ago2025 in Review: Seven Questions for Black Women’s Think Tank Founder Kellie Todd Griffin